On a clear May morning in Shanghai, the C919 airliner took its maiden voyage to rapturous applause from onlookers below. The single-aisle jet, designed and manufactured by Commercial Aircraft Corp. of China, or Comac, signals a turning point not only for China but also the global aerospace manufacturing sector. For more than 30 years, it’s been China’s dream to control its own fate where aviation hardware is concerned, and with the successful demonstration of the C919—already being called a “game changer”—that dream comes one step closer to becoming a reality.

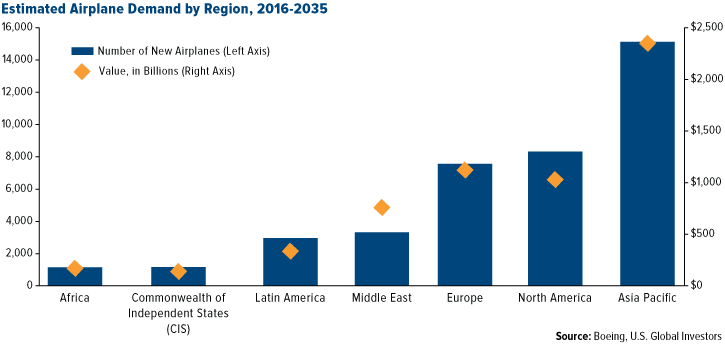

Industry leaders Boeing and Airbus now face a serious competitor in the world’s most valuable single-country aircraft market—and Comac has the home advantage. Back in September, Boeing singled out China as its number one market, worth an estimated $1 trillion over the next 20 years. The entire Asia Pacific region, one of the fastest-growing regions in the world, is valued at more than $2.3 trillion.

So crucial is the Chinese market that Boeing, in cooperation with Comac, just began construction on a 737 completion center in the island-city of Zhoushan. The center is Boeing’s first-ever overseas facility. By 2018, it should be capable of delivering as many as 100 737s per year.

Competition Wanted

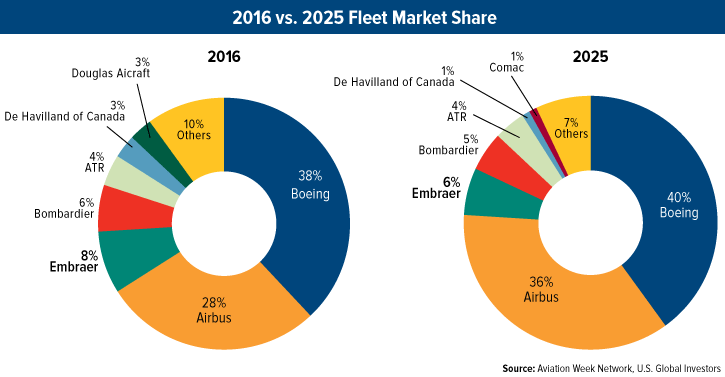

In an industry virtually controlled by two companies, a little competition is more than welcome. According to Aviation Week Network, Boeing and Airbus—both of which are held in the U.S. Global Jets ETF (JETS)—represent 66 percent of the market today. By 2025, they’re projected to manufacture three out of every four new aircraft, with state-owned Comac gaining 1 percent of the market.

Aviation Week could be underestimating Comac’s prospects. Chinese carriers and leasing companies have already placed more than 500 orders for the C919, which is designed to compete directly with the ubiquitous Boeing 737 and Airbus A320. The narrow-body jet is scheduled to start rolling off the production line in 2019.

A Global Supply Chain

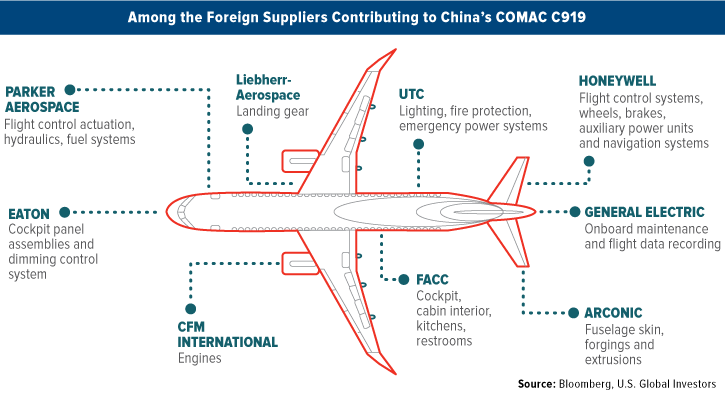

As China seeks to become a high-income, high-tech country, nurturing a homegrown aerospace manufacturing sector is crucial. Aerospace equipment, in fact, is among the 10 key areas of Chinese president Xi Jinping’s “Made in China 2025” initiative, which aims to upgrade the country’s manufacturing industry to include more advanced technologies.

To build the C919, Comac currently relies on a long list of foreign, mostly-Western suppliers. This includes American multinationals General Electric and Honeywell, the latter of which has been working with Comac on the C919 program since the company was founded in 2008. Since it’s is years behind Boeing, Airbus and other established manufacturers, it’s completely reasonable for Comac to take advantage of technologies that already exist.

We wish Comac the best of luck and look forward to seeing where it goes from here! In the meantime, be sure to explore the holdings in the U.S. Global Jets ETF (JETS), which includes not only airlines but also aerospace manufacturers and transportation infrastructure companies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.