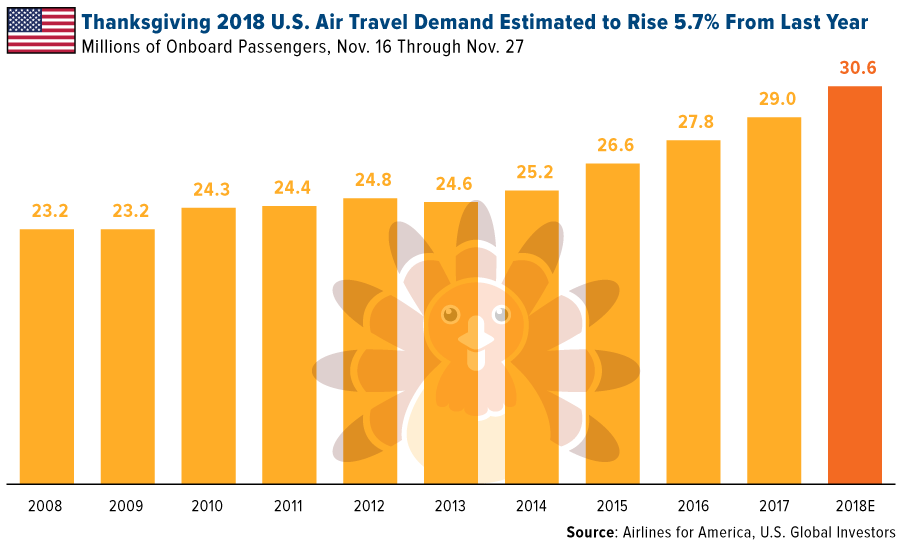

Airlines for America (A4A) predicted U.S. Thanksgiving air travel demand would climb to an all-time high of 30.6 million passengers this year, up from 29 million last year. “It is thanks to incredibly accessible and affordable flight options that more travelers than ever before are visiting loved ones, wrapping up year-end business or enjoying a vacation this Thanksgiving,” commented A4A Vice President and Chief Economist John Heimlich.

An article on Zacks noted that food and beverage and transportation stocks could see a rally during the Thanksgiving time period due to increased consumption and travel demand. Zacks noted that a few ETFs in particular could stand to benefit, one of which is the U.S. Global Jets ETF (JETS). JETS is the only available pure-play fund on the market right now that provides investors access to the global aviation industry.

Read the full article, “ETFs & Stocks to Shower Gains This Thanksgiving Week,” on www.zacks.com.

Past performance does not guarantee future results.

U.S. Global Investors has authored and is responsible for the summary on this page.

All opinions expressed and data provided are subject to change without notice. Opinions are not guaranteed and should not be considered investment advice.

Earnings per Share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company’s profitability.

A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Earnings growth is not a measure of the Fund’s future performance.

References to other securities should not be interpreted as an offer of these securities.

View JETS top 10 holdings by clicking here.