The continued spread of COVID-19 globally has sent investors away from equities and into perceived safe haven assets such as gold. Airlines have been forced to cut almost all flights and share prices are down significantly so far in 2020. However, governments around the world are stepping in to help carriers during this difficult time of decimated demand. Gold, on the other hand, attracted more buyers and saw its price rise from February.

Click below to read our recap of the airline sector and gold market for March 2020.

Strengths

- Investors are noticing the buying opportunities among airlines amid the continued equities selloff on coronavirus concerns. Billionaire investor Warren Buffet’s Berkshire Hathaway, Inc. increased its stake in Delta Airlines in late February, reports Bloomberg. The company acquired more than 976.000 shares for around $45.3 million. Berkshire now owns 17.9 million shares of the carrier – or about 11 percent total.

- As commercial carriers make big cuts to scheduled flights due to plummeting passenger numbers, private jet operators are seeing a surge in demand. Richard Zaher, CEO of Paramount Business Jets, says demand is unbelievable and that “aircraft are getting booked literally in minutes.” Bloomberg reports that Zaher’s business is up 30 percent from the same time last year and that JetSet Group, Inc. is 60 percent higher. The carriers noted that passengers are required to go through mandatory temperature screenings.

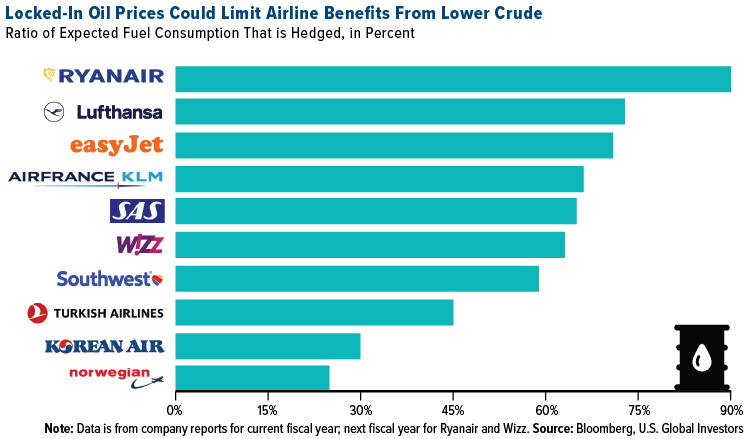

- One positive light for airlines amid the COVID-19 outbreak is lower oil prices. Crude has fallen dramatically as the world predicts weaker oil demand and production continues to grow. Fuel is one of airlines’ biggest expenses. However, many carriers now hedge oil prices and secure locked-in prices. For example, RyanAir hedges almost 90 percent of its oil consumption, while Southwest is less than 60 percent hedged. Airlines learned from the oil surge in 2013 that locking in lower prices can be beneficial when prices rise, but a weakness when prices fall.

Weaknesses

- Airlines could lose $252 billion in revenue from passenger operations this year due to the pandemic, according to the International Air Transport Association (IATA). The organization’s CEO said that half of its member carriers could go bankrupt without government aid. Commercial flights globally have been cut by nearly 90 percent and carriers are seeking bailouts from their respective countries. The U.S. passed a stimulus package that includes more than $50 billion in earmarked liquidity for domestic airlines, $25 billion in loans and guarantees for passenger carriers and $25 billion in direct grants. Although this should help the airlines, many predict that it won’t be enough.

- The entire airline industry is suffering from the slowdown in global travel, including manufacturers and engine makers. Rolls-Royce halted civil engine production for a week and Safran cut a $1.1 billion dividend. Bloomberg writes that the sector employs more than 500,000 people in the U.S. alone. GE Aviation – the world’s biggest engine maker – is cutting 10 percent of its 26,000 U.S. employees and will furlough half of its maintenance staff for 90 days.

- A 136-page report released by Ethiopian investigators shows that Boeing’s design of the 737 MAX jet and inadequate pilot training led to the deadly crash of an Ethiopian Airlines flight a year ago. The report released in early March is a draft and the final report determining the cause of the crash has not yet been released. The report puts a focus back on Boeing for its troubled 737 model that suffered two deadly crashes. Aircraft design and pilot training were also cited as factors in the fatal Lion Air flight.

Opportunities

- Airlines are adapting to the changing travel landscape by venturing into cargo-only flights. Carriers are replacing passengers with goods in a bid to earn some revenue as traffic is down 90 percent during the COVID-19 outbreak. Bloomberg notes that carriers around the world, such as Cathay Pacific Airways, Korean Air Lines and American Airlines, are boosting cargo traffic by transporting goods in the belly of passenger planes. Southwest even offered its first cargo-only flight in its history. Um Kyung-a, analyst at Shinyoung Securities, said “with oil prices falling and higher rates, it’s become economical for some airlines to be using passenger plans for cargo.”

- The European Union (EU) is helping airlines cope with the coronavirus pandemic by waiving until October 24 the requirement that carriers use at least 80 percent of their takeoff and landing positions or risk losing them the following year, reports Bloomberg News. Airline slots are worth millions of dollars and the suspension of the EU “use-it-or-lose-it” rule should help struggling carriers.

- Although the U.S. government stimulus package might not have been all that airlines had asked for, President Donald Trump did express strong support for the sector. In mid-March Trump told reporters that “as far as the airlines are concerned, we are going to back airlines 100 percent. We’re going to help them very much.” President Trump’s economic advisor Larry Kudlow also expressed support for the industry, saying that “If they get into a cash crunch, we’re going to try and help them.” This provides hope that airlines might get even more help further down the road.

Threats

- Bloomberg News used Edward Altman’s Z-score method to predict bankruptcies and created a list of the airlines at most risk of going bankrupt in the next two years. The list is heavily concentrated in Asian carriers due to high debt levels and includes Pakistan International Airlines, Air Asia Indonesia, Nok Air PNG Air and Kenya Airways. Qatar Airways CEO Akbar Al Baker said that “in this very difficult period, it will only be the survival of the fittest.” The executive added that “a lot of airlines” will disappear due to the virus.

- Before U.S. lawmakers passed the over $2 trillion stimulus package, the bill included language that would have linked financial aid to a requirement that airlines would have to cut in half their carbon emissions over the next 30 years and start offsetting emissions in 2025, reports Bloomberg. That provision was ultimately removed from the package, along with other green initiatives, as Republicans accused Democratic lawmakers of trying to add in unnecessary measures and put the Green New Deal in effect.

- From 2010 to 2019, U.S. airlines spent approximately 96 percent of free cash flow, or $45 billion, to purchase shares of their own stock. Share repurchase programs aim to boost share prices. This issue arose when lawmakers were considering aid packages for airlines. Perhaps if airlines used all that cash to build up reserves, rather than buy their own stock, they might have been in a better position to weather a downturn such as now due to the virus.

Strengths

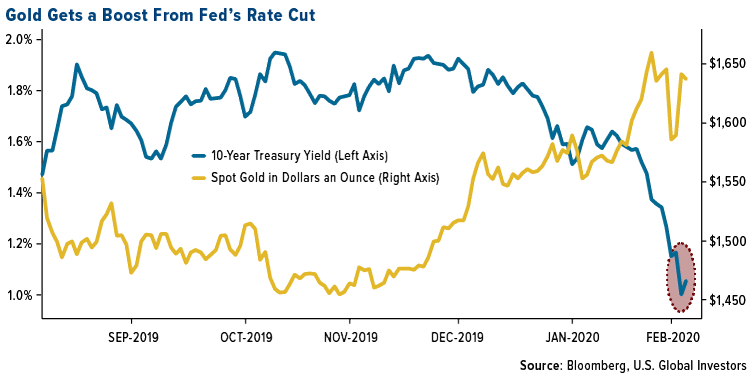

- Gold had its biggest one-day advance in almost four years in the first week of March after the Federal Reserve cut interest rates by 50 basis points to help mitigate the negative economic effects of the coronavirus. The rate cut led to Treasury yields plunging, which is historically good for the price of gold. The 10-year yield fell below 0.7 percent and the yellow metal could soon test $1,700 an ounce. Gold, platinum and palladium surged at the end of the month as supply disruptions due to lockdown orders boosted prices.

- Investors continued to pile into gold as fears of the coronavirus intensified over the course of the month. Holdings in gold-backed ETFs in early March already totaled more than half of the 323.4 tons added in 2019, according to Bloomberg data. ETFs added 55 tons of gold in the three days ended March 11. Indian investors were also buying gold. Net inflows into gold-backed ETFs totaled 14.83 billion rupees, or about $201 million in February – the biggest increase since the funds first launched in 2007. The U.K.’s Royal Mint said that weekly precious metals sales quadrupled from the same period a year earlier last week. The U.S. Mint reported that it has sold out of American Eagle silver coins.

- Mark Mobius, veteran emerging markets investor, said in a Bloomberg TV interview that “with this fear crisis, people want to get into cash so they sell everything, including gold. But I think the trend for gold is going to continue to go up.” Mobius added that if there is a price correction he might add to his gold position. Dymon Asia Capital Chief Investment Officer Danny Yong said in a Bloomberg TV interview this week that investors should be long gold as the U.S. dollar strength won’t last. Yong added that periods such as now with extreme volatility serves as a reminder that there is still a place for active fund managers.

Weaknesses

- Gold moved up and down in March as some investors sold gold to raise cash and find liquidity. The bullion market was thrown in a frenzy the week ended March 27 as investors scrambled to get their hands on gold. Logistical disruptions and tight physical supply led to a wide divergence of prices in the U.S. and London. Contracts for delivery in New York were trading at a $60 premium to London – the highest premium since the 1980s. Bloomberg notes that most banks and traders ship gold around the world on commercial flights. But with most flights cancelled and refineries closing due to lockdowns, it has become more challenging to buy and sell the metal.

- The All India Gem and Jewellery Domestic Council estimated that total purchases of gold jewelry in India are set to fall 30 percent in 2020. Demand had already been hit for months due to high domestic prices and slow economic growth. But now with the added virus threat and the entire country on lockdown, demand could fall to the lowest since 1995. Gold shops will likely stay closed and if the rupee continues to fall, local gold prices will remain elevated.

- BASF announced that it has developed tri-metal catalyst technology that would enable partial substitution of palladium for cheaper platinum in light-duty gasoline vehicles, reports Bloomberg. Although positive for platinum demand, this is negative for palladium, whose recent rally is largely due to demand for use in catalysts. Palladium was one of 2019’s best performing commodities, but it has been caught in the rout.

Opportunities

- Scotiabank analyst Tanya Jakusconek wrote in a note to clients that gold miners are trading at levels cheaper than those seen in the 2008 financial crisis. Gold equities are trading at around a 16 percent discount to gold prices – lower than the 10 percent discount in 2008. Gold miners could be one of the few sectors to report positive first quarter earnings, as spot prices have averaged at least $100 more per ounce than in the fourth quarter of 2019. Desjardins wrote in a note than linear regression suggests a further 12 percent increase to cash flow in the first quarter for gold miners. Oil prices have crashed since the COVID-19 outbreak worsen, which could be a positive for miners, as fuel is a big cost and lower prices would increase their margins.

- Suki Cooper, precious metals analyst at Standard Chartered Bank, said in a Bloomberg TV interview that “global monetary conditions are going to be key for the next move higher in gold.” This comes as central banks globally release fiscal stimulus and interest rate cuts to support economies. UBS raised its 2020 average gold price forecast to $1,650 an ounce, up from $1,600 an ounce previously. They also think that gold has the potential to test the high $1,700s in the first half of this year. Australia & New Zealand Banking Group Ltd. said in a report this week that there’s a high probability of gold reaching $2,000 an ounce in the second quarter depending on the extent of the coronavirus impact, reports Bloomberg.

- Australia is expected to overtake China as the world’s largest gold producing country in 2021, according to its Department of Industry, Science, Energy and Resources. Australia hopes to produce 383 tons of gold in 2021, due to higher prices. The coronavirus outbreak is likely to reduce China’s production by 2.9 percent in 2020 to 369 tons.

Threats

- Treasury yields plummeted to record lows as demand for haven assets grew due to the global health emergency economic fears. Long-bond rates had their biggest intraday drop since 2009, according to Bloomberg. Tony Farren of Mischler Financial Group said “we expected the virus to have a big impact. But it has gone way beyond our wildest expectations.” A credit crisis is brewing as companies fear hurt income and the ability to repay debt. John McClain, a portfolio manager at Diamond Hill Capital Management, said “this is what the start of a recession after a long bull market feels like.”

- The non-partisan U.S. Government Accountability Office found that there are more than 215,000 abandoned hardrock mine sites that pose either a physical safety risk or an environmental risk to the public. Taxpayers could face an $11.6 billion cleanup bill on these mines, on top of the $1.9 billion that was spent from 2008 to 2017 to clean sites. Senator Tom Udall released the report to underscore why Congress must act swiftly to update the outdated 1872 hardrock mining law that keeps mining companies from being liable for cleaning mine sites.

- The dollar rose in March as investors scrambled to get their hands on cash in what some are calling an irrational “fear trade”. If the stress in the dollar funding market continues, it could lend further support for higher prices. A stronger dollar has historically been negative for the price of gold.

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

A basis point, or bp, is a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001).