Airlines continued to weather the COVID-19 storm as a return to normal travel levels appears to be further away. On the other hand, investor interest in gold increased during the month as volatility returned to the markets.

Click the buttons below to read our recap of the airline sector and gold market for May 2020.

Strengths

- Space travel made a big leap forward in May. A private company, SpaceX, for the first time launched two astronauts into orbit nearly a decade after the U.S. government retired the space shuttle program. The Falcon 9, carrying a Crew Dragon capsule, was launched on Saturday May 30, and arrived at the International Space Station the next morning carrying two American astronauts. The successful launch is one step closer toward space tourism and commercial flights. Both SpaceX and Boeing were awarded contracts for the Commercial Crew Program in 2014, and Boeing could soon too achieve the mission of getting astronauts to space.

- The number of passengers screened daily in the U.S. by the Transportation Security Administration (TSA) has steadily been gaining momentum. On May 31, nearly 353,000 people boarded commercial flights in the U.S., up 303 percent from a low of 87,534 people on April 14, and well above the 10-day moving average.

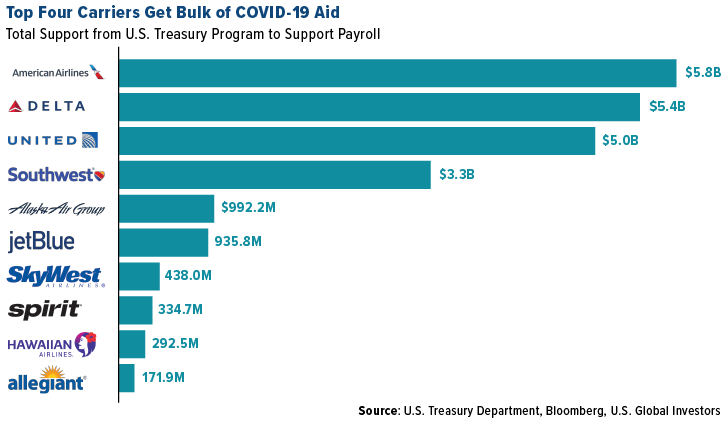

- According to government figures, the bulk of the $25 billion in aid for employees at passenger carriers went to the four biggest airlines: American, Delta, United and Southwest. Bloomberg notes that 90 other companies have received funds under the payroll aid program, including luxury charter carriers. As of May 29, none of the carriers had actually tapped into those funds. Bloomberg reports that the carriers plan to wait until fall and see how the summer travel season goes before deciding to take the government aid. This demonstrates optimism from carriers that travel demand could recover faster than expected.

Weaknesses

- Perhaps the biggest news for the airline industry in May was that legendary investor Warren Buffett sold all his positions in major U.S. carriers. Buffett’s Berkshire Hathaway announced in its annual meeting that sales of shares in Delta, Southwest, American and United made up most of the company’s $6.5 billion April equity sales. At the end of 2019, Buffet’s stakes in the big four carriers neared $10 billion, with greater than 10 percent ownership stakes in Delta and Southwest. “The airline business – and I may be wrong and I hope I’m wrong – but I think its changed in a very major way. The future is much less clear to me,” said Buffett.

- Airbus reported just nine net orders in the month of April and delivered only 14 jetliners. More and more airlines are conserving cash and delaying accepting new planes. Airbus already cut output targets for the year by a third. Rolls-Royce lowered its delivery target for wide-body plane engines by 44 percent for the year. Boeing, which was suffering long before the coronavirus erased travel demand, reported more than 300 cancelled orders so far in 2020.

- A Pakistan International Airlines flight with 99 people on board crashed into a residential neighborhood on May 22 after pilots reported losing power from both engines as the plane neared landing, reports Bloomberg. At least two passengers survived the crash and many on the ground were killed or injured. The flight was from Lahore to Karachi, Pakistan and was on a A320 narrow-body jet that entered service in 2004.

Opportunities

- Despite Buffett exiting the airline space, investors and traders are not deterred from investing in airlines, viewing it as an attractive buying opportunity. The U.S. Global Jets ETF (JETS), which invests in global airlines, airport operators and manufacturers, saw strong inflows even after the Buffett news was released. From May 1 to May 27, investors added $182.14 million to JETS – a sign that investors are betting on a travel turnaround.

- Private air travel could be making a comeback, according to Signature Aviation Plc. CEO Mark Johnstone said “encouragingly, we have seen some early signs of an improvement.” The company said flight activity that fell 77 percent in April from a year earlier was down only two-thirds in the first 13 days of May.

- Airlines are taking big precautions to help make passengers feel safe flying again. JetBlue was the first major carrier to require all employees and travelers to wear a face mask throughout the journey, and other carriers quickly followed suit. Delta is one of many leaving middle seats unoccupied to increase the distance between passengers. Airlines are also allowing passengers to reschedule their trips for free if a plane reaches a certain capacity level. Hopefully these measures, along with the falling number of COVID-19 infections, will get more people in the skies.

Threats

- The International Air Transport Association (IATA) warned that demand for flights will lag behind pre-coronavirus forecasts for at least five more years. Brian Pearce, the group’s chief economist said that global traffic will still be 10 percent below original estimates in 2025. The IATA doesn’t expect travel rebounding to 2019 levels until 2023 at the earliest.

- American Airlines and EasyJet both plan to cut management and staff by 30 percent. These are just a few of the carriers announcing massive job cuts to stem losses from drastically reduced travel. Delta Airlines is offering new retirement programs to entice workers to leave voluntarily as it anticipates a slow recovery in demand. Latam Airlines, the top South American carrier, has filed for bankruptcy and more carriers could be headed in the same direction soon. Boeing CEO Dave Calhoun said on NBC that the travel recovery is going to be slow and there is a risk that a major American airline could fail.

- U.S. and China tensions heated back up in May. China will allow chartered passenger flights from eight countries as it loosens restrictions on inbound travel, but the U.S. will not be included, reports Bloomberg. Although positive that China, and other countries, are easing coronavirus travel restrictions, this is negative for U.S. carriers in losing out on service to the populous nation.

Strengths

- The annual “In Gold We Trust” report was published by Incrementum AG and was filled with bullish expectations for gold. Fund managers and authors of the report Ronald-Peter Stoeferle and Mark Valek wrote that gold could approach $5,000 an ounce and possibly even push toward $9,000 an ounce by 2030. “The proprietary valuation model shows a gold price of $4,800 at the end of this decade, even with conservative calibration.” Kitco News notes that in the 2019 report, they accurately predicted that gold was in the early stages of a new bull market.

- The World Gold Council (WGC) expects the number of central banks buying gold to increase substantially in 2020. Based on the recent WGC survey, 20 percent of central banks intend to boost gold reserves over the next 12 months. This is up from just 8 percent of respondents in a 2019 poll. 22 central banks were net buyers of gold in 2019, up from only 8 in 2010.

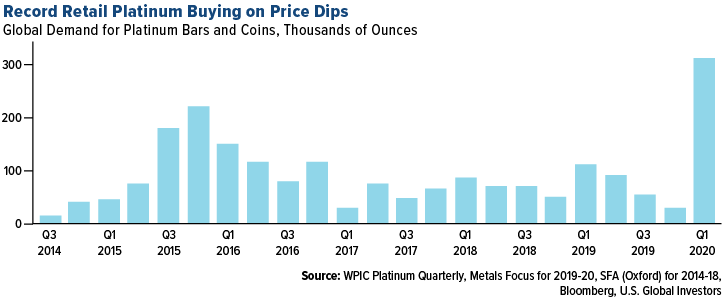

- Purchases of physical platinum by retail investors almost tripled to 312,000 ounces in the first quarter of this year – the most on record – according to the World Platinum Investment Council (WPIC). Prestige Bullion said that over 2,000 platinum coins featuring an elephant sold out to U.S. and Asian investors after being minted in March. The company says that more coins will be produced once South Africa’s virus lockdown is lifted and will feature other animals including the lion, rhinoceros, leopard and buffalo.

Weaknesses

- Venezuela’s central bank sued the Bank of England (BOE) for access to $1 billion in gold reserves. The troubled South American nation asked the BOE to liquidate its gold and send the funds to the United Nations Development Programme, which is working with Venezuela to prepare for an increase in COVID-19 infections. This new lawsuit is another twist to the long dispute of cutting off President Nicolas Maduro’s regime from its overseas assets.

- Gold consumption in China fell 48 percent to 148.63 tons in the first quarter, according to the China Gold Association. Buying in the world’s top consumer was hampered by closed shops and higher metal prices.

- HSBC reported a $1 million loss in metals trading revenue in the first quarter, compared with a $38 million profit for the same period last year. The bank said that it decreased due to “market volatility and unfavorable valuation adjustments on exchange for physical transactions.” Bloomberg reports that the bank cited in a filing “delivery disruptions in the gold market” as one reason why it breached its value-at-risk limits 12 times in March. HSBC normally only expects this to occur two or three times a year.

Opportunities

- Gold miners in Australia are resuming a pandemic-disrupted exploration boom as metal prices surge amid a lack of new major discoveries. According to government estimates, spending on gold exploration in the country rose to a new record in the fourth quarter of 2019, while the annual total of more than $656 million was 20 percent higher than 2018. S&P Global Market Intelligence said in a report this month that there have been no major gold discoveries in the past three years.

- South Africa’s Rand Refinery Ltd., Africa’s largest refinery, said it is restarting gold smelting as the country eases a national lockdown. Rand’s CEO Praveen Baijnath said, “We have established a good routine and have been able to ensure that product from our mining clients is shipped to us and that refined product makes its way to bullion banks and end user customers.” Swiss refineries are also ramping up production, which should ease supply concerns that caused gold prices to diverge widely in April.

- State Street Global Advisors is bullish on gold. The group says gold will trade between $1,700 and $1,800 an ounce for the next few weeks due to lower interest rates and expectations that fiscal stimulus will weigh on the U.S. dollar.

Threats

- COVID-19 remains a major threat globally as the virus continues to spread and lockdown measures ease only in some countries. Brazil, a top miner and exporter, has seen a surge in infections. Reports out of China show that the virus is manifesting differently than doctors have seen before, raising concerns of a second wave of infections.

- South Africa’s mines have been operating with half their workforce since a five-week shutdown ended at the beginning of May and starting on Monday all workers can return. However, there are questions surrounding how workers will be able to safely social distance in cramped mining conditions. The country has seen virus flare-ups temporarily closing individual operations, which could curb output and hurt profitability.

- Cleveland Federal Reserve Bank President Loretta Mester cautioned that the economic recovery from the COVID-19 pandemic could be slow on a Bloomberg TV interview this week. “When we have so many people out of work it’s hard to imagine that we see a quick V-shaped recovery.”

The outbreak of the COVID-19 pandemic and the resulting actions to control or slow the spread has had a significant detrimental effect on the global and domestic economies, financial markets and industries, including airlines. U.S. Global Investors continues to monitor the impact of COVID-19, but it is too early to determine the full impact this virus may have on commercial aviation. Should this emerging macro-economic risk continue for an extended period, there could be an adverse material financial impact to the U.S. Global Jets ETF.