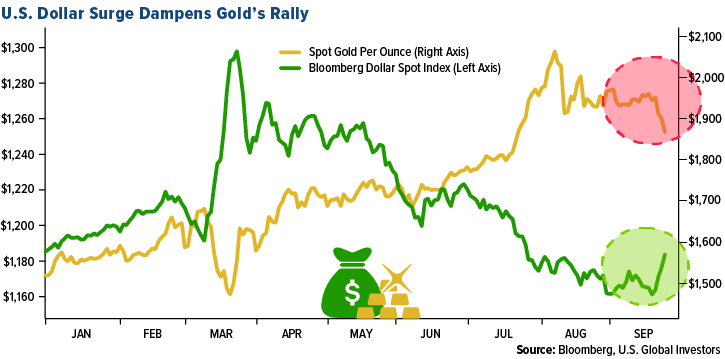

Airlines sunk after recovering slightly on the news that coronavirus cases are ticking back up – especially in Europe. New travel restrictions will hamper the travel recovery. The price of gold was especially volatile in the month of September – falling back below $1,900 an ounce.

Click the buttons below to read our recap of the airline sector and gold market for September 2020.

Strengths

- Airlines are touting coronavirus tests to lure travelers. Hawaiian Airlines is offering customers drive-through COVID testing in California to help Hawaii-bound travelers avoid a 14-day quarantine rule. United is offering on-the-spot testing to customers flying to Hawaii for $250 to avoid the two-week quarantine. Airports are also offering rapid tests to bring back travel. The Rome airport introduced rapid screening on September 16, reports Bloomberg.

- Airbus is preparing to deliver its first American-made A220 jetliner to Delta later this month, doubling down on its Alabama site with a new assembly line building this model after making more than 180 A320s, reports Bloomberg. Despite a long-running dispute with the World Trade Organization, Airbus’ U.S. facility has expanded its global reach.

- JetBlue Airways President Joanna Geraghty, citing Harvard’s School of Public Health data, says that wearing a mask and HEPA air filtration systems yield a “less than 1 percent risk of transmitting COVID in an aircraft.” This positive data could help spur an increase in air travel if passengers are confident that they have a low chance of contracting the virus from another passenger.

Weaknesses

- The airline industry continues to cut jobs around the world. British Airways says it could cut as many as 10,000 jobs. Lufthansa said it plans to cut its fleet by 100 jets and shed 22,000 full-time positions. Singapore Airlines will eliminate 20 percent of its workforce – about 4,300 jobs.

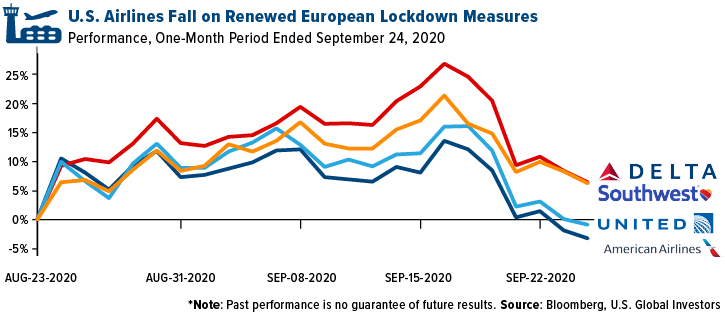

- Coronavirus cases are spiking back up – especially in Europe. U.S. carrier stocks, in addition to global carriers, fell after rising early in the month on the news that new lockdown measures are in place. Some fear this is the “second wave” of cases moving through Europe and could expand to the U.S. A grim milestone was reached in the pandemic – 1 million deaths from the virus globally.

- Tourism is also suffering from the lack of air travel. U.K. hotel operator Whitbread said it plans to eliminate nearly one in five jobs, or about 6,000 workers. The U.K. announced bars will start closing and companies should again have people work from home if possible. Daily COVID cases rose above 4,000 – a number not seen since May.

Opportunities

- Airlines continue to get creative on new sources of income. Thai Airways is opening up its Airbus and Boeing flight simulators to the public, reports Bloomberg. Starting in October, customers can get into a mock cockpit for 30-minutes for around $380. The carrier also transformed its cafeteria into an airplane-themed restaurant complete with plane seats and furniture made from spare jet parts. Australia’s Qantas Airways is selling fully stocked bar carts from its retired Boeing 747 fleet for $1,000 – complete with mini wine bottles. Singapore Airlines has turned its A380 superjumbo jet into a pop-up restaurant.

- American Airlines announced it will begin updated computer-based training for pilots on the grounded Boeing 737 Max in late October. Bloomberg reports the carrier expects all pilots to be re-trained by January and is laying out plans for the Max’s returns “in the near future.” This is a big win for Boeing that a major carrier is showing confidence in the troubled jet’s return to the skies.

- United Airlines boosted its flight schedule in October. The major domestic carrier will fly 40 percent of its schedule from the same month last year, up from 34 percent of its year-earlier schedule in September.

Threats

- Tens of thousands of U.S. airline workers are set to lose their jobs on October 1. The government aid package in March gave carriers support for payroll in return for not cutting jobs until the end of September. However, it seems unlikely that another relief package will pass before then, forcing carriers to make massive staff reductions due to the continued decimation in air travel with a recovery not seen in the near future.

- The impending Brexit could threaten British pilots. A no-deal exit of Britain from the European Union at year-end could deprive British pilots of the right to fly EU-registered planes. Bloomberg notes that The Department of Transport is hoping for a bilateral agreement on aviation safety that would include mutual recognition of pilot licenses.

- According to Air New Zealand’s CEO, quarantine-free travel between Australia and New Zealand is unlikely to resume for at least another six months. Plans for a safe-travel corridor to stimulate tourism was put on hold after renewed coronavirus outbreaks in both countries, reports Bloomberg.

Strengths

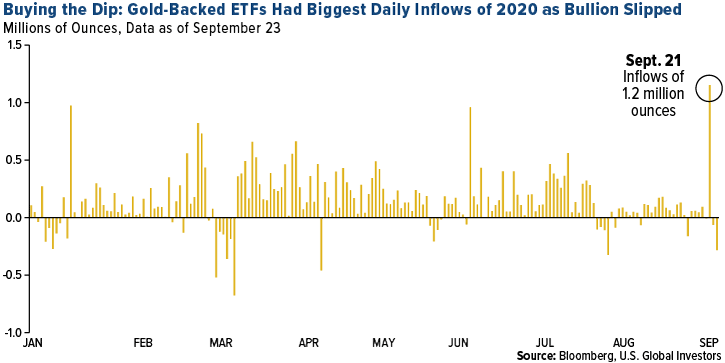

- On September 21, when the price of gold fell nearly 2 percent, investors added 1.2 million ounces to ETFs backed by physical gold. That was the most for a single day in 2020. This is a positive sign that investors “bought the dip.” Gold-backed ETFs saw a ninth-straight month of inflows in August, driven by growing appetite in Asia. Collectively, 39 tons of bullion, equivalent to $2.1 billion, were added to ETFs in August with 7 tons coming from Asia.

- Australian gold output is surging and proves production didn’t slow due to the pandemic. Production for the three months ended June 30 totaled 85 tons, up from 77 tons in the March quarter. Output for the 12 months ended June 30 totaled a record 328 tons.

- India’s gold imports nearly doubled in August to 35.5 tons, up from 14.8 tons a year earlier. The world’s second largest consumer is preparing for the start of key festivals where gold is given in the form of jewelry for gifts. Platinum exports from Switzerland remained at elevated levels in August. According to data from the Swiss Federal Customs Administration, supplies of platinum hit 6.7 tons in August, up 40 percent from the previous month. Gold shipments from Switzerland resumed to China after a five-month break. China’s gold demand is showing signs of recovery after importing 10 tons in August.

Weaknesses

- Due to sanctions and a collapsing oil industry, Venezuela is ramping up mining by moving into protected areas of the Amazon. Bloomberg notes the country already has a thriving illegal gold industry that harms waterways, forest and indigenous communities. According to a study by local non-profit Wataniba, the amount of land used for mining has more than tripled since March 2019.

- World Gold Council (WGC) data shows that central banks’ net purchases of gold fell below 9 tons in July, the lowest since 2018. After two years of strong buying, demand has eased in 2020. Bloomberg notes a slower pace of buying could curtail an important driver of gold’s rally.

- Silver had a weak month on the heels of a stronger dollar and is back in a bear market. The metal was down a massive 14.55 percent for the week ended September 25. After approaching $30 an ounce in mid-March, silver suffered severe losses on a resurgent U.S. dollar and concerns about growth. The dollar is also driving the gold price. The two assets historically trade in the opposite direction and the dollar rallied in September.

Opportunities

- An artificial intelligence start-up is working to solve the problem of declines in ore grades at mines. British tech company Intellisense.io has software that uses sensors built into the plant to form a model of the grinding process and flag problems before they happen – a valuable feature when a company’s mines produce ore with lower levels of gold. Bloomberg notes that the mining sector has been slower to adopt AI in comparison with other sectors.

- A diamond the size of an egg is being put up for auction in October and is expected to fetch $12 million to $30 million. Kitco News reports that Sotheby’s is selling a 102.39-carat diamond – the second largest oval diamond of its kind to be offered at auction. The largest ever, a 118.28-carat stone set a record $30.8 million price in 2013. Petra Diamonds found five blue diamonds, considered the most valuable in the world, at its flagship Cullinan mine in South Africa. The gems range in size from 9.6 carats to 25.8 carats. Bloomberg notes Petra sold a 20-carat blue diamond for almost $15 million last year.

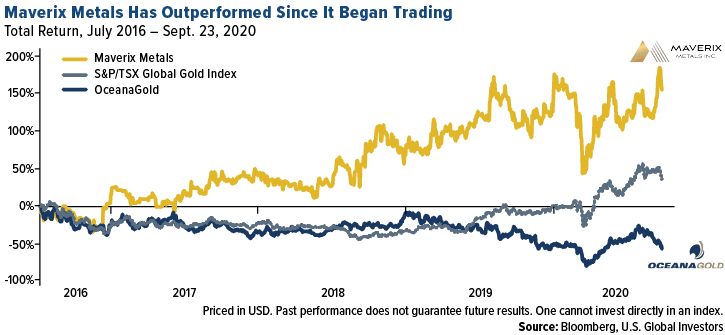

- Maverix Metals, a royalty and streaming company, formed in 2016 after the company acquired a package of assets from Pan American Silver. In late September, Maverix entered into a binding purchase and sale agreement to buy a portfolio of 11 royalties from Newmont, including the Camino Rojo gold and silver project in Mexico. Raymond James upgraded the stock to an Outperform rating. We like the stock and, based on our quant stock-picking model, it rotated into the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) in the September rebalance. This replaced Australia-based producer OceanaGold. Maverix’ gross margin overtook OceanaGold’s in 2019 and has only continued to increase.

Threats

- B2Gold Corp is expanding its gold mining operations in Mali, even as the West African nation ousted its president last month – the second coup in less than 10 years. Mali’s gold mines have not been affected by the political turmoil, but it is still a threat to operation in the region. CEO Clive Johnson said in a phone interview with Bloomberg that “the current situation doesn’t deter us.”

- Russia is raising mineral-extraction taxes on mining companies to narrow a budget deficit of 4 percent of GDP, reports Bloomberg. The Finance Ministry proposed more than tripling taxes for extracting most metal and fertilizers for next year. This is a threat to Russian mining companies and would increase costs. However, silver mining and new projects will be excluded.

- A flurry of new investors to the gold mining space has Newmont Corp. warning against dodgy deals. The SEC warns investors of “mini-tender” offers: “Some bidders make mini-tender offers at below-market prices, hoping they will catch investors off guard if the investors do not compare the offer price to the current market price.” Newmont explains that these are offers to acquire less than five percent of a company’s outstanding shares and avoid many of the investor protections afforded for larger tender offers.

Want to receive this recap straight to your inbox? Sign up for monthly updates by clicking here.

The Bloomberg Dollar Spot Index (BBDXY) tracks the performance of a basket of 10 leading global currencies versus the U.S. Dollar. It has a dynamically updated composition and represents a diverse set of currencies that are important from trade and liquidity perspectives.

The S&P/TSX Global Gold Index is designed to provide an investable index of global gold securities. Eligible Securities include producers of gold and related products, including companies that mine or process gold and the South African finance houses which primarily invest in, but do not operate, gold mines.