The price of gold fell below $1,800 an ounce briefly and the largest gold-backed ETF had its biggest monthly outflow in three years. On the other hand, airlines surged on positive news of a virus vaccine.

Click the buttons below to read our recap of the airline sector and gold market for November 2020.

AIRLINES

GOLD

Strengths

- Airlines surged on November 9 after Pfizer and BioNTech announced its vaccine candidate against the coronavirus was 90% effective in its phase 3 study. Hawaiian Holdings ended the day up a massive 50.83%. Carriers have recovered as positive vaccine news spurs hopes of a travel demand recovery.

- The International Air Transport Association (IATA) is working on a mobile app that will help flyers show their COVID-19-free status. These so-called COVID “passports” could be one way to speed up the travel recovery. A test program will begin with British Airways by the end of this year before arriving to Apple in the first quarter and on Android devices by April.

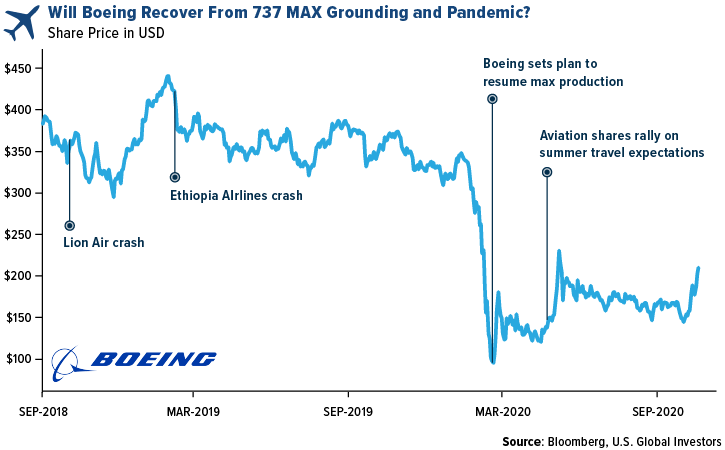

- S. regulators ruled that the Boeing 737 MAX can return to the skies with an extensive package of fixes, after the 20-month grounding following two deadly crashes. There are 72 of the planes in the U.S., another 315 in the rest of the world and around 450 built jets Boeing has been unable to deliver, amounting to billions of dollars in inventory that can now be sold. The manufacturer is still suffering from the impact of the pandemic as carriers globally have cancelled and deferred orders for new aircraft.

Weaknesses

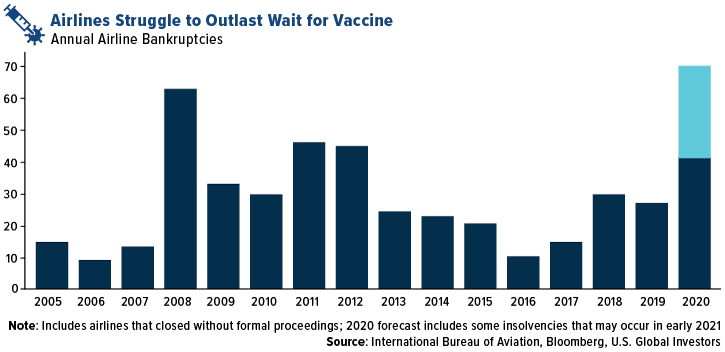

- IATA estimates global carriers will lose a combined $157 billion in 2020 and 2021 – five times the amount racked up during the 2008-2009 recession. Bloomberg notes this forecast is 60% higher than that in June. IATA calls the crisis “devastating and unrelenting.” The biggest threat for airlines is they will run out of cash before a vaccine is distributed and people begin to fly again.

- Data from OAG Aviation Worldwide shows that a third of the world’s air travel routes have been lost due to the pandemic. In January there were 47,756 operational routes around the world and by November there were just 33,416 routes. As nations closed borders and restricted outside travel, the number of international routes dropped far more drastically than domestic.

- Despite warnings by the CDC to refrain from Thanksgiving travel, a post-pandemic record for U.S. passengers was hit on November 22, with 1,047,934 people passing through airport security. Although negative that travelers are bucking the CDC warning, it does give hope to the air travel recovery.

Opportunities

- A surprising side effect of the pandemic has been progress toward digitizing aspects of flying. The push to reducing human touchpoints is reducing cabin weight and boosting cost-savings. British Airways has removed the in-flight magazine and is now available as a free download, saving a significant amount of weight. Bloomberg notes fuel is a major expense for carriers and just small changes can result in big savings. In 2018, United saved $290,000 in annual fuel costs by using a lighter weight of paper for its magazine.

- Although international air travel remains weak, domestic travel is recovering as certain countries ease restrictions with the pandemic under control. All 10 of the world’s busiest domestic routes so far in November are in Asia. The busiest route is between South Korea’s capital Seoul and the island Jeju – with 1.3 million seats scheduled for the month.

- Both an opportunity and a threat: Qantas Airways’ CEO Alan Joyce said the carrier plans to require future international passengers to have a COVID vaccination prior to flying. Joyce added that “it’s going to be a common theme across the board” to require all travelers to take a vaccine. This is an opportunity to restore confidence in flying and a threat that travel won’t recover until a vaccination is widely distribution. Vaccines are still in final trial stages and might not be distributed until the first quarter.

Threats

- According to research from IBA Group, 42 airlines globally have entered bankruptcy so far this year. Norwegian Air Shuttle filed for insolvency last week. The group predicts the total will push through 70 by March next year. IBA’s Stuart Hatcher said in an interview: “Airlines will be trying everything to get through to Easter, when higher demand should coincide with the roll-out of the vaccine, but there comes a point when the money runs out.”

- Although Boeing’s 737 MAX aircraft is cleared to fly again, it still faces the challenge of passenger fear after two deadly crashes. Some carriers are even giving passengers the option of changing flights if they are scheduled to fly on the aircraft. Another challenge is the timeline of the jets return. United said it will take 1,000 hours of work on each aircraft to prepare it for flights after a long time in storage and the extensive changes required. American is the first carrier to add the jet to its schedule, while Southwest, the largest buyer, said it won’t use the plane until the second quarter of 2021. The aircraft is also awaiting approval internationally.

- The European Union said it will place a 15% tariff on U.S. jets, along with other goods, creating a big problem for Ryanair. The carrier has more than 135 Boeing Max 200 jets on order and plans to take delivery of as many as 30 in 2021. Bloomberg reports that Boeing has over 300 pending orders from within the EU that could face cancellation due to the new tax. During the major cash burn during the pandemic, most airlines are not in a place to suddenly pay 15% more for their aircraft.

Strengths

- Thanks to higher metal prices and investor interest, gold mining equities have lately been cash flow machines. Gold royalty companies, including Franco-Nevada and Royal Gold, reported record revenues in the third quarter. Franco reported close to $280 million in revenues, up 43% quarter-over-quarter (qoq) and approximately 19% year-over-year (yoy). Royal Gold reported $147 million, up 22% qoq and 27% yoy.

- Barrick Gold reported its highest quarterly revenue since its 2019 merger with Randgold on stronger bullion prices. The second-largest gold producer announced $3.54 billion in revenue for the quarter ended September 30. Barrick raised its dividend by 12.5% to 9 cents a share. AngloGold Ashanti also doubled its dividend payout ratio due to surging gold prices. Bloomberg notes the world’s third-largest gold producer will now return 20% of free cash flow before growth capital to shareholders. In the September quarter, AngloGold’s free cash flow rose nearly fourfold to $339 million.

- Newmont is on the Dow Jones Sustainability World Index for the 13th year in a row, which represents the top 10% of the world’s largest 2,500 companies in the S&P Global Broad Market Index. Newmont was named the top global gold mining company for its leading environmental, social and governance (ESG) performance, reports Kitco News.

Weaknesses

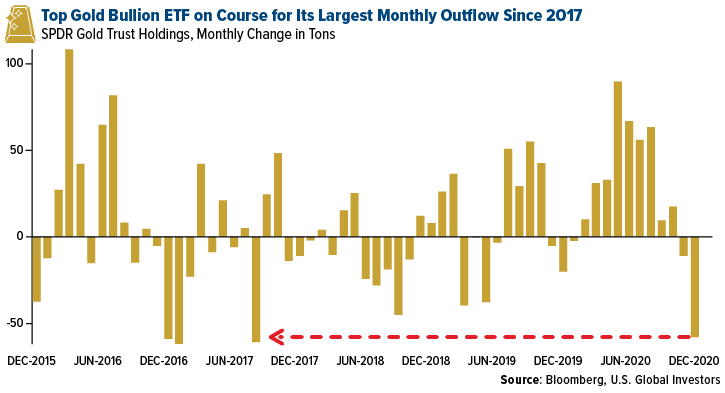

- Gold rose nearly 4% the week ended November 6, to trade above $1,950 an ounce, for its best week since July as results slowly came in that Joe Biden won the U.S. presidential election. However, the metal tumbled later in the month to below $1,800 an ounce on news that a COVID-19 vaccine was near approval, sparking hopes of a wider economic recovery.

- The largest gold-backed ETF, the SPDR Gold Trust*, had its largest monthly outflow since 2017. The ETF has already lost over 50 tons of bullion so far in November. Gold is heading for a fourth straight monthly decline and ETFs are set for the first month of outflows this year, after holdings hit a record in October. (*No other products mentioned are distributed by Quasar Distributors, LLC.)

- The London Bullion Market Association (LBMA) sent a letter to countries with large gold markets threatening to blacklist them if they fail to meet standards on money laundering and responsible gold sourcing, reports Reuters. The letter says nations that don’t declare support for LMBA standards by December 11 and share plans on how to implement them by the end of January won’t be able to supply LBMA-accredited refiners. This is the latest initiation to crack down on illegal or unethical gold trading.

Opportunities

- Goldman Sachs is targeting gold at $2,300 an ounce next year due to reflation pushing near-term real rates lower. Analysts said in a report that gold is primarily bought as a hedge against dollar debasement, and the bank expects its to be more sensitive to short-term real rates, akin to currency markets.

- Russia’s finance ministry is proposing allowing its sovereign wellbeing fund to invest in precious metals, according to a draft amendment of the law published on the government’s website. Russian giant Polyus said the prefeasibility for Sukhoi Log, the world’s largest untapped gold deposit, shows annual production of 2.3 million ounces at a cash cost of $390 per ounce, reports Kitco News.

- Endeavour Mining Corp is in talks for a potential merger of equals with rival Teranga Gold Corp as it seeks to build scale. Bloomberg reports Endeavour is considering an all-stock purchase and may offer a low premium for Teranga, which has seen its stock surge 87% so far this year. This is a positive sign with more potential for deal-making in the industry.

Threats

- According to research from International Crisis Group, more than $1.5 billion worth of gold is smuggled out of Zimbabwe each year, depriving the stricken economy of crucial foreign-exchange revenue. The report noted how gold is illegally shipped from small-scale miners to Dubai. Zimbabwean law requires miners to sell their gold to the central bank, paying 70% in dollars and the rest in local currency, which is worthless outside the country and is below black-market rates. Payments to these miners are “considerably lower” than the spot price of gold, prompting sellers to look for more lucrative markets.

- Gold bull Eddie van der Walt published a bearish macro view on gold and is looking for a price collapse of more than 9%. Bloomberg’s Mark Cudmore notes that gold has lost one of its biggest supporters. The bearish views come amid a lack of demand for usual sources – in this case the outflows from gold-backed ETFs.

- Money managers are also turning bearish on the yellow metal. Bullish gold bets decreased by 10,994 net-long positions for the week ended November 20, according to CFTC data on futures and options. This is least bullish net-long position in more than 17 months, according to Bloomberg.