If you were hoping to visit the Eiffel Tower or Colosseum this summer, you may be in luck. European Commission officials proposed at the start of May that member European Union (EU) states should start allowing fully vaccinated foreigners to enter for “non-essential reasons.”

The EU could represent the next leg in the recovery of commercial air travel. With the 27-member bloc ready to begin receiving international tourists, it may be time for investors to act.

In the U.S., domestic leisure travel has largely rebounded thanks to an aggressive vaccine rollout, and many carriers are capitalizing on the pent-up wanderlust by announcing new summer routes to popular vacation destinations. American Airlines in particular is betting big on summer, with 150 new routes available to travel-starved Americans starting next month. Ninety percent of its seat capacity will be open compared to summer 2019.

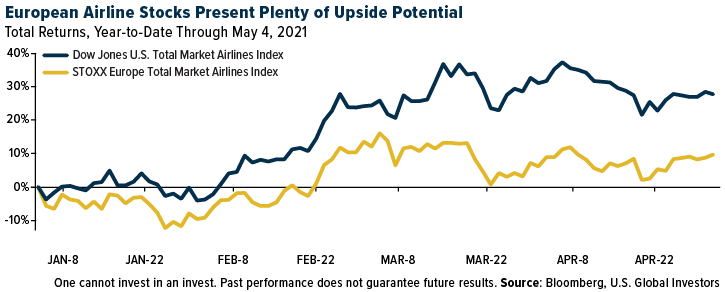

This has helped lift the Dow Jones U.S. Total Market Airlines Index up nearly 24% for the year and 111% for the 12-month period, as of May 11, 2021.

European airline stocks, meanwhile, have struggled to get off the ground with the EU still off-limits to visitors from all but seven countries, including Australia and Singapore. The news of relaxed travel signals a potential buying opportunity, especially for low-cost leisure-focused carriers.

Take a look at Hungary’s Wizz Air, Ireland’s Ryanair and the U.K.’s easyJet. They have managed to generate strong revenues from ancillary, or non-ticket, fees (think extra legroom, WiFi, hotel accommodations and more). In 2019, ancillary revenues represented a whopping 45.4% of Wizz Air’s total revenue, 4.3 percentage points higher than the previous year, according to consulting firm IdeaWorks. Ryanair’s ancillary revenues were 34.5% of total revenue; easyJet’s, 21.6%. For comparison’s sake, major long-haul carrier Lufthansa generated only 8% of its total revenue from ancillary means.

EU Vaccine Rollout Expected to Improve After Lagging Other Economies

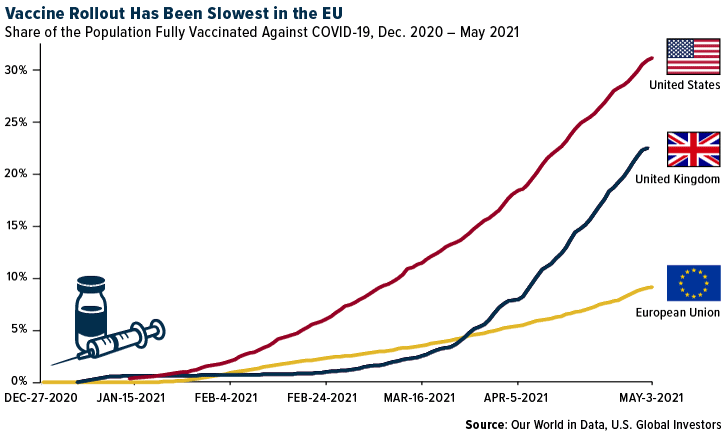

The EU’s reopening comes as its vaccine rollout “turns the corner,” according to the Wall Street Journal. Up until now, the number of vaccinations as a share of its populations has very much lagged those in the U.S., U.K. and Israel. As of May 4, less than 10% of people in the EU were fully vaccinated, compared to 23% of Brits and 32% of Americans.

But thanks to bigger deliveries and less bureaucracy, the EU is finally catching up. In the June quarter, the region is expected to receive 400 million doses of various approved vaccines, more than 3.5 times as many doses that were delivered in the March quarter, the WSJ writes.

If the trend continues in this direction, the EU could very well resemble the U.S. in the coming weeks, in terms of its ability to keep the economy open and running on all cylinders.

Some tourism-dependent EU member states have jumped ahead of the line to welcome international travelers, regardless of vaccination status. Greece, for instance, whose tourism industry accounts for more than 20% of gross domestic product (GDP), is mostly open to overseas visitors already, as are Croatia and Cyprus.

Here’s to the future of the global airline industry!

Interested in investing in airlines? Learn more about the U.S. Global Jets ETF by clicking here!

The Dow Jones U.S. Total Markets Airlines Index measures the performance of the portion of the airline industry which is listed in the U.S. equity market. STOXX Europe Total Market Airlines Index measures the performance of airline stocks listed in Europe.