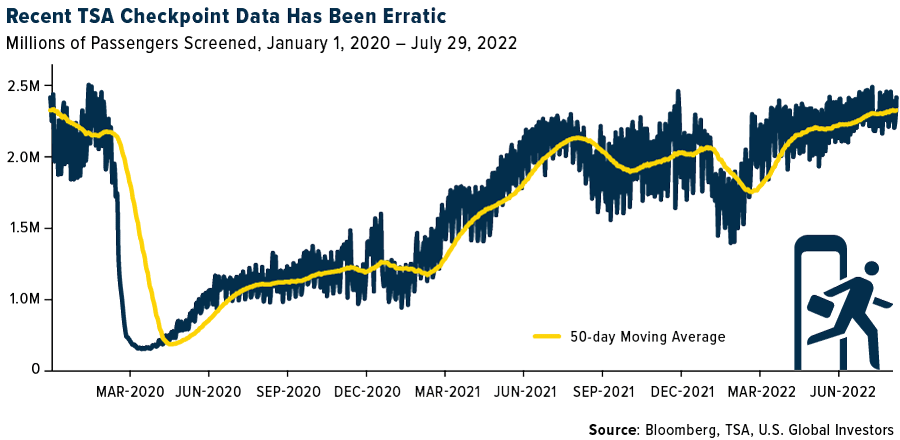

Air travel has rebounded to near pre-pandemic levels so far this summer. One of the best indicators of the return to the skies can be seen in the latest Transportation Security Administration (TSA) data below, which shows the number of passengers moving through U.S. airports from the start of the pandemic through the last week of July.

A lot has happened among some of the major carriers over the last two months. Below we highlight a few significant announcements and industry updates from June and July.

Citi Analyst on Economic Concerns: As reported by Barron’s on June 22, airlines have been facing numerous headwinds lately. These include labor shortages, soaring jet fuel prices, an uneven rebound in business travel and fears of a looming recession. Despite the worrisome landscape, however, one Citi analyst says shareholders could see some relief soon and explains how the market seems “to underappreciate” the strides the sector has made in recent years. Citi analyst Stephen Trent commented that there is “much less risk now embedded in airlines’ operations,” and believes investors have “overlooked wage growth, pent-up demand and relatively low capacity per capita which are relevant factors to consider in today’s domestic airfare strength versus three years ago.”

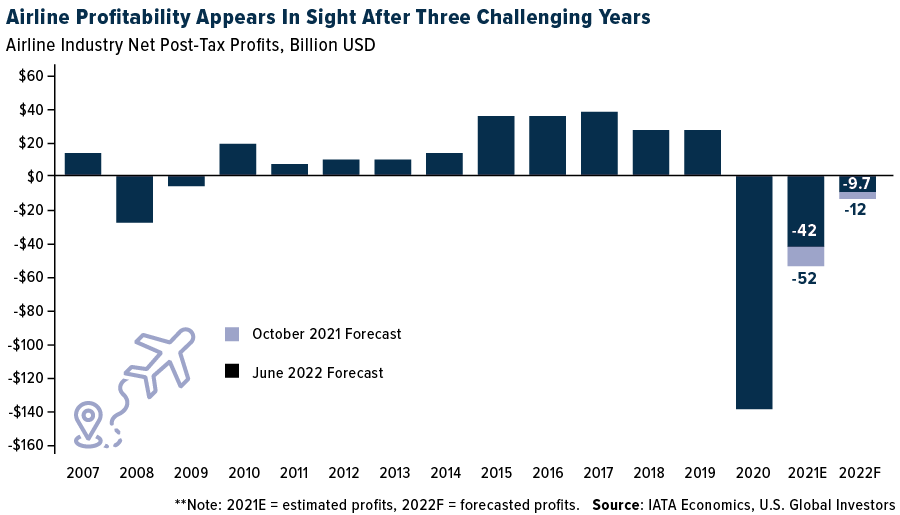

IATA Revises Profitability Outlook: The International Air Transport Association (IATA) released its updated airline industry forecast in its “Global Outlook for Air Transport” report. The chart below, created by the IATA, shows the evolution of airline industry net post-tax profit figures (from 2007-2022). The IATA revised its 2021 net loss estimate from $52 billion to $42 billion, the report explains, which is a significant improvement compared to the net loss of $138 billion in 2020. For the year 2022, the group is also forecasting industry losses to shrink to $9.7 billion from the $12 billion in losses forecast in October 2021.

Major U.S. Carriers Report Positive Quarterly Revenue: For the first time since the start of the pandemic, a handful of major U.S.-based airlines are returning to profitability in 2022. Strong demand for air travel and high fares have allowed names like American Airlines and United to overcome rising fuel prices. In its second quarter reporting announcement, Southwest Airlines’ CEO Bob Jordan stated, “We are very pleased to report all-time record quarterly revenues and net income, excluding special items, representing a significant milestone in our pandemic recovery.”

JetBlue Buys Spirit Airlines: JetBlue Airways announced at the end of July that it has reached a $3.8 billion deal to buy Spirit Airlines, reports CNBC. The takeover would create the country’s fifth-largest airline and remove a fast-growing budget carrier from the market. If approved by regulators, JetBlue’s takeover of Spirit would leave Frontier as the largest discount carrier in the U.S.

Interested in gaining exposure to the global airline industry?

Consider the U.S. Global Jets ETF (NYSE: JETS). Click here to download a fact sheet!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index.

The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.