A recent survey conducted by McKinsey & Co. shows that many Americans are still planning a vacation this summer “no matter what,” even as inflation remains a top concern. Nearly 70% of respondents said they were taking a trip regardless of rising prices, Covid, a potential economic slowdown and other worries.

This positive sentiment was echoed by Booking Holdings CEO Glenn Fogel, who told CNBC last week that Americans are “going to keep on traveling and they are going to travel more and more over the long run.”

Fogel joined the network to discuss Booking’s incredible second-quarter financial report. The online travel agency, which owns well-known brands such as Priceline, Kayak and OpenTable, recorded more room bookings in the three months ended June 20 than in any quarter in 2019, before the pandemic. Total revenues were $4.3 billion, nearly double what they were in the previous quarter, while net income was $857 million, compared to a net loss in the same quarter last year.

Looking ahead, Fogel expects record revenue in the third quarter, and bookings for the final quarter of the year are currently about 15% ahead of the same period in 2019.

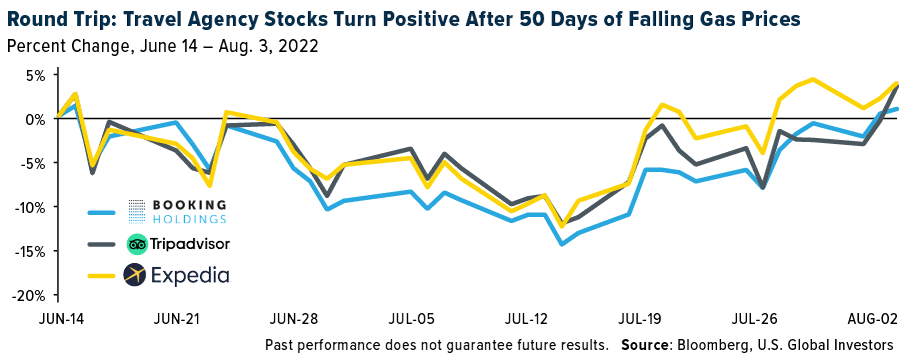

We’re bullish on not just Booking but also rivals Tripadvisor and Expedia, shares of which have recovered their loses, and then some, as gas prices have fallen for more than 50 days from their all-time highs on June 14.

All three companies are currently held in the U.S. Global Jets ETF (NYSE: JETS), which provides investors access to the global airline industry, including airline operators, aircraft manufacturers, airport services and travel services companies.

See the entire list of holdings in JETS by clicking here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.