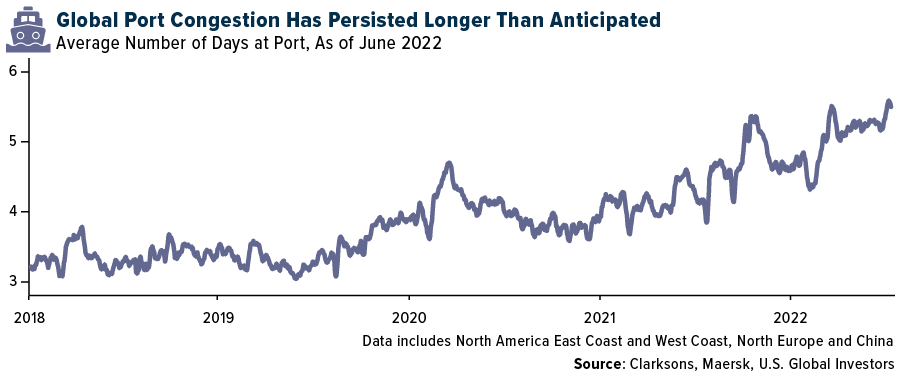

Lower gas costs have been beneficial to not just consumers but also industries that consume great amounts of petroleum liquid fuels. Those include airlines and shipping container companies, the latter of which is still seeing worsening congestion at ports in North America, Europe and China, according to shipping giant A.P. Moller-Maersk.

The world’s second-largest shipping company is often seen as a barometer of the global shipping industry, and if that’s the case, Maersk’s second-quarter results may put investors’ minds at ease. The Copenhagen-based company reported record revenue of $21.7 billion in the June quarter and a net profit of $8.6 billion, also a new quarterly record.

Based on these impressive results, Maersk is raising its guidance for the full year, from $30 billion EBITDA (earnings before interest, taxes, depreciation and amortization) to $37 billion. It’s also raised its free cash flow (FCF) estimate from $19 billion to “above” $24 billion. Maersk’s Board of Directors is also increasing the company’s share buyback program to $3 billion for the years 2022-2025, up from $2.5 billion earlier.

Some financial news outlets have drawn attention to the fact that Maersk moved 7.4% fewer containers in the second quarter compared to the same quarter last year, but as the company itself points out, this is due to the increasing port congestion, not to a meaningful slowdown in demand. According to the Census Bureau, new orders for manufactured durable goods rose to $272.6 billion in June, a 2% increase from May. Shipments of manufactured goods have also been up 13 of the last 14 months as of June.

Maersk is currently held in the U.S. Global Sea to Sky Cargo ETF (NYSE: SEA), which provides investors access to the global shipping industry.

See the entire list of holdings in SEA by clicking here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for SEA by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns, and share price may be more volatile than those of a less concentrated portfolio. Cargo Companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company’s overall financial performance and is used as an alternative to net income in some circumstances. Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to SEA.