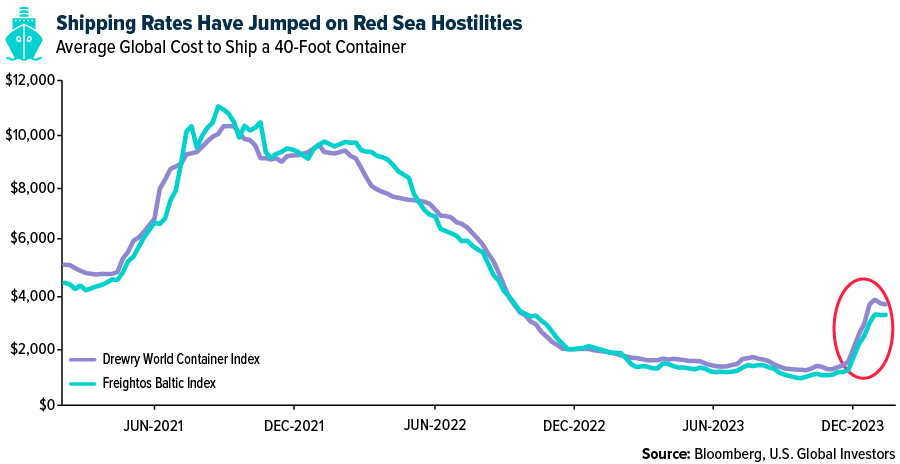

Transportation costs for the shipping industry have surged to a 15-month high as commercial vessels continue to take the lengthier but safer route around the Cape of Good Hope, bypassing the Houthi-controlled waters of the Red Sea.

The detour, though necessary for the time being, has broad implications beyond increased operational costs. Automobile factories have been idled in Western Europe, while shipments of liquified natural gas (LNG) have been delayed or cancelled. Many businesses are reporting inventory builds at the highest level since last June.

The rerouting of shipping lanes, especially along the Asia-Europe routes, underscores the industry’s vulnerability to geopolitical tensions and the necessity for flexibility in operations. Fortunately for investors, this vulnerability may be exploitable.

How Freight Rates Impact Shipping Industry Earnings

If you recall, freight rates similarly exploded to all-time highs in 2022 due to pandemic-related supply chain issues. The added revenue that year helped carriers achieve record annual profits of almost $300 billion in earnings before interest and taxes (EBIT), according to the United Nations Conference on Trade and Development (UNCTAD).

The market appears to favor the chaos. The Solactive Global Shipping Index delivered its third consecutive annual gain last year, rising 25.5%, after advancing a phenomenal 83.2% in 2021, 5.4% in 2022.

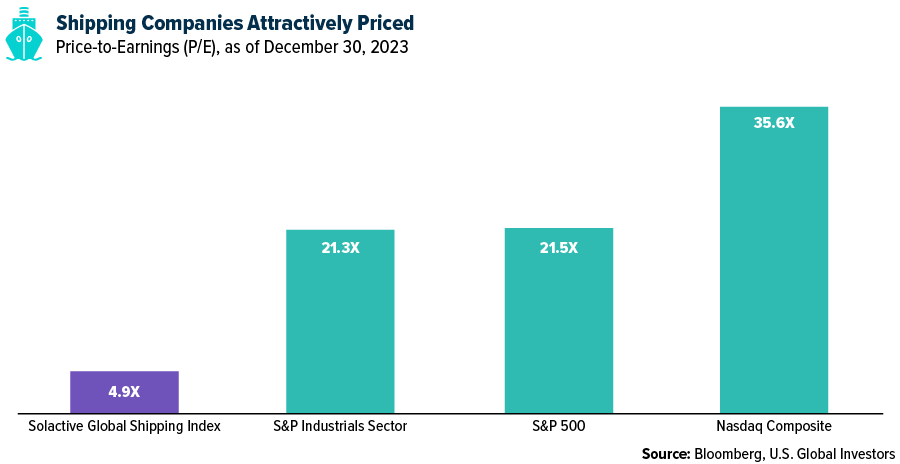

With freight rates once again undergoing strong upward pressure, will investors see another bumper year? That’s impossible to say, and besides, shipping stocks have more than performance going for them. The Solactive Global Shipping Index currently trades at a very attractive 4.9 times earnings, which is more than four times more affordable than the S&P 500 and the S&P Industrial Sector, of which shipping is a member; it’s also more than seven times more affordable than the tech-heavy Nasdaq Composite.

Consumer Spending as a Catalyst

As you probably could guess, the shipping industry is closely tied to consumer behavior. When product sales are hot, demand for new orders and transportation services increases.

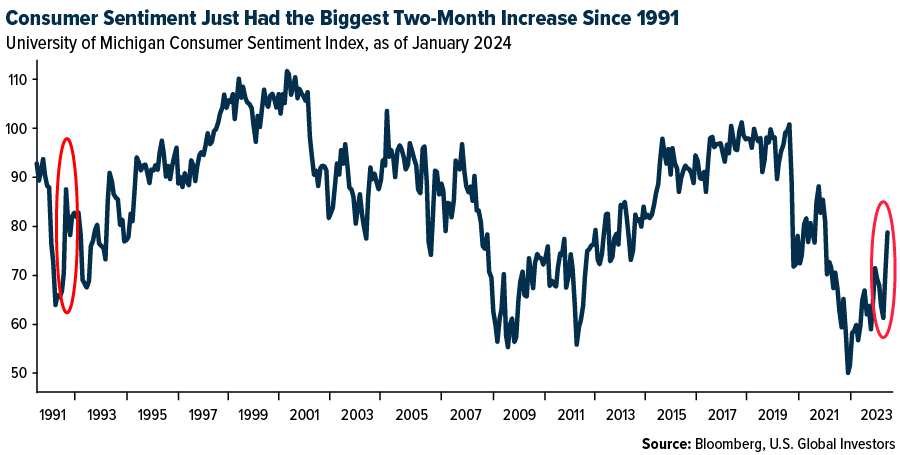

With domestic consumer spending constituting a significant portion of the U.S. economy, the sector’s performance is a bellwether for shipping demand. Encouragingly, consumer confidence indicators, such as those from the Conference Board and the University of Michigan, have shown remarkable resilience in recent months.

This, I believe—coupled with downward-trending inflation and potentially lower interest rates— bodes well for shipping services as consumers continue to exhibit demand for both foreign and local products.

How Emerging Economies Are Steering Global Shipping

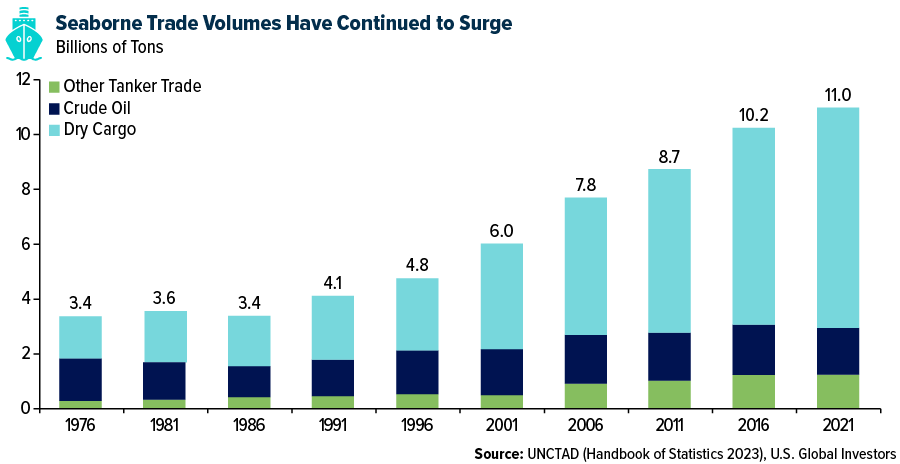

Emerging economies, particularly in Asia, are increasingly becoming the linchpins of maritime trade growth. Since 1990, the volume of goods transported by sea has more than doubled as people in China, India and other rapidly developing countries join the global middle class and seek a more comfortable, “Western” lifestyle filled with modern conveniences.

Asia remains at the forefront of maritime freight, with its ports handling about 42% of the world’s goods, according to the UNCTAD. Due to their central role in globalized manufacturing and containerized trade, developing economies in the Asian continent account for roughly a third of all goods loaded worldwide and half of all goods unloaded.

As the global manufacturing sector shows signs of revival and business confidence surges, the shipping industry stands at a crossroads. The marginal rise in January’s operating conditions for copper and steel users, as indicated by the Purchasing Managers’ Index (PMI), points to a broader economic recovery that could further stimulate maritime trade. However, the industry must remain vigilant, adapting to shifts in trade routes, environmental regulations and technological advancements to sustain growth.

The shipping industry’s trajectory is linked to the fortunes of emerging economies and consumer behavior. As developing countries continue to assert their influence on global trade, their contribution to maritime freight will be crucial in charting the industry’s course. With strategic investments and partnerships, the shipping sector can harness these growth drivers to face the challenges ahead, ensuring a resilient and dynamic future for global trade.

Set Sail with SEA

We believe the current standoff in the Red Sea presents a unique opportunity for investors to consider global shipping stocks. The hostilities are reshaping the logistics of international trade, leading to higher costs and extended transit times. The situation is likely to persist, offering a potentially lucrative method for investors seeking to capitalize on these developments.

The U.S. Global Sea to Sky Cargo ETF (NYSE: SEA) provides investors diversified access to the global sea shipping and air freight industries. SEA seeks to track the performance, before fees and expenses, of the U.S. Global Sea to Sky Cargo Index (SEAX). The Index uses a smart beta 2.0 strategy to help determine the most efficient marine shipping, air freight and courier, and port and harbor companies in the world.

Think it’s time to set sail? Explore SEA by clicking here!

Please click here to see the SEA prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Cargo companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, regional ETFs’ returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS, GOAU and SEA.

Smart-beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization-based indices. The U.S. Global Sea to Sky Cargo Index is a 29-stock index that seeks to provide diversified access to the global sea shipping and air freight industries. The index uses various fundamental screens to determine the most efficient sea shipping, air freight and port companies in the world. The index consists of common stocks listed on developed and emerging market exchanges across the globe.

The World Container Index assessed by Drewry reports actual spot container freight rates for major East West trade routes, consisting of 8 route-specific indices representing individual shipping routes and a composite index. The Freightos Baltic Index (FBX) provides 40′ container (FEU) indices for ocean freight. The Solactive Global Shipping Index is a rules-based index that seeks to provide exposure to a global portfolio of companies identified as being engaged in the water transportation industry. The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Standard and Poor’s 500 Industrials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The Conference Board Consumer Confidence Index (CCI) is a barometer of the health of the U.S. economy from the perspective of the consumer. The Michigan Consumer Sentiment Index (MCSI) is a monthly survey of consumer confidence levels in the United States conducted by the University of Michigan. The survey is based on telephone interviews that gather information on consumer expectations for the economy. The Purchasing Managers’ Index (PMI) is a survey-based indicator of business conditions, which includes individual measures (‘sub-indices’) of business output, new orders, employment, costs, selling prices, exports, purchasing activity, supplier performance, backlogs of orders and inventories of both inputs and finished goods, where applicable. The price-to-earnings (P/E) ratio measures a company’s current share price relative to its per-share earnings.