The airline industry is gearing up for what could be a record-breaking summer travel season, if forecasts turn out to be correct. Despite challenges such as the Boeing 737 MAX 9 grounding and aircraft delivery delays, airlines are reporting strong demand and growth, particularly in international markets. For investors, this could be a unique opportunity to gain exposure to a sector that’s potentially poised for takeoff.

Not every carrier has reported results for the March quarter yet, but what we’ve seen has been encouraging. Delta Air Lines reported record quarterly revenue and expects continued strong momentum, targeting earnings of $6 to $7 per share and free cash flow of $3 to $4 billion for the full year. United Airlines, despite a pre-tax loss that’s largely attributed to the MAX 9 grounding, saw a $92 million improvement over the same quarter last year.

“Demand continued to be strong, and we see a record spring and summer travel season with our 11 highest sales days in our history all occurring this calendar year,” Delta CEO Ed Bastian said during the company’s earnings call.

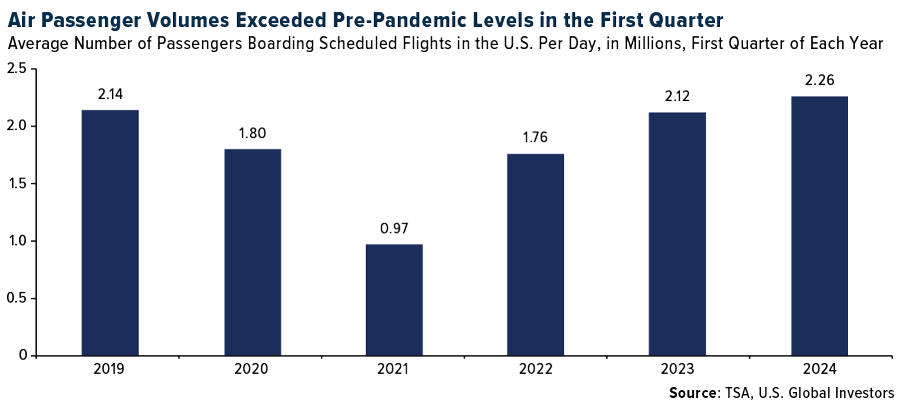

Passenger Figures Off to a Record Start

The big takeaway is that the U.S. economy and air travel remain healthy, with airlines experiencing record numbers of travelers. Checkpoint volumes provided by the Transportation Security Administration (TSA) are off to a record start in 2024, with carriers in the U.S. handling an average of 2.26 million passengers each day, a 5.6% increase over the same period in 2019.

This bodes well for the industry, as higher passenger volumes translate to increased revenue and potentially better margins.

International Travel Boom Despite Supply Constraints

International travel is driving the recovery, with U.S.-international air travel rising 15% year-over-year in the first three months of 2024, according to Airlines for America (A4A). This trend is also reflected in the latest data from Airports Council International (ACI), which shows that while domestic airport markets grew over 20% in 2023, international markets drove the recovery with a 36.5% growth rate.

The global airline industry isn’t without its challenges. Carriers are facing a summer squeeze as travel demand is expected to surpass pre-pandemic levels while aircraft deliveries drop sharply due to production problems at Boeing and Airbus. Airlines are spending billions on repairs to keep flying older, less fuel-efficient jets and paying a premium to secure aircraft from lessors. This has led to increased costs and could potentially impact margins in the short term.

Why Airline Stocks Could Soar in the Coming Years

Nevertheless, we believe the long-term outlook for the airline industry remains positive. The shift toward hybrid work has created a new segment of travelers who have the time and money to spend on air travel. This trend, coupled with the pent-up demand for leisure travel, should help support the industry’s growth in the coming years.

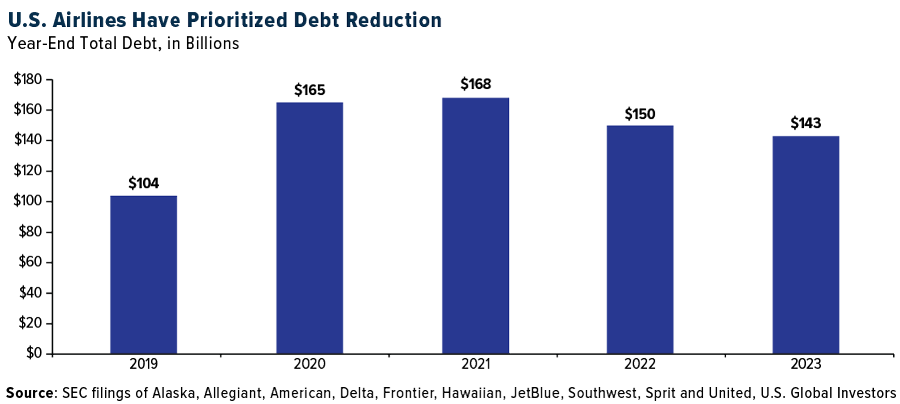

Additionally, airlines have prioritized debt reduction, which should help improve their balance sheets and credit ratings over time. At the end of 2023, the domestic industry reported a collective $143 billion in debt, an approximately 15% decrease from 2021 levels.

How to Participate

As we head into the summer travel season, we believe now may be the time for investors to consider adding exposure to this sector. With a long-term outlook and a diversified approach, investors can potentially benefit from the industry’s recovery and growth in the coming years.

One of the best (and easiest) ways to participate, we think, is the U.S. Global Jets ETF (JETS),which provides investors access to not only airlines but also airport operators, aircraft manufacturers an online booking companies.

We like to call JETS a smart-beta 2.0 ETF. That means companies are selected and weighted based not just on market cap. We use a number of quant factors to help us put money on the leaders and toss out the laggards. Every quarter, JETS is recalibrated and reconstituted.

Curious to learn more? We invite you to explore JETS’ overview, holdings, performance and more by clicking here!

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization-based indices. Smart beta emphasizes capturing investment factors or market inefficiencies in a rules-based and transparent way.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.