As we move into the final stretch of 2024, many investors may be asking themselves: Is it time to give airline stocks another look? According to a new report from Bank of America (BofA), the answer might be yes.

Despite the turbulence the airline industry has faced in recent years—from pandemic shutdowns to winter storms to rising fuel prices—the winds may finally be shifting in the industry’s favor. With fuel costs easing and pricing power returning, there are several reasons to believe that now could be an attractive time to reconsider the sector.

Let’s walk through the reasons why BofA analysts believe airline stocks are ready to take off again.

Tailwinds for the Airline Industry

BofA points to four key tailwinds that could help the airline industry outperform in the coming months. These factors are worth paying attention to for those who might have written off the sector too soon:

- Steady TSA Throughput Despite Lower Capacity

Data from the Transportation Security Administration (TSA) shows that flight demand has remained strong, despite airlines reducing their overall capacity. This is crucial because it indicates that people are still flying even though airlines are offering fewer seats. Less capacity combined with solid demand is typically a recipe for improved pricing power, which can support earnings.

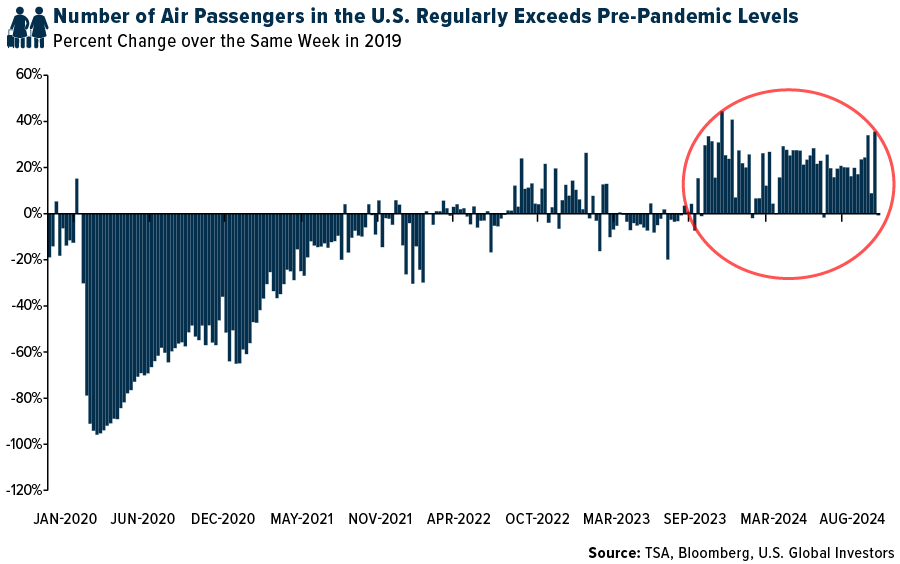

Today, the TSA regularly clears over 2.5 million people to fly every day, exceeding pre-pandemic figures, and in July, a new record was set when 3 million passengers were screened in a single day. As you can see below, passenger volumes in the U.S. now regularly exceed pre-pandemic levels.

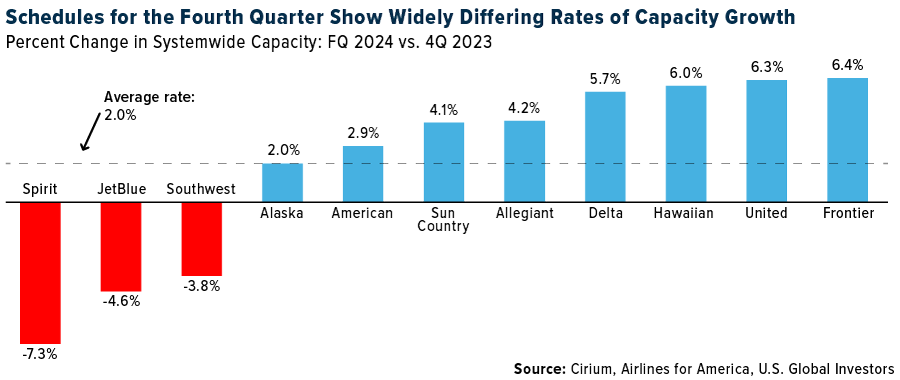

- Decelerating Domestic Capacity

U.S. airlines are cutting back on domestic capacity. Why? The oversupply of seats during the summer months led to lower fares and compressed margins, even though travel demand was strong. By trimming capacity, airlines can drive up fares without chasing customers away. It’s a classic supply and demand play, and if demand holds steady, we could see a nice bump in revenue for airlines, especially as we move into the fall.

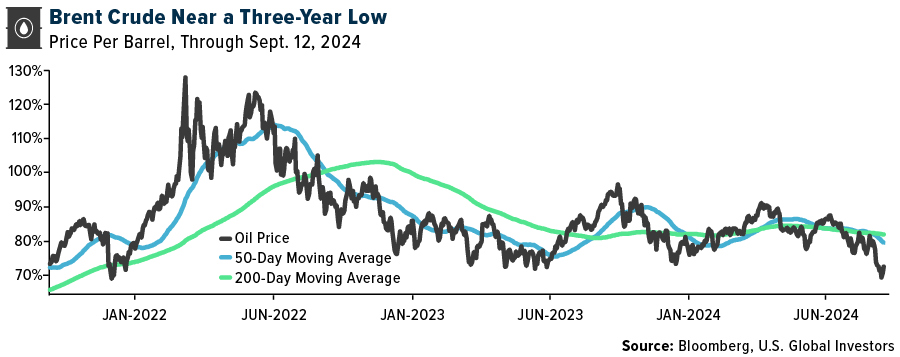

- Lower Fuel Prices Boosting Earnings

Fuel is one of the biggest expenses for airlines, accounting for 20% to 30% of their total costs. After a period of rising fuel prices, we’re now seeing some relief, which is great news for the airline industry.

BofA has raised its earnings estimates for several airlines, including United and Alaska Airlines, due to recent declines in fuel prices. Lower fuel costs, combined with higher ticket prices, could help airlines retain profitability and possibly beat earnings expectations in the fourth quarter.

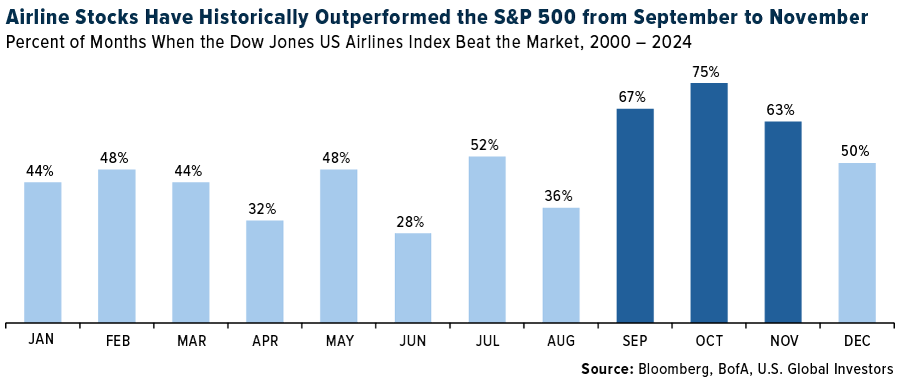

- Seasonal Outperformance in the Fall

Historically, airlines have tended to outperform in the fall. According to BofA’s analysis of the Dow Jones U.S. Airlines Index since 2000, the second half of the year has typically been the stronger half for airlines. The industry has outperformed the S&P 500 in three of the last six months of the year—namely September, October and November. If history is any guide, investors who get in now could see some attractive returns by the end of the year.

A Value Play in the Making

For value-conscious investors, the airline industry could be particularly appealing right now. Airline stocks are trading at attractive price-to-earnings ratios compared to other sectors, and given the potential for earnings growth in the fourth quarter and beyond, this could be an interesting time to consider adding airlines to your portfolio.

As we’ve explored, the airline industry is showing signs of recovery and potential growth, with improving fundamentals such as steady demand, reduced capacity, lower fuel costs and seasonal outperformance. For investors looking to capitalize on these trends, the U.S. Global Jets ETF (NYSE: JETS) offers an opportunity to gain exposure to the global airline sector.

The JETS ETF provides access to not only major U.S. airlines but also global aircraft manufacturers, airport operators and service companies—giving investors diversification across the entire air travel ecosystem. By leveraging a smart beta 2.0 strategy, JETS carefully selects companies based on key metrics like passenger load factor, cash flow return and gross margins, ensuring a focus on the most efficient and profitable carriers worldwide.

With the travel industry recovering and the long-term growth driven by rising middle-class demand and expanding global mobility, JETS allows investors to participate in the next phase of airline growth. If you’re looking for a convenient, diversified way to invest in this evolving industry, JETS could be the ticket to capturing potential gains in the months and years ahead.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Dow Jones US Total Market Airlines Index is constructed and weighted using free-float market capitalization and the index is quoted in USD. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. Passenger load factor (PLF) is a measure of how much of an airline’s passenger carrying capacity is being used. A cash flow return on investment (CFROI) is a valuation metric that acts as a proxy for a company’s economic return. Gross margin is the percentage of a company’s revenue that’s retained after direct expenses such as labor and materials have been subtracted.