The aerospace and defense industry plays a pivotal role not just in national security but also the stock market. With U.S. defense spending leading the world, the largest contractors are well-positioned for growth amid rising global tensions.

Below, we rank the top 10 largest U.S. contractors by defense revenue, using 2024 data from Defense News. We believe these companies represent attractive opportunities for investors seeking exposure to the sector.

10. Amentum

Amentum, a leading provider of engineering and technical services, specializes in supporting government missions. The Virginia-based company’s $5.7 billion in defense-related revenue stems from key contracts with the Department of Defense (DoD) and other federal agencies. Amentum’s expertise spans logistics, cybersecurity and nuclear operations.

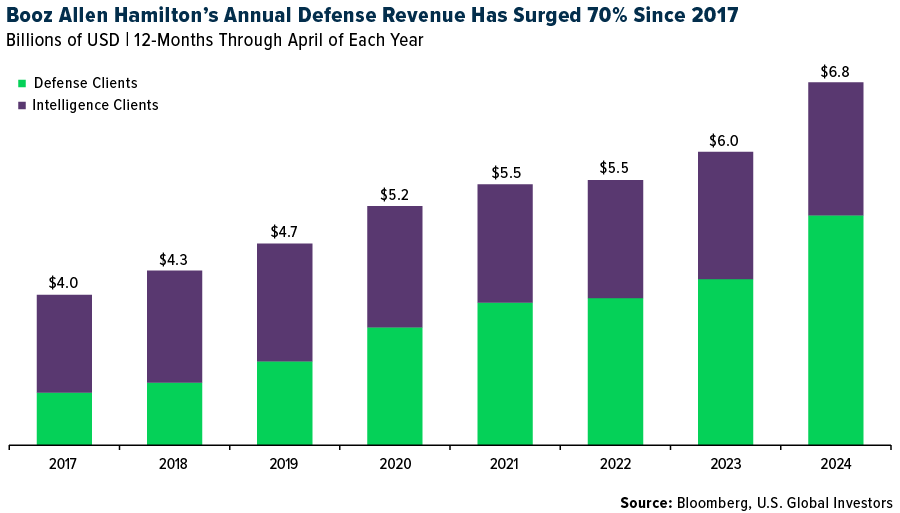

9. Booz Allen Hamilton

Booz Allen Hamilton has built its reputation as a leading provider of technology and consulting services for the DoD. The company leverages advanced capabilities in artificial intelligence (AI) and cybersecurity to address complex defense challenges. With $6.8 billion in defense-related revenue, Booz Allen’s strong cash flow and diversified portfolio make it an attractive investment in the defense space.

8. Leidos

Leidos specializes in IT services and solutions, providing support for mission-critical systems for the DoD and other federal agencies. With $11.1 billion in defense revenue, the company’s expertise spans cybersecurity, data analytics and autonomous systems. Last year, Leidos secured major contracts like the Advanced Battle Management System (ABMS) and engineering services for the F-16 weapon system. Its consistent revenue growth demonstrates strong operational performance and future potential.

7. HII (Huntington Ingalls Industries)

HII is a leader in shipbuilding and defense technologies, generating $11.4 billion in defense-related revenue in 2024. As the sole builder of U.S. Navy aircraft carriers and a key supplier of nuclear-powered submarines, HII has expanded its capabilities in unmanned underwater vehicles (UUVs) and cybersecurity. Its strategic focus on naval innovation ensures its continued importance in U.S. defense operations.

6. L3Harris Technologies

L3Harris Technologies is known for its advanced communication systems, tactical radios and next-generation jamming technology. The Florida-based company’s $15.6 billion in defense-related revenue reflects its critical role in providing cutting-edge solutions to the U.S. military. Recent achievements include contracts for the Glide Phase Interceptor and acquisition of space exploration company Aerojet Rocketdyne. With an emphasis on margin expansion and cost efficiency, we believe L3Harris is well-positioned for continued growth.

5. Boeing

Boeing’s defense segment, which contributed $32.7 billion in revenue last year, complements its commercial aerospace business. Programs like the F-15EX fighter jet and satellite systems highlight Boeing’s engineering background. Despite challenges in its commercial segment, Boeing’s defense arm continues to drive innovation and secure key contracts.

4. General Dynamics

General Dynamics’ diverse portfolio spans combat vehicles, shipbuilding and IT services, generating $33.7 billion in defense revenue in 2024. Its Gulfstream aerospace division also contributes to its strength, although primarily in the civilian sector. The Virginia-based company’s shipbuilding division, which delivers submarines to the U.S. Navy, was just awarded a $188 million contract to aid Virgina-class submarines. With profitability expected to rise through improved margins, General Dynamics remains a cornerstone of U.S. defense capabilities.

3. Northrop Grumman

Northrop Grumman is at the forefront of aerospace and defense innovation, with $35.2 billion in defense revenue. Known for its contributions to nuclear modernization, the B-21 Raider stealth bomber and space systems, Northrop is a leader in cutting-edge defense technologies. The company has expanded its missile production capacity and bolstered its backlog through international sales and key programs like Sentinel.

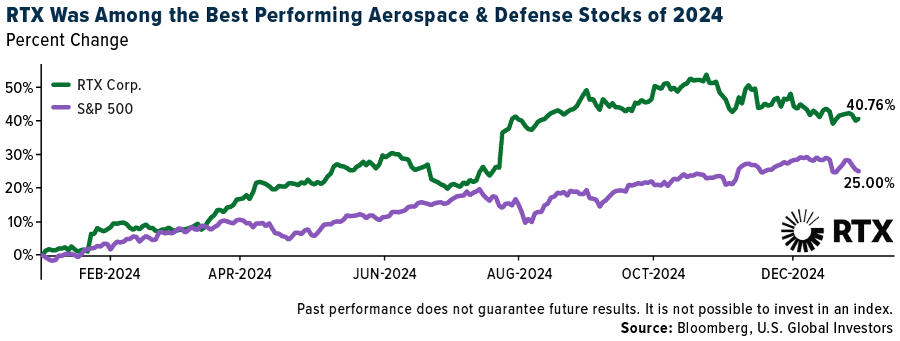

2. RTX

RTX specializes in missile systems, integrated defense solutions and advanced sensors, with $40.6 billion in defense revenue in 2024. Formerly known as Raytheon Technologies, the company’s notable projects include hypersonic weapons development and advanced air defense systems. RTX’s strategic divestitures also demonstrates its commitment to delivering shareholder value.

1. Lockheed Martin

Lockheed Martin stands as a giant in the defense sector, with a whopping $64.7 billion in defense revenue. The Bethesda, Maryland-based company’s iconic programs like the F-35 Lightning II fighter jet and advanced hypersonic weapons have solidified its dominance. Lockheed continues to expand its space division, announcing its acquisition of satellite firm Terran Orbital in August 2024. Its robust backlog and commitment to cutting-edge technology make it, we believe, a no-brainer for defense investors.

Consider the WAR ETF for Diversified Exposure to Aerospace & Defense

Investors looking to capitalize on the growth opportunities in the aerospace and defense sector may want to consider the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR). This actively managed ETF offers exposure to a diversified portfolio that blends traditional defense with cutting-edge technology sectors, including:

- Aerospace and Defense: From fighter jets to advanced naval systems, WAR captures companies at the forefront of defense innovation.

- Cybersecurity: Addressing rising global cyber threats, WAR includes firms providing essential security solutions.

- Semiconductors and Data Centers: Supporting both traditional and high-tech defense applications.

The ETF uses a smart-beta 2.0 strategy to identify companies poised for long-term growth based on factors like profitability, liquidity and technological advancements. With a focus on rising defense budgets and geopolitical tensions, the WAR ETF provides investors with a distinctive opportunity to benefit from industry trends shaping the future of global security.

To learn more about WAR, including its holdings and investment case, click here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus at www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk including the possible loss of principal.

The Fund is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

The Fund’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment advisor to WAR.