We believe today’s heightened geopolitical climate can best be described as a “new red Cold War,” where artificial intelligence (AI)—not necessarily fighter jets and nuclear weapons—serves as the primary battleground between the U.S. and its adversaries, most notably Russia and China.

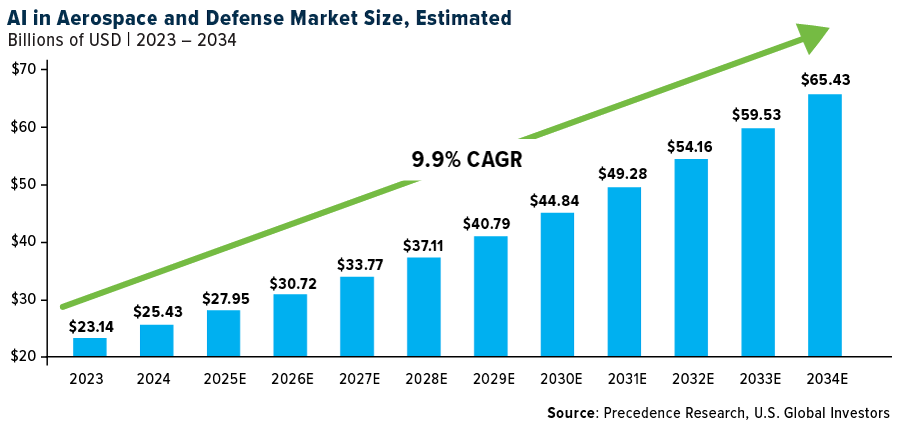

The numbers tell a compelling story. According to one research firm, the global AI market in aerospace and defense is projected to surge from approximately $28 billion today to a staggering $65 billion by 2034. That’s a solid 9.91% compound annual growth rate (CAGR). North America alone represents $10.43 billion of this market, and it’s growing even faster at 10.02% annually.

Palantir’s Meteoric Rise

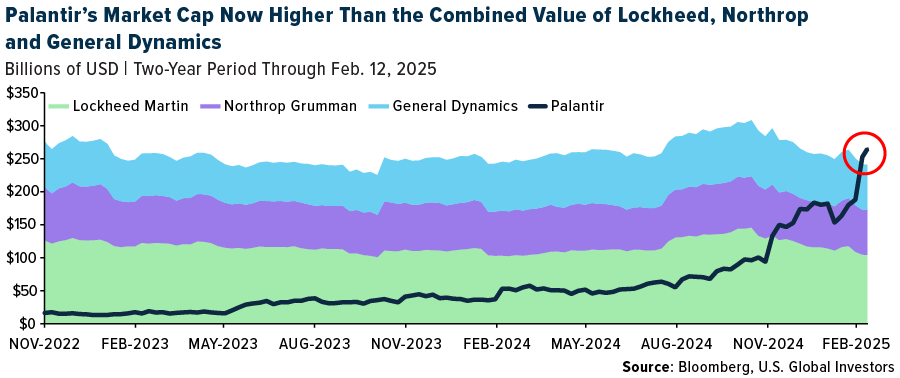

We’re seeing a dramatic reshuffling of the traditional defense sector hierarchy.

Take Palantir Technologies. The AI-focused company—founded in 2003 by Peter Thiel, among others, and named for a magical artifact from Lord of the Rings—has seen its stock soar approximately 61% so far this year, after returning a massive 340% in 2024.

Meanwhile, traditional defense giants like Lockheed Martin, Northrop Grumman and General Dynamics have been struggling, with their combined market value now lower than that of Palantir, whose chief technology officer, Shyam Sankar, recently called the competition between the U.S. and China an “AI arms race.”

And let’s not discount the influence of Elon Musk’s cost-cutting Department of Government Efficiency (DOGE) initiative. We could see a push to modernize military procurement, prioritizing software, drones and robots over traditional hardware. DOGE has already sent tremors through the defense sector, with traditional contractor stocks taking hits as new players like SpaceX, OpenAI and Anduril Industries gain ground.

Europe’s Defense Tech Boom Is Just Getting Started

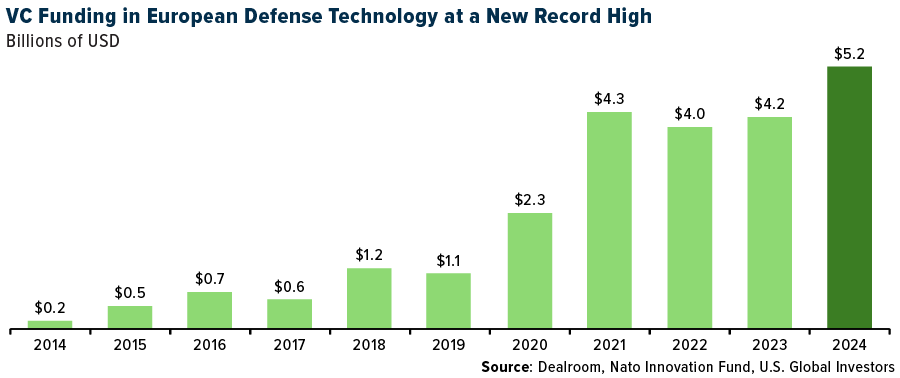

The transformation isn’t limited to the U.S. Facing its own security challenges with Russia, Europe is seeing unprecedented growth in defense tech investment. Venture capital (VC) funding in defense technology hit a record $5.2 billion in 2024, according to recent Dealroom data. This represents an incredible fivefold jump from six years ago, making defense one of the fastest growing VC sectors in Europe right now.

Positioning for the Biggest Defense Tech Shift in Decades with WAR

We’re witnessing one of the biggest transformations in defense technology since the advent of nuclear weapons, and we believe that those who position themselves in this new “AI arms race” could see substantial returns as this multi-decade trend unfolds.

So where should investors be looking?

One option is the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), which provides exposure to cutting-edge defense technology companies spanning AI-driven cybersecurity, semiconductors, aerospace and data centers.

WAR was built to capture the shift in warfare dynamics by investing in a diverse mix of traditional defense leaders and emerging technology firms. The ETF’s holdings include companies specializing in:

- Aerospace & Defense (31% of the portfolio), including military contractors developing next-generation fighter jets, space technology and defense systems.

- Cybersecurity (28%), with a focus on companies providing network security, AI-driven threat detection and cloud defense solutions.

- Semiconductors (28%), which power everything from missile guidance systems to AI-driven battlefield analytics.

- Data Centers (12%), supporting the massive computing power required for military AI, intelligence operations and command-and-control systems.

WAR is actively managed, allowing our investment team to adjust allocations based on geopolitical trends, emerging defense priorities and advances in AI. The ETF uses a quantamental, smart beta 2.0 approach, blending quantitative analysis with fundamental research to target high-growth companies that stand to benefit from increased defense spending.

The battlefield is shifting, and the most significant military advantages are no longer just in hardware—but in intelligence, software and AI-powered decision-making.

Request more information on the WAR ETF today by clicking here.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus at www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The Fund is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

The Fund’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment advisor to WAR.