High-quality liquid assets (HQLAs) are considered to be the most liquid and readily available to meet liquidity needs during times of stress. They include cash, government securities like U.S. Treasury bonds—and soon gold.

Starting July 1, gold will officially be classified as a Tier 1 HQLA under the Basel III banking regulations. This means U.S. banks can count physical gold, at 100% of its market value, toward their core capital reserves. No longer will it be marked down by 50% as a “Tier 3” asset, as it was under the old rules.

This is a huge shift in how regulators perceive gold, and it’s a long-overdue recognition of what many of us have known for decades: Gold is money. And it’s the kind of money you want to own when the world is on fire.

Central Banks Know that Gold Is Real Money. Shouldn’t You?

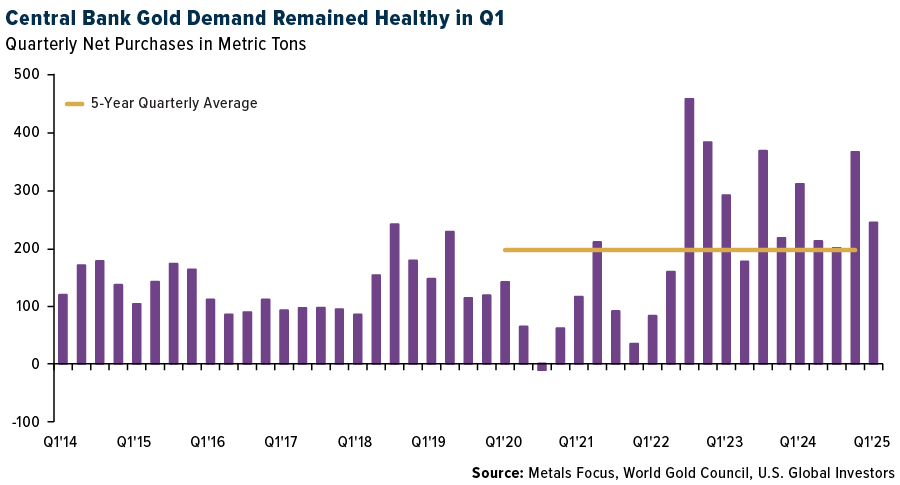

Obviously, we’re not the only ones who believe this. Central banks have been leading the charge for 15 years. In the first quarter of this year, central banks added 244 metric tons of gold to their official reserves, according to the World Gold Council (WGC). That’s 24% above the five-year quarterly average.

This isn’t a one-off anomaly. It’s part of a longer-term trend that began in earnest after the 2008 financial crisis and accelerated after gold’s reclassification under Basel III in 2019. According to the WGC, about 30% of central banks say they plan to increase their gold holdings in the next 12 months—the highest level ever recorded in their survey.

Why are central banks buying gold? The same reason many investors favor the metal: to protect against currency debasement, geopolitical turmoil and runaway debt. As global fiat currencies get printed with increasing abandon, we believe gold remains one of the few truly finite, unprintable stores of value.

So if the world’s central banks are moving into gold, shouldn’t retail investors be doing the same?

The Curious Case of Gold Miners

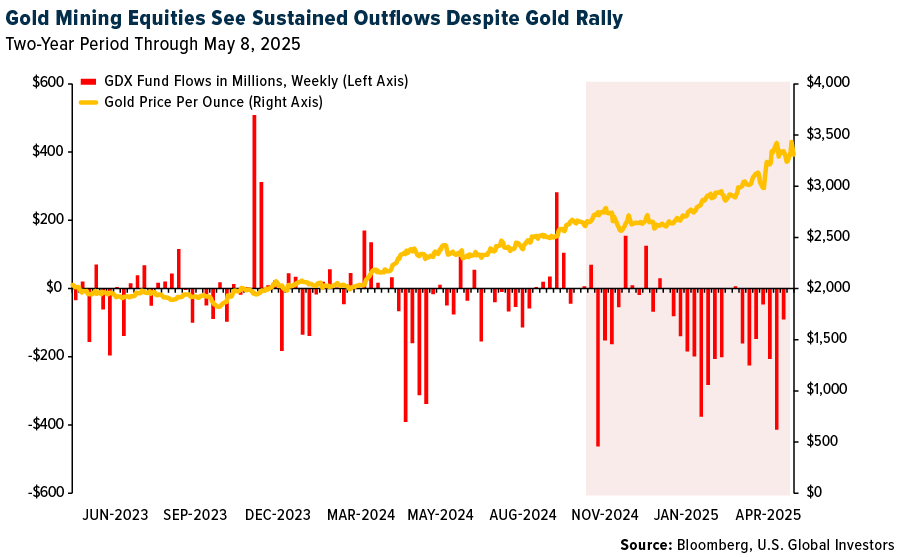

Here’s where things get interesting—and puzzling. While gold prices continue to make new all-time highs, gold mining stocks have been seeing sustained outflows.

The VanEck Vectors Gold Miners ETF (GDX), which tracks many of the world’s largest publicly traded gold producers, has been bleeding capital for months. Even as gold prices surge, weekly fund flows have been negative, with investors pulling billions out of mining equities.

This disconnect is hard to ignore. It points to a deeper concern investors may have about the operational and financial health of mining companies. Unlike physical gold, which simply tracks the spot price, miners are exposed to cost inflation, labor shortages, geopolitical risk and more. These headwinds aren’t new, though, and they shouldn’t obscure the fundamental leverage that quality mining stocks offer in a rising gold environment.

Meanwhile, we’ve seen investors increasingly favor physically backed gold ETFs and streaming/royalty companies as lower-risk ways to gain exposure. That’s understandable. These vehicles have historically offered gold’s upside with fewer operational headaches.

Consider GOAU for Targeted Exposure to Gold Royalty Companies

One ETF that seeks to capitalize on this shift is the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU). GOAU is designed to give investors focused exposure to high-quality gold and precious metal mining companies, with a distinctive tilt toward royalty and streaming firms.

Unlike traditional gold miner ETFs that overweight the largest producers regardless of quality, GOAU uses a smart beta 2.0 model to screen for companies with strong balance sheets, efficient operations and consistent cash flow generation, even during periods of lower gold prices. It eliminates companies that rely heavily on debt and emphasizes those with sustainable profitability.

A distinguishing feature of GOAU is its deliberate allocation to royalty and streaming companies like Wheaton Precious Metals, Franco-Nevada and Royal Gold—firms that offer exposure to gold without the heavy capital costs of owning and operating mines. These companies collect revenue based on a fixed percentage of production or at discounted metal prices, which can provide more stable margins and less volatility.

With Basel III reclassifying gold as a Tier 1 asset and central banks ramping up their purchases, it may be time for retail investors to rethink how they access the gold market.

Explore GOAU today and position your portfolio for the next phase of the gold story.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU by clicking here. Read it carefully before investing.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Gold, precious metals and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Basel III is an international regulatory framework that strengthens bank capital requirements, risk management and liquidity. It was created by the Basel Committee on Banking Supervision in response to the 2008 financial crisis to address weaknesses in the previous regulations. Basel III builds upon the foundations of Basel I and Basel II, but with more stringent requirements and broader reforms. Smart beta 2.0 is a rules-based investment approach that blends passive indexing with active strategies. It uses dynamic models and multiple fundamental factors to select and weight stocks with the goal of improving long-term performance.

GOAU is distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.