President Donald Trump’s first overseas trip since returning to the White House turned a lot of heads across the aerospace & defense and semiconductor industries last week. Over the course of just a few days, he visited three key Persian Gulf states—Saudi Arabia, Qatar and the United Arab Emirates (UAE)—where a cascade of economic agreements potentially totaling in the trillions of dollars was unveiled.

One of the marquee announcements was a $142 billion arms deal, part of a broader $600 billion commercial package between the U.S. and Saudi Arabia. Touted by the White House as the “largest defense sales agreement in history,” the deal includes “state-of-the-art warfighting equipment” and services from more than a dozen American defense companies, though none are named.

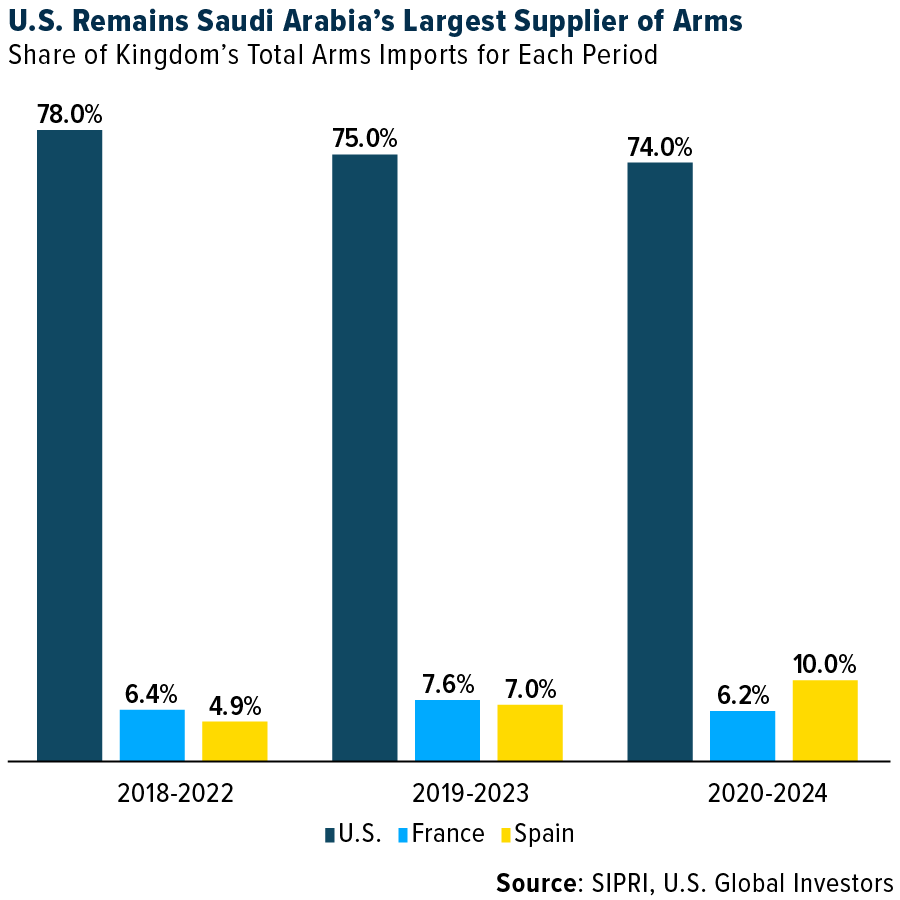

Saudi Arabia is already the largest U.S. foreign military sales (FMS) customer, with nearly 80% of its defense acquisitions coming from American companies. According to the Stockholm International Peace Research Institute (SIPRI), Saudi Arabia spent more than $80 billion on defense in 2024, making it the seventh-largest military spender in the world and by far the largest in the Middle East.

The Saudis aren’t alone. The UAE and Qatar have also made substantial defense purchases in recent months, including advanced drones, helicopters and counter-drone systems. As geopolitical uncertainty grows, Gulf nations are doubling down on deterrence, and they’re looking to the U.S. for the tools to do it.

Betting Big on AI Infrastructure and American Semiconductors

One of the more striking takeaways from the trip might be the emergence of AI and semiconductors as critical assets in the defense toolkit.

In Saudi Arabia, a new state-backed initiative called HUMAIN is leading a multibillion-dollar push to build an “AI Zone,” in partnership with Amazon Web Services (AWS). The project, which will feature dedicated server farms powered by American semiconductors, is part of a broader effort to localize advanced tech manufacturing and training within the Kingdom.

NVIDIA, the world’s leading AI chipmaker, is expected to provide HUMAIN with at least 18,000 of its GB300 Grace Blackwell processors. Over the next five years, that number could reach several hundred thousand chips. Meanwhile, the UAE is negotiating for more than a million NVIDIA chips, enough to radically boost its own AI infrastructure.

Saudi Arabia’s AI investments alone could generate $3 to $5 billion in annual chip sales, with longer-term infrastructure spending estimated at $15 to $20 billion, according to Bank of America analyst Vivek Arya. That would make sovereign AI one of the fastest-growing areas in the broader $450 billion AI infrastructure market.

Global Military Spending on a Relentless Uptrend

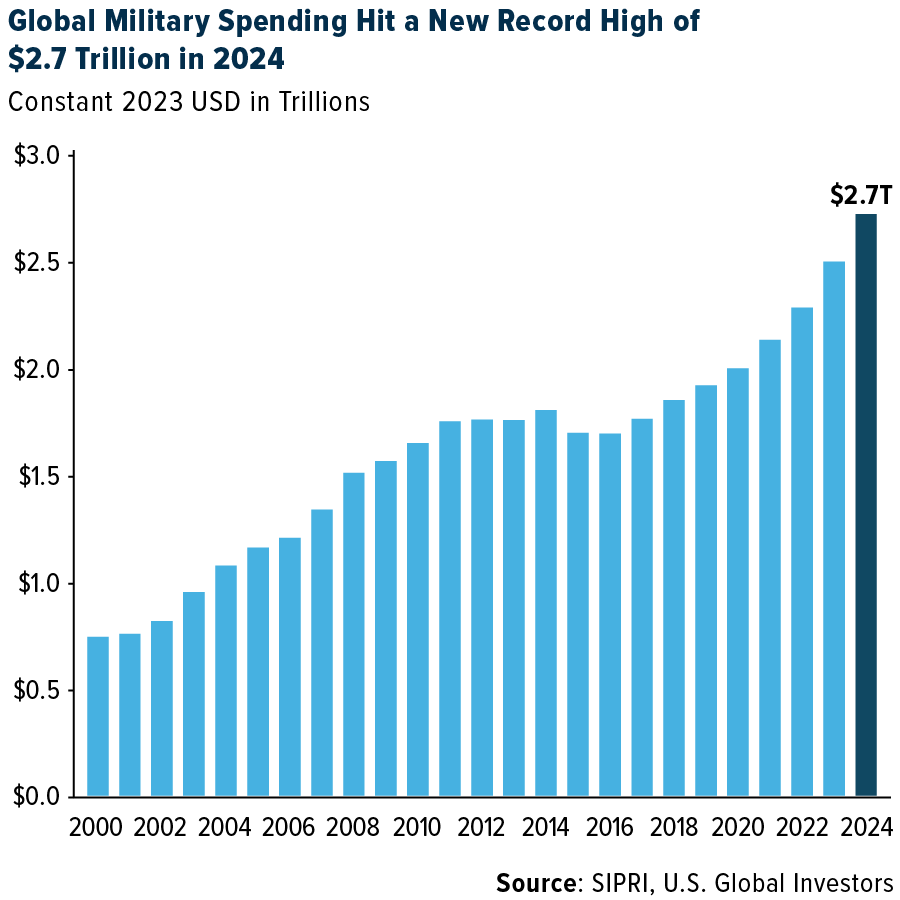

All of this comes against a backdrop of surging global military budgets. World defense spending hit a record $2.7 trillion in 2024, a 9.4% year-over-year increase and the sharpest rise since at least 1988, according to SIPRI. Spending has risen for 10 consecutive years, with gains across all five global regions.

Meanwhile, NATO is moving toward a new target of 5% of GDP for defense spending, up from the longstanding 2% benchmark. Both Germany and the U.S. have endorsed the increase, and the final plan is expected to be unveiled at the NATO summit this June.

The world isn’t de-escalating. It’s rearming, with greater urgency, more advanced tools and higher price tags.

We see these trends as a growing opportunity across multiple sectors—defense contractors, semiconductor makers, AI infrastructure providers and aerospace manufacturers. While individual names and strategies must be evaluated with care, the broader momentum is unmistakable.

Introducing WAR, A Smart Beta 2.0 Strategy

For investors looking to position themselves at the crossroads of rising global defense spending and AI-driven innovation, we believe the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR) offers a compelling opportunity.

Launched in December 2024, WAR is an actively managed ETF designed to capture the growth potential of companies operating in aerospace, defense, semiconductors, cybersecurity and data infrastructure.

What sets WAR apart is its smart beta 2.0 strategy. Rather than relying on traditional market-cap weighting alone, the fund uses a quantamental approach—blending quantitative screening and fundamental analysis—to select companies based on factors like profitability, volatility, and liquidity. This enables dynamic sector rotation and responsiveness to macro trends such as regional conflict, AI deployment and digital sovereignty efforts.

With exposure to firms like Rheinmetall, General Dynamics, Leidos and NVIDIA, WAR reflects the modern defense paradigm: not just boots and bullets, but chips, code and cloud. As of March 2025, nearly 40% of the fund is allocated to aerospace & defense, 25% to cybersecurity, and 24% to semiconductors—the very components driving Saudi Arabia’s and the UAE’s massive investments.

To see WAR’s top 10 holdings, click here.

To receive more info on WAR, click here.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus at www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk including the possible loss of principal.

The Fund is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

The Fund’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment advisor to WAR.