We believe President Donald Trump’s recent announcement of a new trade agreement with China provides investors with a fresh incentive to turn their attention to global trade, particularly the shipping industry.

According to the president’s June 11 statement on Truth Social, the deal is “done,” pending final approval from both him and President Xi Jinping. The terms include a commitment from China to supply rare earth metals, while the U.S. maintains significantly higher tariffs on Chinese imports—reportedly 55% compared to China’s 10%.

After months of tariff turmoil, this appears to be a constructive step toward stability and, indeed, fairness. For shipping, it matters more than what some readers might realize.

Shipping Activity Rebounds as Tariff Pause Boosts Imports

In April, the White House imposed a 145% tariff on Chinese imports, sending shockwaves through global supply chains and capital markets. Retailers hit the brakes. Orders were delayed or canceled, and ocean freight volumes plunged.

Just a few weeks later, the administration announced a 90-day pause and slashed tariffs to 30%. “Reciprocal” tariffs with other trading partners were also temporarily frozen.

During that window, we’ve seen a surge of renewed shipping activity.

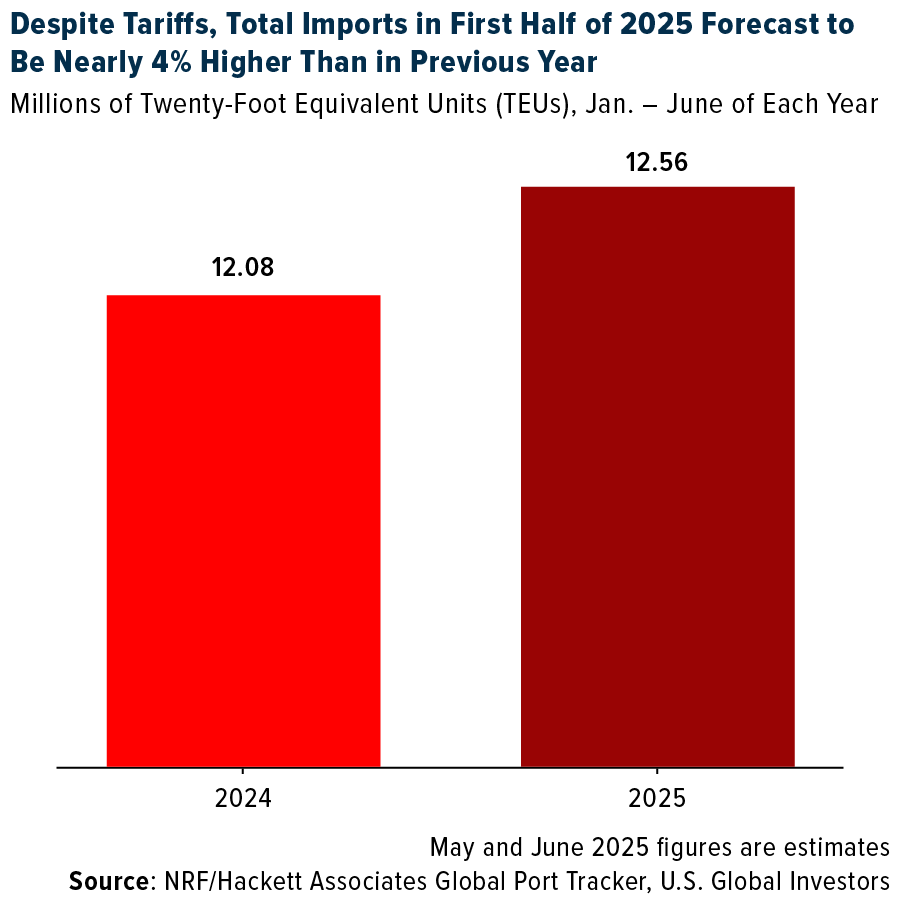

The National Retail Federation (NRF) reported that container imports at U.S. ports are now expected to climb 3.7% year-over-year for the first half of 2025. That’s better than forecasts before the pause. Shipping volume from China jumped 9% in the first week of June alone, according to Goldman Sachs data.

Rates Are Moving Higher

The container shipping industry has always been cyclical and sensitive to geopolitical events, and this year has been no exception. After bottoming in 2023, rates have rebounded sharply, driven not only by tariff uncertainty but also by persistent global disruptions, such as the Red Sea crisis.

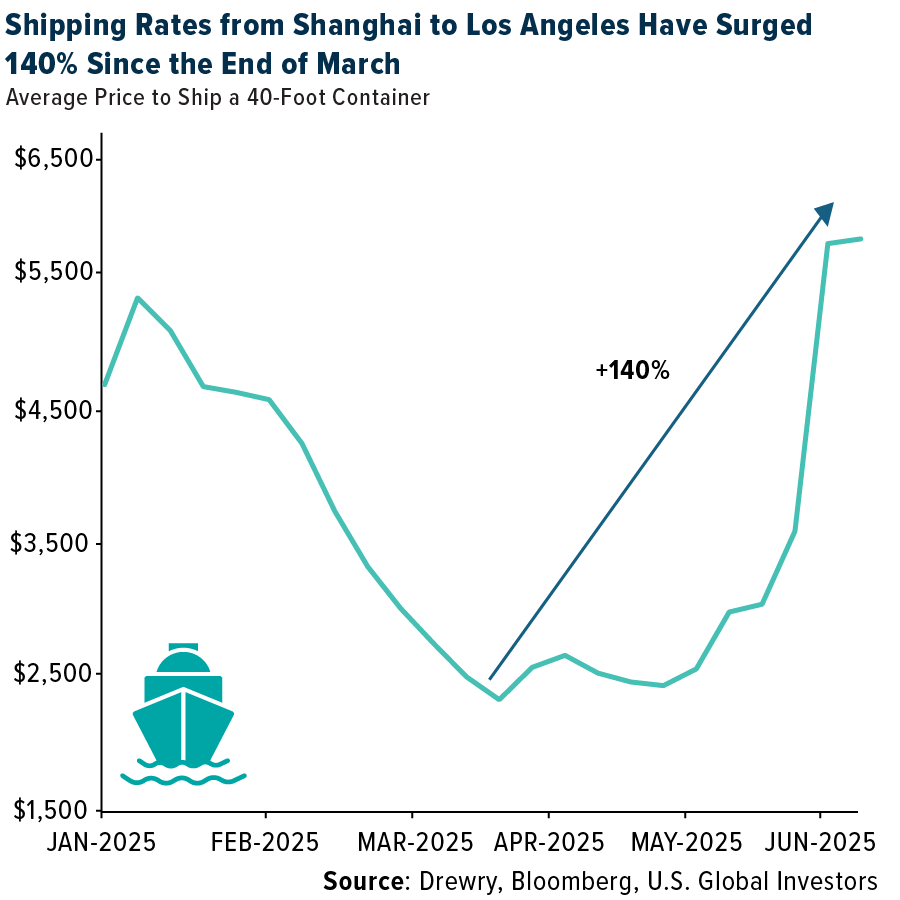

Drewry’s World Container Index showed a 70% spike in just four weeks, with freight costs from Shanghai to Los Angeles up nearly 140% since the end of March. That said, prices remain well below the COVID-era highs, when rates surpassed $10,000 per 40-foot container.

For context, today’s rates are closer to $5,800—a historically elevated level, but not unsustainable. Importers are rushing to restock while the policy window remains open, which supports not only shipping volumes but also company earnings.

More Shipping Companies Joining the $10 Billion+ Market Cap Club

In the first quarter of 2025, the global container shipping industry posted nearly $10 billion in profit. That’s a drop from the $15.6 billion earned in Q4 of last year, but it’s also 83% higher than the same period in 2024.

The market has begun to take notice. As of this month, we count nine publicly traded container carriers with a market capitalization of at least $10 billion. This includes names like Maersk and Hapag-Lloyd, along with rapidly growing Asian players such as Wan Hai Lines. These companies now rival or surpass familiar, investable U.S. airline stocks in terms of valuation.

This suggests that institutional investors recognize the potential in global shipping.

To see the top 10 holdings in SEA, click here.

The SEA ETF: Smart Beta 2.0 Exposure to Global Shipping

For investors seeking a diversified, data-driven way to participate in the shipping rebound, the U.S. Global Sea to Sky Cargo ETF (NYSE: SEA) could be a compelling solution. SEA provides exposure to leading global shipping and air freight companies—industries we believe are poised to benefit from rising freight demand and long-term growth in global logistics.

What sets SEA apart is its Smart Beta 2.0 strategy, which blends the strengths of passive indexing with the selectivity of active management. The fund tracks the U.S. Global Sea to Sky Index, which uses a quantamental approach to screen companies by market capitalization, cash flow metrics and earnings growth. We’ve found that this helps identify the most operationally effective players in marine shipping, air freight and port operations.

With holdings diversified across major carriers like Maersk, COSCO and Evergreen, and spanning geographies from the U.S. to Taiwan, SEA is designed to capture both the cyclical recovery and long-term transformation of the shipping sector.

To learn more about SEA, including its full list of holdings and Smart Beta 2.0 methodology, click here!

Please click here to see the SEA prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Cargo companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, regional ETFs’ returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to SEA.

Smart-beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization-based indices.

The World Container Index assessed by Drewry reports actual spot container freight rates for major East West trade routes, consisting of 8 route-specific indices representing individual shipping routes and a composite index.