Gold mining equities are having a remarkable 2025. Prices for the precious metal have hit one all-time high after another, and the miners who pull it from the ground have been rewarding investors with some of the best returns in the market today.

We’ve rarely seen such a powerful convergence of factors favoring this industry. From central bank buying to political uncertainty to disciplined corporate behavior, everything appears to be lining up for gold and the miners who produce it.

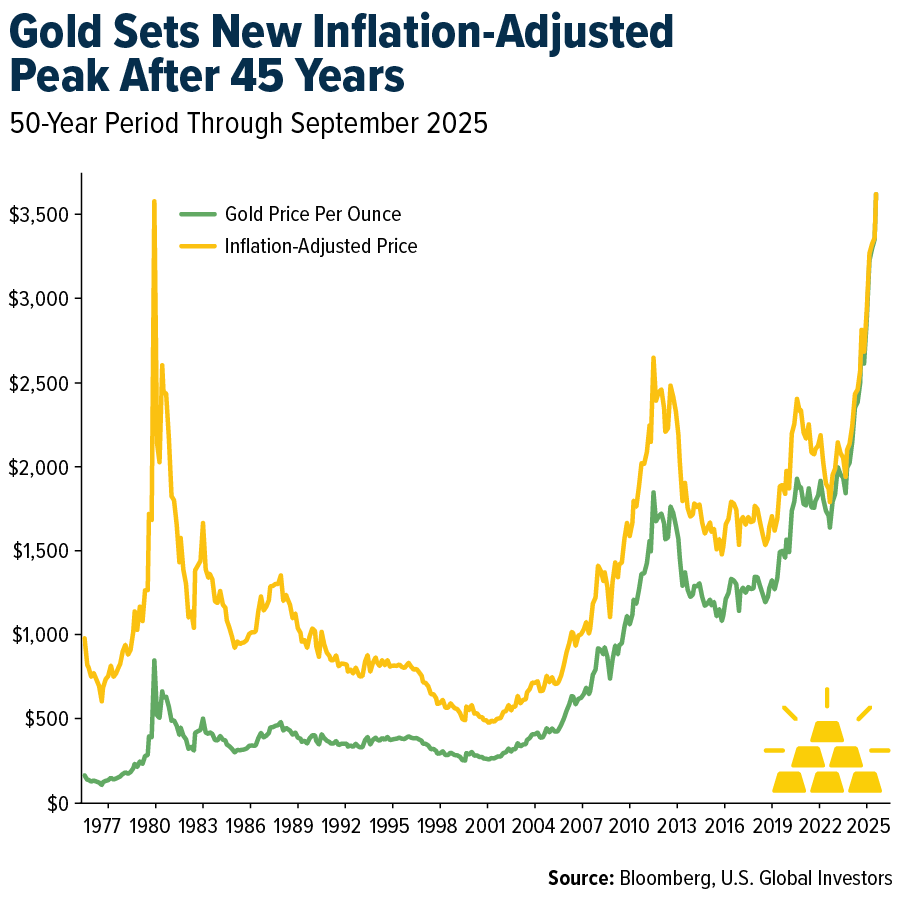

In the first week of September, the metal recorded its sixth fresh record high in just seven trading days. Having surpassed its inflation-adjusted record, set in 1980, gold has made all-time highs not just in U.S. dollars but in euros, pounds, yuan and nearly every major currency.

The Flight to Precious Metals

What’s driving this? In short, fear and uncertainty. Central banks around the world have been consistent buyers, topping up their reserves with bullion in record amounts. Gold-backed ETFs have seen nearly $50 billion in inflows so far this year, their second-strongest run on record, according to the World Gold Council (WGC).

Ray Dalio, the legendary founder of Bridgewater Associates, put it plainly this month: A well-diversified portfolio should have 10–15% in gold. He likens U.S. debt to plaque clogging an artery, warning that a financial “heart attack” may be looming. Gold, he says, looks attractive.

Mining Stocks Surge Past Highs

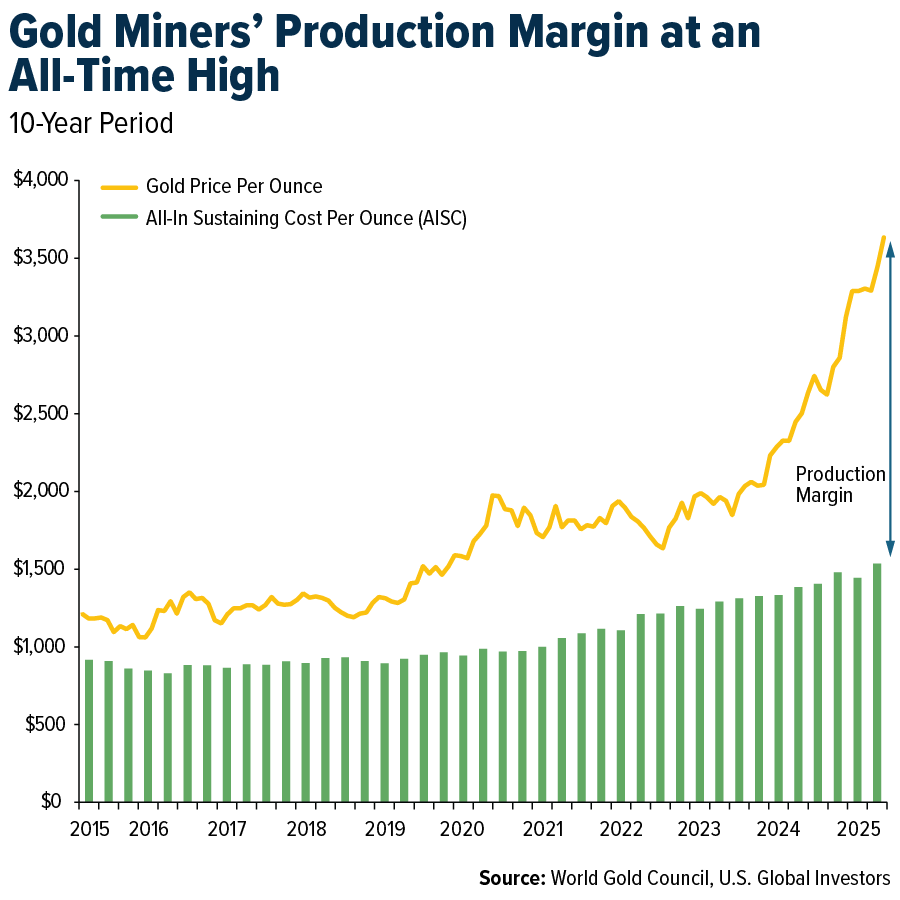

Historically, when gold has risen, miners have tended to rise faster. That’s because their costs are relatively fixed: Once you’ve paid to dig, crush and process ore, the value of each extra ounce flows straight to the bottom line. At $1,800 gold, many mines were just scraping by. At $3,600 gold, they’ve been generating substantial margins.

Consider the numbers. Average all-in sustaining costs (AISC) for major producers hover between $1,080 and $1,220 per ounce. With spot prices more than triple that, the margins are extraordinary.

It’s no wonder, then, that mining indices have performed well. The NYSE Arca Gold Miners Index hit a new all-time high this month, surpassing levels last seen in 2011. Individual names like Sibanye-Stillwater, AngloGold Ashanti and Gold Fields have each gained more than 150% year-to-date, while SSR Mining has risen an extraordinary +220%.

Free Cash Flow Fuels Dividends and Buybacks

Veteran investors might remember past gold bull markets where companies, flush with cash, chased growth at any cost. They spent recklessly on acquisitions, overbuilt mines and diluted shareholders. Not this time.

In 2025, miners have been showing discipline, according to our findings. Management teams are focused on operational efficiency, strong balance sheets and shareholder returns. They’re channeling cash into dividends and buybacks. Free cash flow has surged across the industry, and return on invested capital (ROIC) is at multi-year highs.

This new culture of restraint makes the current rally very different from the last one. The fundamentals are healthier, and balance sheets are stronger.

Recession Warnings Are Growing Louder

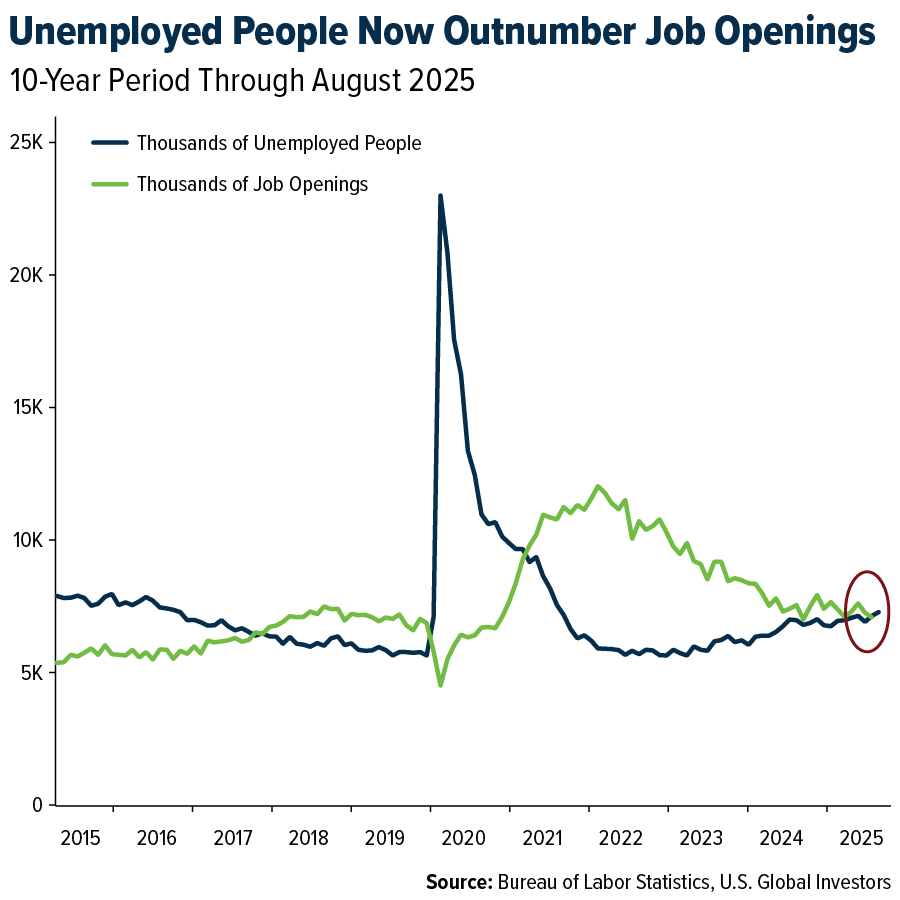

We can’t ignore the broader macroeconomic backdrop. The U.S. economy is showing unmistakable signs of strain, in our view. The Labor Department recently revised job growth lower by 911,000 positions through March, the largest adjustment in more than two decades. The country now has more unemployed workers than job openings for the first time since 2021. Consumer inflation remains sticky at 2.9%, even as wholesale prices briefly dipped.

Economists warn the economy could tip into recession by year-end. JPMorgan CEO Jamie Dimon recently said he thinks the economy is “weakening,” while Moody’s chief economist Mark Zandi, who forecast the 2008 financial crisis, expressed concern about stagflation, describing it as “pernicious.”

Layer onto this the political noise. President Trump’s moves to exert control over the Federal Reserve—such as efforts to oust Governor Lisa Cook—have many investors on edge. Goldman Sachs warns that if Fed independence is compromised and just 1% of the $27 trillion Treasury market flows into gold, the price could soar to $5,000 per ounce.

Consider GOAU for Diversified Gold Exposure

For investors who want targeted exposure to gold miners, one option to consider is the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU). Unlike many funds that concentrate only on the largest mining companies, GOAU uses a Smart Beta 2.0 strategy that blends quantitative factors with fundamental screening to emphasize high-quality, well-managed producers.

A distinguishing feature of the ETF is its special allocation to royalty and streaming companies, often referred to as the “smart money” of the mining industry. These businesses provide upfront capital to miners in exchange for royalties or production streams, allowing them to benefit from commodity upside without taking on the risks and heavy costs of operating mines. This model can help mitigate volatility and enhance capital efficiency.

As of June 30, 2025, GOAU held 29 companies with a weighted average market cap of $10.9 billion, including well-known royalty names such as Wheaton Precious Metals and Franco-Nevada among its top positions. Click here to see the top 10 holdings.

The ETF’s disciplined construction seeks to capture the upside of rising gold prices while maintaining exposure to firms with strong balance sheets and sustainable profitability.

GOAU offers investors a rules-based, differentiated approach to gold equities, balancing traditional miners with royalty companies that have historically shown resilience across commodity cycles. For those looking to add precious metals exposure to their portfolios, especially in today’s uncertain macro environment, GOAU may be worth a closer look.

Ready to get started? Request additional information on GOAU by clicking here.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU by clicking here. Read it carefully before investing.

Gold, precious metals and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

The NYSE Arca Gold Miners Index is a market-capitalization-weighted index that tracks the performance of the largest publicly traded companies worldwide involved primarily in gold mining, with a smaller, but still significant, silver mining component.

Smart Beta 2.0 is an investment approach that combines the broad diversification and low cost of passive indexing with the factor-based insights and selectivity of active management strategies.

All-in sustaining costs (AISC) is a metric used primarily by gold mining companies to represent the total cost of producing a unit of gold, including operating costs, sustaining capital expenditures, and other related expenses necessary to maintain current production levels. Return on Invested Capital (ROIC) is a profitability ratio that measures how effectively a company uses the capital invested in its operations to generate profits.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

GOAU is distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.