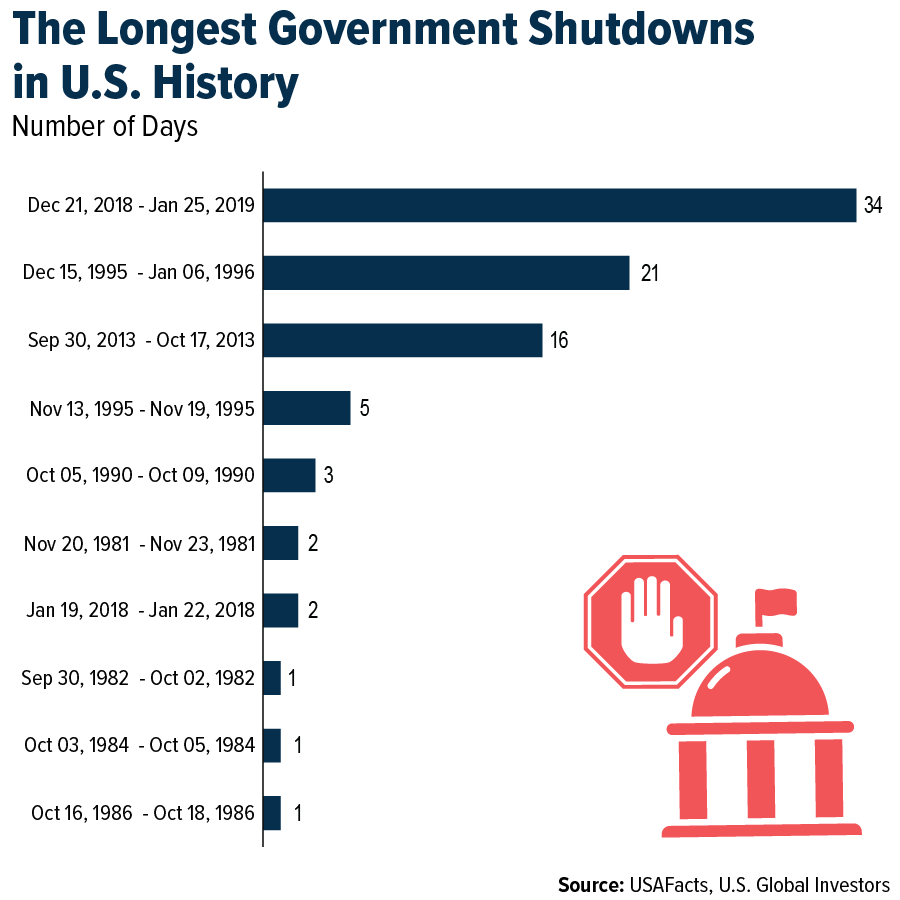

The U.S. government has been shut down since October 1, with no end in sight. This is the first shutdown since 2019, when political gridlock over how to fund President Donald Trump’s border wall kept federal doors closed for a record 34 days. (Spoiler alert: No funding deal was reached, prompting Trump to reallocate Department of Defense funds to pay for the wall.)

This time, the pain is real for many everyday Americans. Hundreds of thousands of federal employees are either furloughed or working without pay. National parks are operating under limited access. Certain home loans aren’t getting to new homebuyers.

And at airports across the country, travelers are encountering longer security lines, delayed flights and air traffic control shortages.

But for investors, especially those with an eye on airlines, the story might not be as grim as it looks on the surface.

Airline Stocks Soared During Last Shutdown

Let’s rewind to December 2018 and January 2019, when the government endured the longest shutdown in its history. Some 800,000 workers went without paychecks, and an estimated $3 billion were shaved off GDP in the fourth quarter of 2018, according to the Congressional Budget Office (CBO).

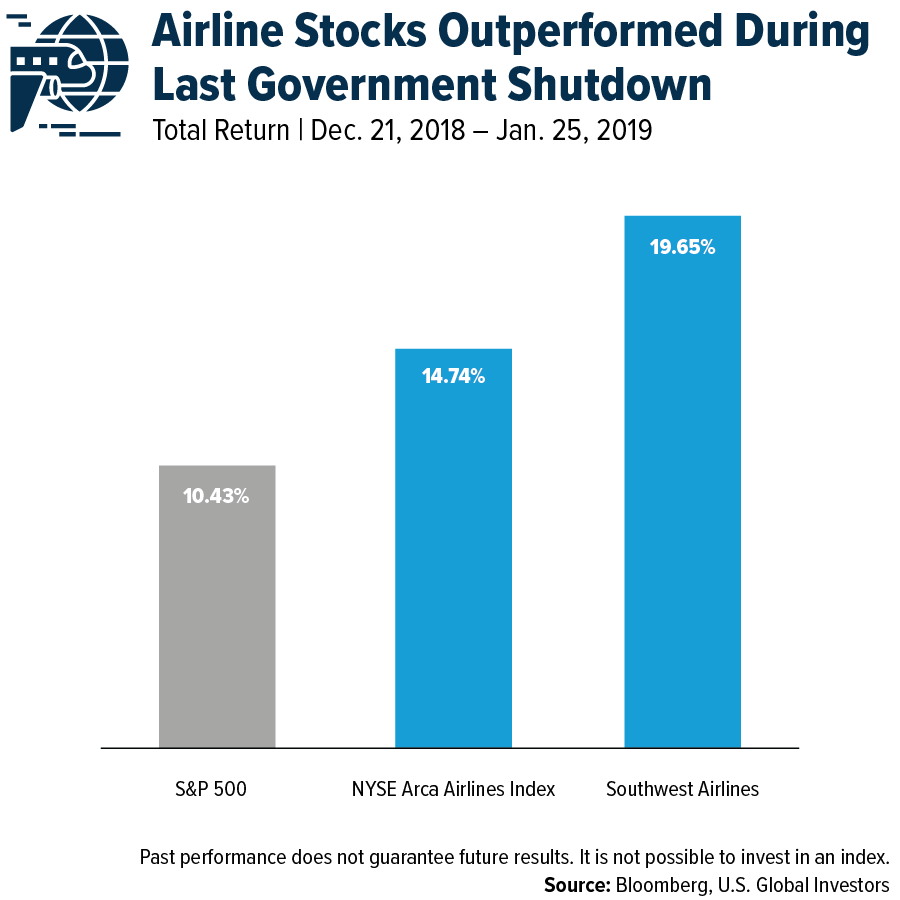

Yet Wall Street told a different story. An index of major airline stocks actually rose nearly 15%, outperforming the market. Southwest Airlines was the top performer, soaring close to 20%. Even though flights were delayed, investors understood that Americans weren’t going to stop flying.

Granted, inbound international travel to the U.S. is expected to decline about 6% this year. But domestic travel—the bread and butter of most U.S. carriers—is still growing nearly 2% year-over-year.

Delta Targeting High-Net Worth Customers

No carrier embodies this resilience better, perhaps, than Delta Air Lines. On its Q3 earnings call, Delta executives emphasized the airline’s focus on the premium traveler—the business class passenger, the frequent flyer, the high-net-worth leisure customer.

“We’re not trying to be everything to everyone,” Delta President Glen Hauenstein said. “Our exposure to a higher-income cohort has enhanced our relative position versus carriers catering to a more stressed, lower- to middle-income environment.”

That strategy appears to be paying off. Delta’s revenues associated with premiere seating jumped 9% year-over-year last quarter, handily outpacing growth in its main cabin. CEO Ed Bastian recently told CNBC that operations remain “smooth,” adding that it would take several more days of political stalemate before he expects any significant impact.

The World’s Fleet Expected to Double in Size by 2044

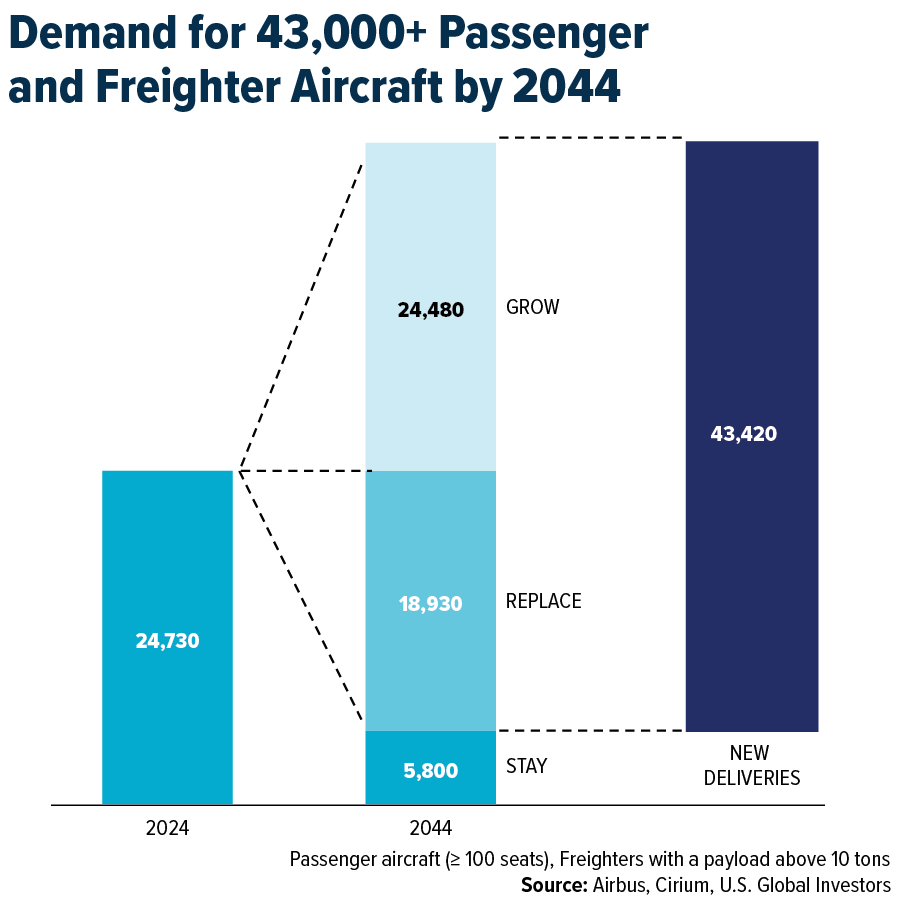

If we zoom out beyond Washington’s dysfunction, we believe the long-term picture for global aviation is nothing short of extraordinary.

According to Airbus’s Global Market Forecast, the world’s passenger and freighter fleet is expected to double over the next two decades, from 24,700 aircraft today to nearly 50,000 by 2044, adding more than 43,000. That growth will be fueled by the rise of the global middle class—an estimated 1.5 billion new travelers, primarily from Asia and the Middle East.

Even if mature markets like the U.S. grow at a slower pace, international and regional traffic flows are set to explode. Airbus forecasts annual passenger growth of 8.9% in India and 8.5% in emerging Asia.

Consider JETS for the Long Haul

We believe commercial aviation’s long-term growth story remains intact, fueled by an expanding middle class in emerging markets, rising demand for both business and leisure travel and the modernization of fleets worldwide. According to the International Air Transport Association (IATA), total global airline revenues are expected to surpass $1 trillion in 2025.

For investors seeking diversified exposure to this dynamic sector, the U.S. Global Jets ETF (NYSE: JETS) offers a convenient way to participate. The fund tracks the U.S. Global Jets Index, which combines the advantages of passive and active investing through a Smart Beta 2.0 strategy that screens airlines, manufacturers and airport service companies based on fundamentals like cash flow return on invested capital, passenger load factor and gross margin.

With 50 holdings spanning major U.S. carriers, aircraft manufacturers and international operators, JETS provides broad yet targeted exposure to the companies that keep the world connected.

To see the top 10 holdings in JETS, click here.

Learn more about JETS by clicking here.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

Cargo Companies may be adversely affected by downturn in economic conditions that csn result in decreased demand for sea shipping and freight.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P 500 is a stock market index that measures the performance of about 500 U.S. companies across 11 sectors. The NYSE Arca Airline Index is an equal-dollar weighted index that tracks the price performance of major U.S. and international airline companies.

The U.S. Global Jets Index seeks to provide access to the global airline industry. The index uses various fundamental screens to determine the most efficient airline companies in the world, and also provides diversification through exposure to global aircraft manufacturers and airport companies. The index consists of common stocks listed on well-developed exchanges across the globe. It is not possible to invest directly in an index.

It is not possible to invest in an index.

Smart beta 2.0 combines the benefits of passive investing and the advantages of active investing strategies.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.