Are artificial intelligence (AI) and Magnificent 7 stocks in a bubble? We’ve been seeing more and more headlines lately speculating that a crash could be imminent, and while we don’t hold the same opinion, we do believe that prudent risk management demands that investors consider allocating to risk-off assets, including gold and silver.

Like AI stocks, precious metals look overbought; but unlike AI stocks, they’re structurally underinvested. As such, we believe they deserve another look.

Valuations Overextended

In case you’ve been living around a rock, AI has dominated both public markets and venture capital flows. According to PitchBook, more than 55% of global venture funding this year has gone to AI, with giants like OpenAI, Anthropic and xAI receiving the lion’s share.

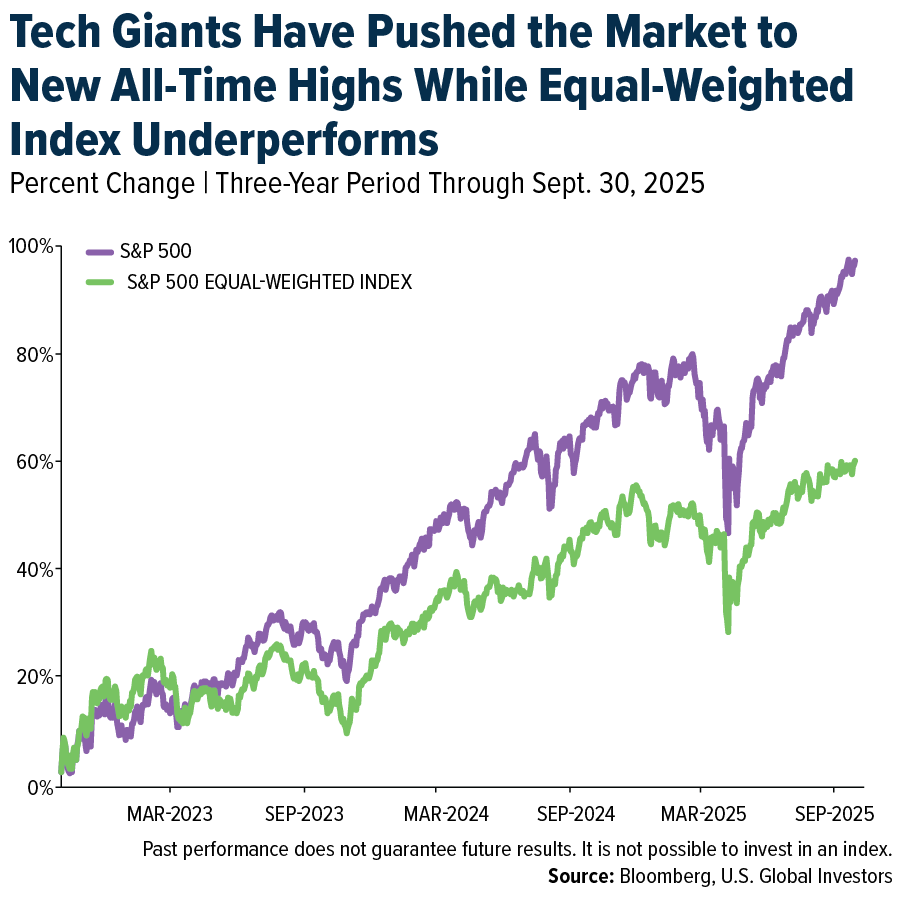

In the public markets, Nvidia, Microsoft and their Mag 7 peers have carried the Nasdaq and S&P 500 to repeated all-time highs, while equal-weight indices lag far behind.

Valuations are stretched. The S&P’s forward price-to-earnings multiple sits near 23 right now, on the higher end of the spectrum.

Billionaire hedge fund manager Leon Cooperman told CNBC last week he thinks we’re at the stage of the bull market that Warren Buffett cautioned about; namely, irrational exuberance appears to be in control, not fundamentals. The so-called Buffett indicator—the ratio of total U.S. market cap to gross national product (GNP)—surged past 200% last week, meaning equities are now valued at more than double the size of the U.S. economy.

None of this guarantees a crash is coming, of course. But if you lived through the internet frenzy of the late 90s, we might have some idea what can happen when investor capital collects too narrowly in a handful of names. If an AI pullback happens, it could be sharp.

Gold and Silver Still Under-owned

That brings us to gold and silver, which just posted a historic third quarter. Gold surged 17% to $3,840 an ounce, its largest quarterly dollar gain on record, according to the Wall Street Journal. Silver jumped nearly 30% to $46.25, its biggest quarterly percentage gain ever, and just shy of its 1980 peak, when the Hunt brothers notoriously tried to corner the global silver market.

Remarkably, precious metals remain deeply underrepresented in portfolios. In a report dated September 25, Bank of America strategists point out that gold makes up a measly 0.4% of private client assets and 2.4% of institutional assets.

Gold Miners Back in Favor

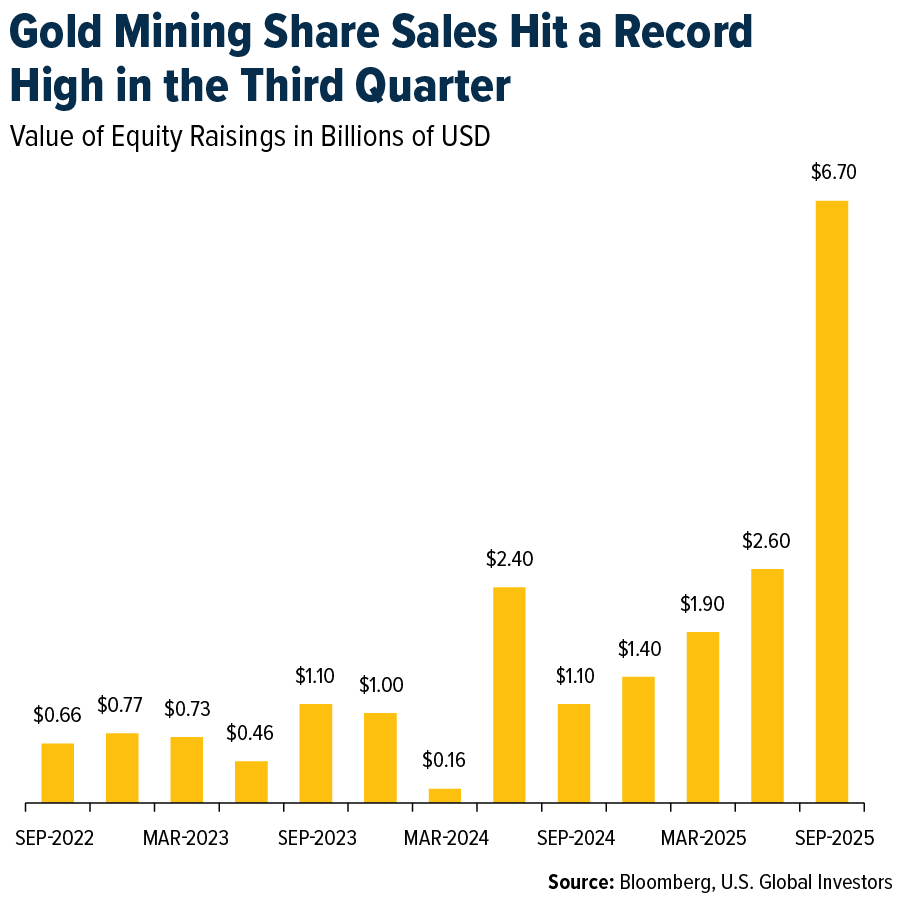

The rally hasn’t been limited to physical bullion. Bloomberg reports that gold mining stocks collectively raised $6.7 billion in equity in the third quarter alone, the highest quarterly total on record.

Major offerings from Hong Kong’s Zijin Gold, China’s Shandong Gold and Indonesia’s Merdeka Gold are leading the rally.

We was pleased to see that Bank of America named gold miners its number one investment theme of 2025, ahead of uranium, defense tech and even AI. That’s a huge endorsement in a year when tech and AI have dominated the news.

Gold in a Diversified Portfolio

We would be remiss if we didn’t mention that gold and silver are flashing overbought signals right now, whether viewed through standard deviation or the 14-day relative strength index (RSI). Historically, such moves have preceded pullbacks.

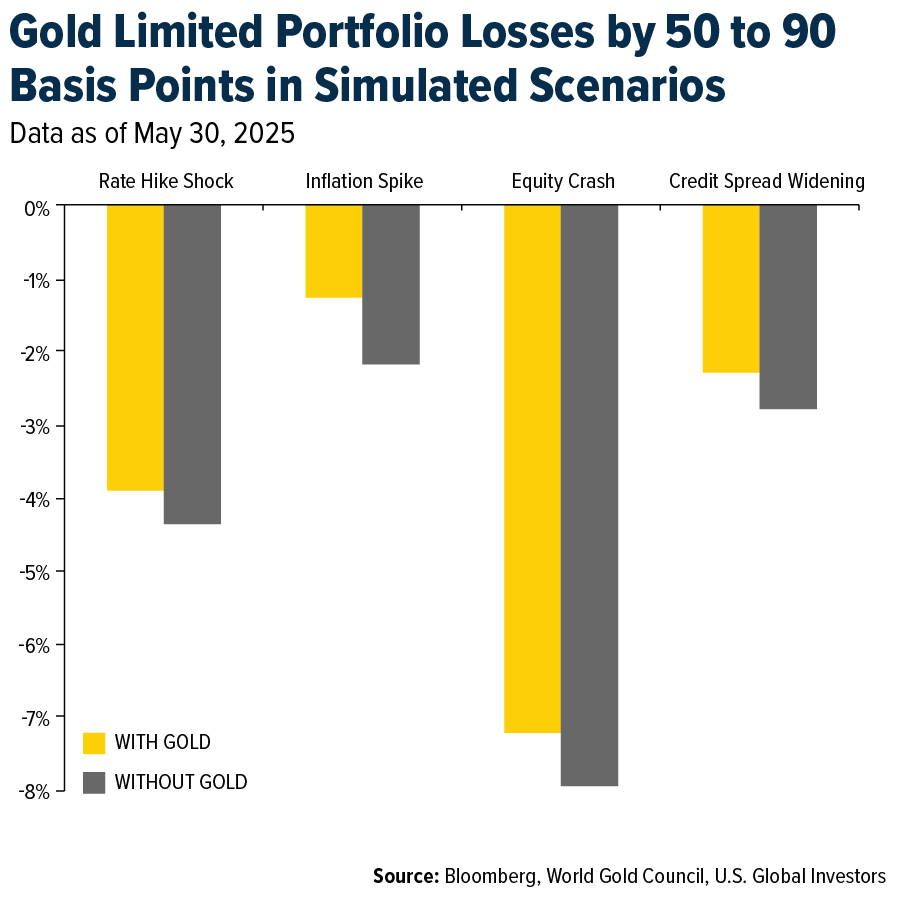

Even if precious metals roll over, the losses could be smaller and shorter-lived than a potential AI crash. Hypothetical stress tests conducted by the World Gold Council (WGC) found that adding gold to a diversified portfolio reduced declines by 50 to 90 basis points across scenarios ranging from equity crashes to credit squeezes.

Accessing the Opportunity with GOAU

Investors seeking to gain exposure to the gold and precious metals sector might consider the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU). Launched in 2017, the GoGold ETF, as we sometimes call GOAU, is designed to capture the performance of companies in both the active production and passive ownership of precious metals, through a Smart Beta 2.0, rules-based strategy.

What makes GOAU stand out is its focus on high-quality producers and royalty companies—firms with strong balance sheets, sustainable profitability and disciplined capital allocation even when metal prices are down. Unlike traditional miners, which might face exorbitant operational costs, royalty and streaming companies provide upfront financing to mining projects in exchange for a share of future production at a fixed price.

The GoGold ETF’s index, the U.S. Global GO GOLD and Precious Metal Miners Index (GOAUX), selects companies that derive at least 50% of their revenues from precious metals and weights them using both market capitalization and fundamental factors such as valuation, profitability and operating efficiency. Its top holdings include industry leaders such as Franco-Nevada, Wheaton Precious Metals and OR Royalties, all of which have long histories of prudent capital management and consistent dividend growth.

For investors looking to completement their portfolios with gold exposure while maintaining focus on quality and efficiency, we believe GOAU offers a thoughtfully constructed, cost-effective solution.

To learn more about GOAU and request additional information, click here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Smart Beta 2.0 is an investment approach that combines the broad diversification and low cost of passive indexing with the factor-based insights and selectivity of active management strategies.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The S&P 500 Equal Weight Index is a version of the S&P 500 index where each of its approximately 500 constituent companies holds an equal dollar value, unlike the traditional market-cap weighted S&P 500 where larger companies have a greater impact.

A basis point (bp) is a standard unit of measurement in finance equal to 0.01% or 1/100th of 1 percent. Standard deviation measures how spread out a set of data is from its average (mean). The Relative Strength Index (RSI) is a popular technical indicator that measures the speed and magnitude of recent price changes to identify overbought or oversold conditions in a security, oscillating between 0 and 100.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

GOAU is distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.