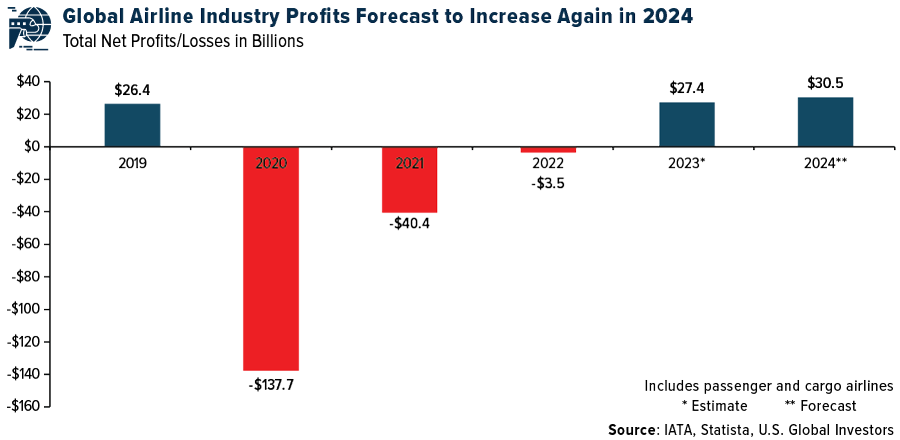

U.S. Global Jets ETF NYSE: JETS

Providing investors access to the global airline industry, including airline operators and manufacturers from all over the world.

JETS Industry Breakdown

Airlines

Transportation Infrastructure

Internet

Commercial Services