NYSE: SEA

Why we like shipping, cargo and logistics companies

-

Demand growth has been strong

-

High barriers to additional capacity

-

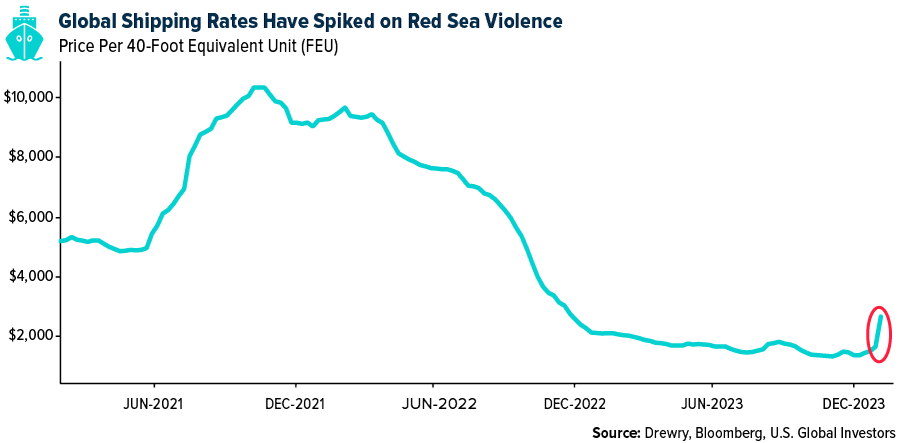

Favorable pricing power

-

Stocks have performed well