Batteries may one day be used for short-range, small-capacity planes to curb potentially harmful airline emissions. But for longer flights made by jumbo-size passenger jets, sustainable aviation fuel, or SAF, appears to be the only feasible near-term option.

Over the years, plane makers such as Boeing and Airbus have managed to improve aircraft fuel efficiency through new lightweight materials, better designed aerodynamics and other technologies.

These manufacturers have lately also turned their attention to solving the problem of emissions. The global airlines industry, which is responsible for an estimated 2.5% of global carbon dioxide (CO2) emissions, currently has a goal of achieving net zero carbon by 2050, with an increasing number of individual carriers seeking to reach that milestone much earlier.

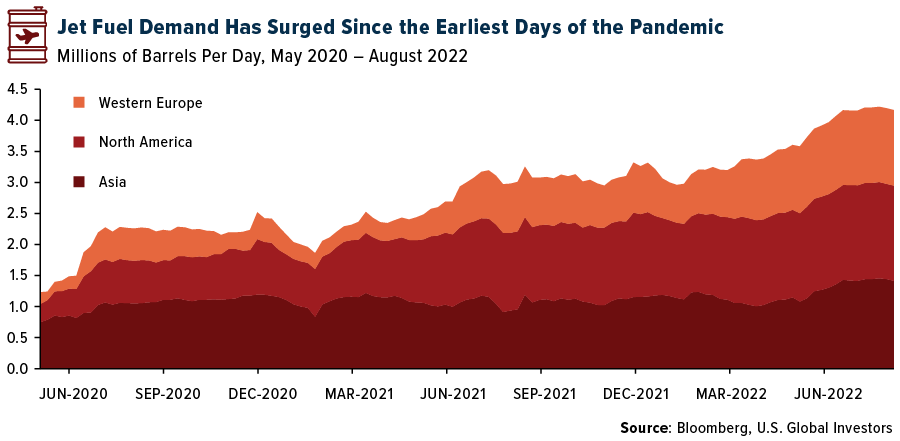

Two and a half percent doesn’t sound like a lot, but as air travel demand increases, so too does the consumption of jet fuel, and that means more emissions. Just since the earliest months of the pandemic, fuel consumption in North America, Western Europe and Asia has surged more than threefold to a combined 4.2 million barrels per day as borders have reopened and carriers have operated at full capacity.

The Nuts and Bolts of Sustainable Aircraft Fuel (SAF)

That brings us back to SAF. What is it, and why is it an important puzzle piece in airlines’ carbon neutral ambitions?

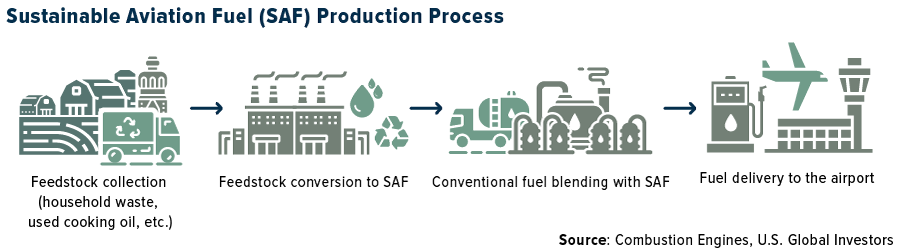

In short, SAF is a biofuel that can be produced from a number of different feedstock, including used cooking oil, animal fats and forestry residues. This biofuel is blended with conventional jet fuel, which is then delivered to airports. Currently, the maximum permittable SAF-jet fuel blend is 50%-50%, but research is being conducted by Boeing, Rolls-Royce and others to achieve certification for 100% SAF flights.

Not all SAF is the same, but on average it can help reduce aircraft CO2 emissions by as much as 80% compared to fossil jet fuel. Put another way, SAF is expected to contribute 65% to the commercial airline industry’s goal of decarbonization by 2050, the remaining 35% represented by carbon offsets, carbon capture and storage and new propulsion technologies.

If that’s the case, why haven’t more airlines adopted it in greater droves? The answer to that question is price. At the moment, it’s much more costly to produce SAF than conventional jet fuel due to the fact that feedstock is typically bulky and therefore expensive to gather, transport and store.

However, production costs are expected to fall as the technology is improved and more airlines become buyers.

Scaling Up Production and Current Availability

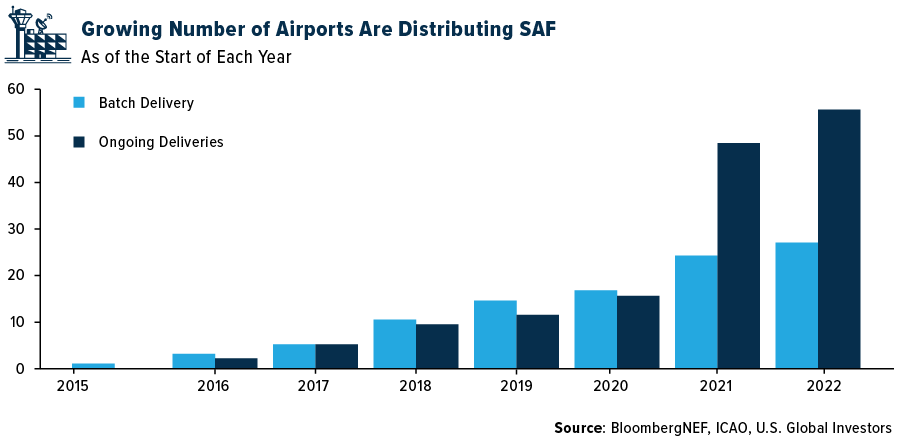

As of June, nearly 30 major global airlines have set an SAF adoption target, such as 10% of fuel consumption by 2030, according to Bloomberg New Energy Finance (NEF). An increasing number of airports are ensuring that carriers have access to SAF. At the beginning of 2022, 53 airports around the world had ongoing deliveries of the biofuel. That’s more than triple the number in 2020.

Before 2021, there were only two companies globally that were producing SAF at a commercial scale: Finland-based Neste and Boston-based World Energy. Other companies that have entered the field, in 2021 and 2022, include Spain’s Repsol, France’s TotalEnergies, the U.K.’s BP, Phillips 66 and California-based Fulcrum BioEnergy, which is the first to manufacture fuel from garbage.

As the current global leader, Neste has a small annual capacity for 100,000 metric tons of SAF, but it is believed to be on track to increase this to 1.5 million tons by the end of 2023 at its facilities in Europe and Singapore. The publicly-traded company has contracts with Deutsche Lufthansa and KLM Royal Dutch Airlines, departing from airports in Germany, the Netherlands, Sweden and France.

Meanwhile, World Energy is planning to convert a refinery in Houston to an SAF plant, and Boeing is establishing a facility in Japan to begin researching and developing SAF. In early August, Alaska Airlines announced it had finalized an agreement to buy 185 million gallons of SAF from biofuel company Gevo over five years starting in 2026. Alaska also has announced a collaboration between Microsoft and start-up Twelve to advance production of E-Jet, an even more sustainable fuel that’s made from CO2.

We expect to learn of more SAF deals and agreements in the coming weeks and months, many of them potentially involving airlines, manufacturers and airports that are held in our U.S. Global Jets ETF (NYSE: JETS).

To see the entire list of holdings in JETS, click here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.