We believe gold appears well-positioned for a strong pump that could potentially carry it to new all-time high prices in 2023. We see a number of unique catalysts that could contribute to higher gold prices, and if you’re underexposed or have no exposure, it may be time to consider changing that.

Below are just three potential catalysts for stronger gold.

Emergence of a Multipolar World and Rapid Dedollarization

We’ll begin with what we believe to be the biggest risk that could be beneficial for gold prices: rapid dedollarization.

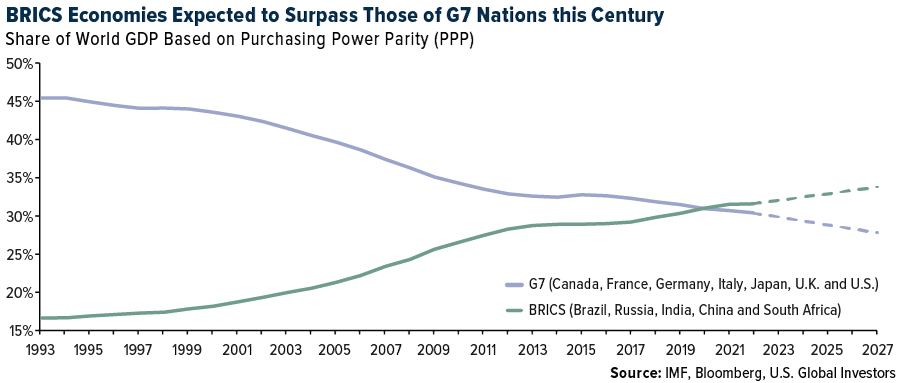

Take a look at the chart below. The purple line shows the combined economies of G7 nations (Canada, France, Germany, Italy, Japan, the U.K. and the U.S.) as a share of global GDP, in purchasing parity terms. The green line shows the same, but for BRICS countries (Brazil, Russia, India, China and South Africa). As you can see, G7 economies have steadily been losing their economic dominance to the BRICS—China and India, in particular. Today, for the first time ever, the leading developed countries contribute less to global GDP than the leading emerging countries.

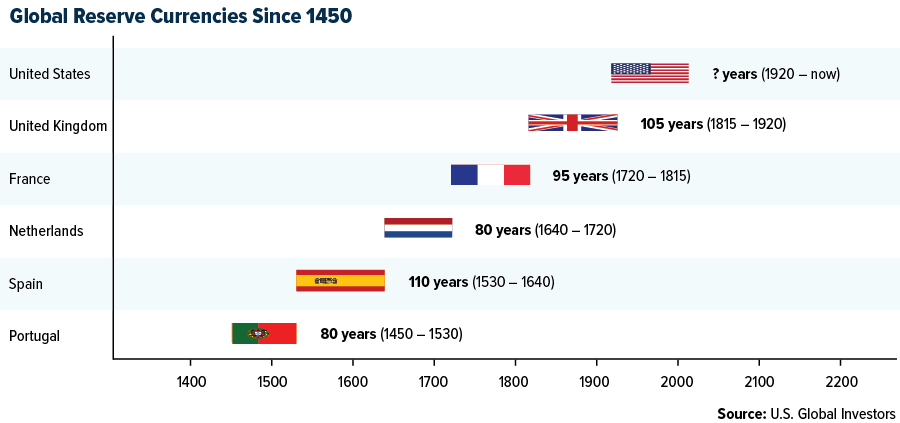

The implications of this could be multi-faceted, but for our purposes here, let’s focus just on currencies. Since the end of World War I, the U.S. dollar has served as the world’s reserve currency, and since the 1970s, crude oil and other key commodities—including gold—have traded globally in greenbacks.

That may be set to change with the rise of a multipolar world in which half of all commodities are traded in U.S. dollars, the other half in another currency—the Chinese yuan, perhaps, or a BRICS currency of some kind, or a digital currency such as Bitcoin.

An increasing share of commodities is already being settled in non-dollar currencies. China recently settled a liquid natural gas (LNG) trade with France in yuan for the first time ever. Since Russia’s invasion of Ukraine last year and the international sanctions that followed, Russia’s de facto reserve currency has been the yuan.

Some economists believe the time may be right for a major competitor to the dollar to step up. Jim O’Neil, the former Goldman Sachs economist who coined the acronym BRIC, recently urged BRICS nations to challenge the greenback’s dominance, saying that shifts in U.S. monetary policy create dramatic fluctuations in the value of the dollar that affect the rest of the world.

We believe gold would be a direct beneficiary of rapid dedollarization since it’s priced in the greenback. Gold is trading at or near all-time highs in a number of currencies right now, including the British pound, Japanese yen, Indian rupee and Australian dollar, and it would likely be hitting new highs in USD terms as well were the dollar to be devalued.

Acceleration of the Liquidity Crisis and Return of Quantitative Easing (QE)

The next potential catalyst has to do with the ongoing shakiness of certain segments of the traditional financial sector. Pressured under an estimated $620 billion in unrealized losses, the U.S. banking industry has seen the failure of two large firms this year—Silicon Valley Bank (SVB) and Signature Bank—and a significant erosion in depositors’ confidence.

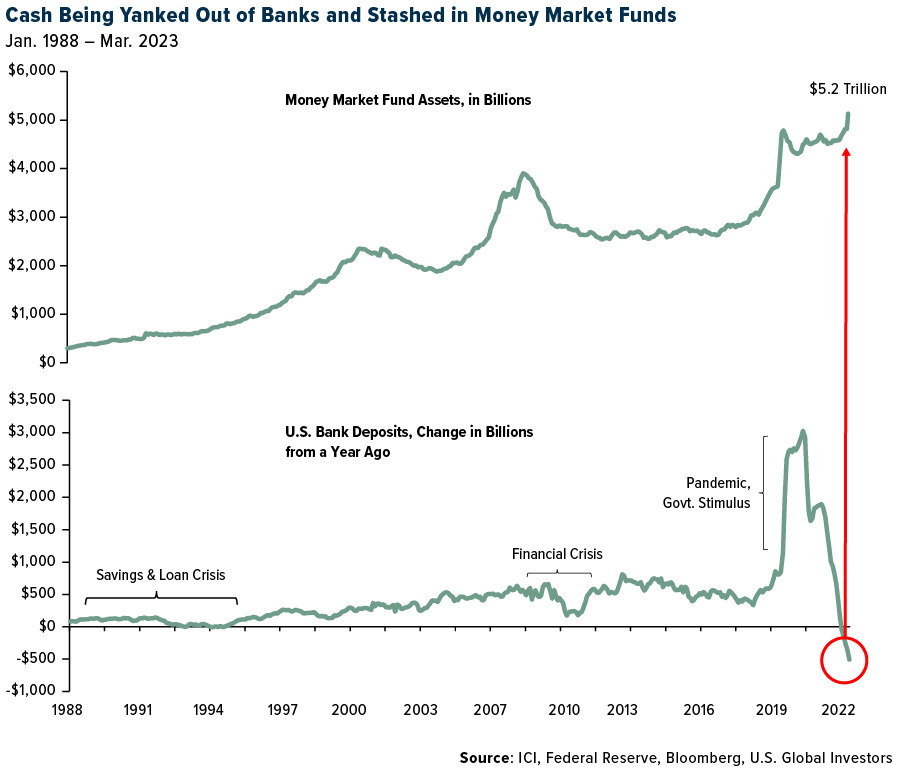

As a result of these failures, people and companies have withdrawn tens of billions of dollars from banks. In March, bank deposits were down more than $500 billion compared to the same month in 2022, a more dramatic year-over-year change than the savings and loan crisis in the 1980s and 1990s and the financial crisis.

Where is all this capital going? Money market funds, which are perceived to be safer and, in many cases, deliver higher yields than savings accounts right now. A record $5.2 trillion now sit in these funds, according to the Investment Company Institute (ICI), and the stockpile is expected to get much higher.

Many regional and community banks were already facing a liquidity crunch due to massive unrealized losses, and the sudden withdrawals will only amplify things. As reserves drop, banks will become less and less willing to lend to households and businesses, slowing the economy even more than the Federal Reserve’s rate hikes.

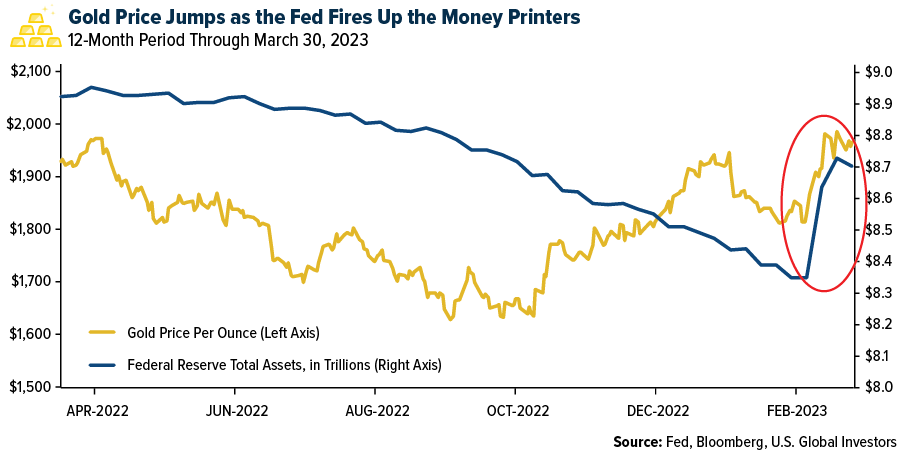

In the event that the liquidity crisis expands into a full-blown recession, the Fed may have no other choice than to pivot and begin another cycle of quantitative easing (QE). The central bank has been trying to unwind its balance sheet, but in an effort to stabilize the banking sector, it added nearly $400 billion in the two weeks ended March 22. Over the same period, the price of gold jumped 8.6%, reversing its 2023 losses.

Worsening Geopolitical Uncertainty

The final catalyst involves worsening diplomacy between the U.S. and its allies and Russia and China. Relations between the West and the East are about as bad as we remember them ever being, and they could get much worse before they get better.

According to a recent Foreign Affairs article, Chinese Leader Xi Jinping appears to be shoring up his country’s military readiness by increasing the defense budget and building new air-raid shelters in key cities and “National Defense Mobilization” offices. “Something has changed in Beijing that policymakers and business leaders worldwide cannot afford to ignore,” the piece reads.

Whether the military build-up is a precursor to an invasion of Taiwan or something else remains to be seen.

What we do know is that investors have historically put their trust in gold in times of geopolitical risk and uncertainty, and gold mining stocks could be one way to get additional exposure.

Our U.S. Global GO GOLD and Precious Metals Miners ETF (NYSE: GOAU) provides investors access to companies engaged in the production of precious metals either through active (mining or production) or passive (owning royalties and production streams) means.

GET STARTED TODAY! EXPLORE GOAU BY CLICKING THE LINK BELOW!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political, or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.