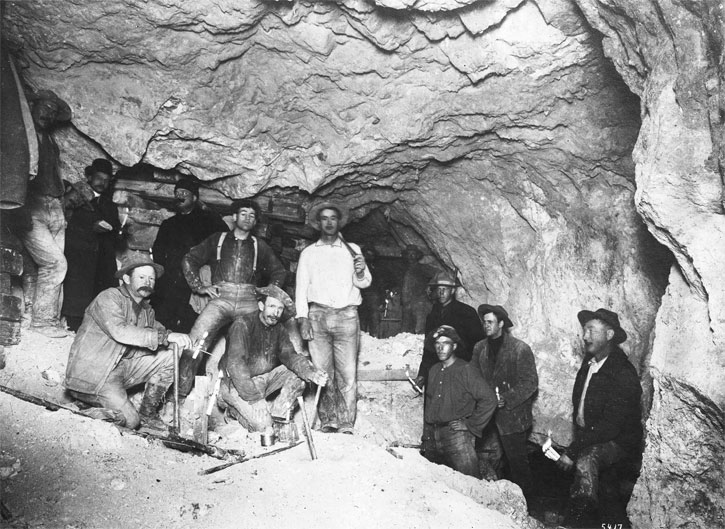

“During the gold rush, it’s a good time to be in the pick and shovel business.”

So writes Samuel Clemens, otherwise known as Mark Twain, who cut his literary teeth in the mining camps of California and Nevada during the 1860s. Gold Rush speculators, hundreds of miles from home, were in need of basic goods and services, from clothing to financial services to food, creating huge opportunities for entrepreneurs and anyone else with a dream. The period gave rise to a number of now-iconic American companies, including Levi Strauss and Wells Fargo.

Fast forward nearly 170 years, and it can still be profitable to be in the “pick and shovel business.”

With operating costs on the rise, and gold down from its peak of $1,900 an ounce in 2011, what producers need now more than anything is capital. Developing a mine is expensive and time-consuming—sometimes prohibitively so—and projects typically must operate for years before producers begin to recover their startup costs.

This is where royalty and streaming companies come into play. They provide upfront cash to producers to develop a project, and in return, they receive royalties or rights to a “stream,” an agreed-upon amount of gold, silver or other precious metal at a lower-than-market price.

We believe this is a superior business model. Royalty companies have exposure to the precious metal space but have managed to remain profitable even when prices are down. They’ve taken on very little debt relative to producers, making them better allocators of capital.

A Unique Gold Miner ETF

Among our favorite royalty companies right now are Wheaton Precious Metals, Royal Gold and Franco-Nevada. Together they make up about 30 percent of our U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), which launched at the end of June.

The VanEck Vectors Gold Miners ETF (GDX) and the VanEck Vectors Junior Gold Miners ETF (GDXJ)—both hugely popular gold ETFs that we consider GOAU’s main competitors—are structured mostly on market cap. They ignore profitability metrics such as cash flow return on invested capital (CFROIC) and revenue per employee. Only 15.8 percent of GDX, and just under 2 percent of GDXJ, is invested in royalty companies, which are sometimes described as the “smart money” of the precious metals industry.

Royalty Companies Make the Difference

Again, 30 percent of GOAU is composed of royalty names, which have a history of appreciating in price even in gold bear markets. From its all-time high in September 2011 to September 2017, the gold price fell nearly 30 percent. During the same six-year period, Royal Gold gained 21 percent, Franco-Nevada 82 percent.

Barrick, the largest producer in the world by market cap with a 10 percent weighting in GDX, lost 65 percent.

As for the remaining 70 percent of the fund, GOAU is very selective when it comes to explorers and producers, seeking to invest only in high-quality mining companies with stellar balance sheets. Companies that rely primarily on debt to finance operations are screened out.

And unlike GDX and GDXJ, which partition senior and junior producers, GOAU brings the two together into one gold ETF, providing investors exposure to 28 of the most profitable firms across the industry. This makes it, we believe, a more convenient “one click” way to gain exposure to the broader metals and mining space.

Curious to learn more about GOAU? Visit the fund page today!

The fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The statutory and summary prospectus contains this and other important information about the investment company. To obtain a statutory and summary prospectus for GOAU visit www.usglobaletfs.com or call 844.383.5387, or visit www.vaneck.com or call 800.826.1223 for GDX and GDXJ. Read it carefully before investing.

For information regarding the investment objectives, strategies, liquidity, risks, expenses and fees of the VanEck Vectors Gold Miners ETF and VanEck Vectors Junior Gold Miners ETF, please refer to the prospectuses for those funds.

Investment Objectives: The U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) is a passively-managed fund that provides investors access to companies engaged in the production of precious metals either through active (mining or production) or passive (owning royalties or production streams) means. The VanEck Vectors Gold Miners ETF (GDX) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index, which is intended to track the overall performance of companies involved in the gold mining industry. The VanEck Vectors Junior Gold Miners ETF (GDXJ) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Junior Gold Miners Index, which is intended to track the overall performance of small-capitalization companies that are involved primarily in the mining for gold and/or silver.

Liquidity: The U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ) can be purchased or sold intraday on the New York Stock Exchange.

Safety/Fluctuations of principal/return: Loss of money is a risk of investing in the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ). Shares of all of these securities are subject to sudden fluctuations in value. Gold, precious metals and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies.

Tax features: Trading the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ) will generate tax consequences and transaction expenses. This information provided is not intended to be tax advice. The final determination of the tax characteristics cannot be determined until after each Fund’s yearend. The tax treatment and characterization of the Fund’s distributions may vary significantly from time to time depending on whether the Fund has gains or losses on the securities in its portfolio.

Quasar Distributors, LLC is not affiliated with the VanEck Vectors Gold Miners ETF and VanEck Vectors Junior Gold Miners ETF.

References to other ETFs should not be interpreted as an offer of these securities.

Cash Flow Return on Invested Capital (CFROIC) is defined as consolidated cash flow from operating activities minus capital expenditures, the difference of which is divided by the difference between total assets and non-interest bearing current liabilities.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.