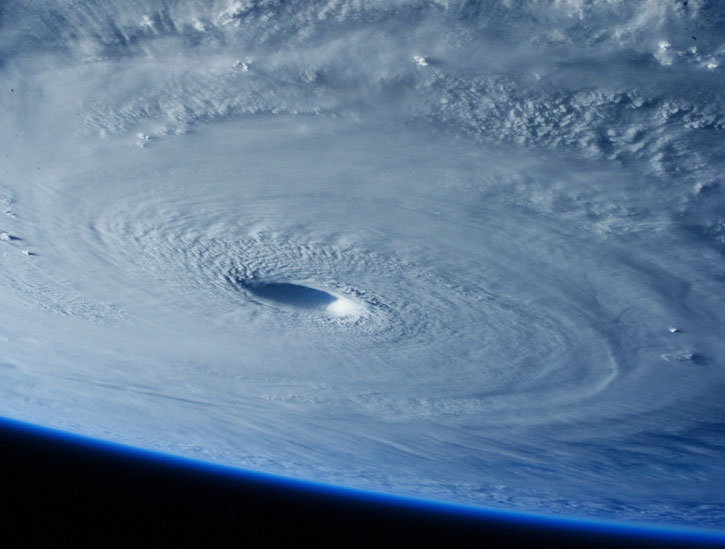

Despite hurricane season’s Harvey, Irma and Maria slamming the Gulf Coast and Caribbean, the airline industry has appeared to weather the storms, writes ETF Trends. Delta Air Lines, one of the major domestic carriers, and a top holding in the U.S. Global Jets ETF (JETS), surged in early October. Delta projected consolidated passenger unit revenue for the third quarter to rise 2 percent year-over-year, the article continues, a much rosier outlook than many had previously expected in light of the severe storm systems. A handful of other airliner stocks also rebounded during the week of October 3 following Delta’s outlook.

READ THE ARTICLE FROM ETF TRENDS

Past performance does not guarantee future results.

Please click here for standardized performance.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end please call 844.383.5387 or visit www.usglobaletfs.com.

U.S. Global Investors has authored and is responsible for the summary on this page.

All opinions expressed and data provided are subject to change without notice. Opinions are not guaranteed and should not be considered investment advice. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

ETF Trends publisher Tom Lydon is on the board of U.S. Global Investors.

Unit revenue is the average amount of revenue received by an airline per unit of capacity available for sale. Most often used to measure the effectiveness with which revenue-management activity balances price and volume to generate passenger unit revenue per ASM, known as PRASM.

Smart beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization based indices.