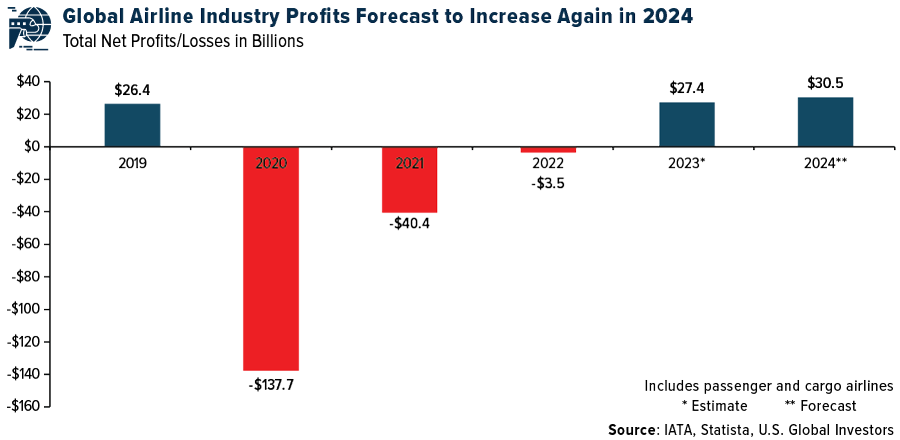

Last week, the International Air Transport Association (IATA) significantly upgraded its profitability projections for airlines in 2024. The trade group now expects net profits to reach $30.5 billion, an increase from $27.4 billion in 2023.

This surge in profitability is accompanied by record-high traveler numbers and revenues. A fresh record number of passengers is expected to fly in the U.S. this summer. For the full year, the total global number of travelers is forecasted to reach approximately 5 billion, with revenues projected to soar to $996 billion, a 9.7% increase from 2023.

The recovery in travel has been nothing short of remarkable. Domestic travel bounced back to pre-pandemic levels by the spring of 2023, while international routes have recently surpassed 2019 numbers. The IATA now expects the number of world passengers to grow by an average of 3.8% per year over the next 20 years, resulting in over 4 billion additional passenger journeys by 2043.

“The human need to fly has never been stronger,” said Willie Walsh, IATA’s Director General.

Business Travel Spending Set to Surpass $1.5 Trillion this Year

While leisure travel has been leading the recovery, business travel is steadily gaining momentum, albeit at a slower rate. A Morning Consult survey found that only 10% of U.S. adults had traveled domestically for work in March 2024.

The trend appears to be headed in the right direction, however, with corporations prioritizing domestic trips over long-haul international travel. The Global Business Travel Association (GBTA) predicts global business travel spending will surpass $1.5 trillion in 2024, up from $1.02 trillion in 2022.

Regarding the hotel market, investors are optimistic, but forecasts are being downgraded. Profitability still lags pre-pandemic levels. Early last week, STR and Tourism Economics revised down their 2024-2025 U.S. hotel forecast, reflecting lower-than-expected performance in early 2024 and reduced growth projections for the rest of the year.

Domestic Travel Spending in China

Another exciting development is the revival of Chinese outbound travel. The World Travel & Tourism Council (WTTC) predicts that China’s travel & tourism sector will contribute a record-breaking 12.62 trillion yuan ($1.7 trillion) to the country’s economy by the end of this year.

Domestic travel spending in China is also expected to reach new heights, providing a significant boost to the luxury market. Chinese shoppers were major luxury-goods spenders before the pandemic. These shoppers are gradually returning, with domestic luxury spending up by 50%, according to Bloomberg Intelligence. The resurgence is encouraging for long-term luxury investments, both in mainland China and Europe.

How You Can Participate

We believe there are a number of good reasons to invest in the airline industry. One of the best (and easiest) ways to participate, we think, is the U.S. Global Jets ETF (JETS), which provides investors access to not only airlines but also airport operators and manufacturers. The four major U.S. carriers represent approximately 45% of the fund.

Curious to learn more? We invite you to explore JETS’ overview, holdings, performance and more by clicking here!

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.