Airlines continued to weather the COVID-19 storm as a return to normal travel levels appears to be further away. On the other hand, investor interest in gold increased during the month and bullion rose about $1,700 an ounce for the first time since 2012.

Click the buttons below to read our recap of the airline sector and gold market for April 2020.

Strengths

- Although it wasn’t as much relief as expected or wanted, as a part of the $2 trillion coronavirus aid package signed into law on March 27, $25 billion was included in assistance for passenger airlines. Treasury Secretary Steven Mnuchin said that the following airlines plan to participate in the Payroll Support Program: Alaska Airlines, Allegiant Air, American Airlines, Delta Air Lines, Frontier Airlines, Hawaiian Airlines, JetBlue Airways, United Airlines, SkyWest Airlines and Southwest Airlines. MarketWatch reports that the aid is primarily meant to help carriers with payroll and go toward paying employees as cash flow dries up from severely reduced air service.

- According to the Australia Institute, airlines’ carbon emissions could fall by more than a third this year due to reduced flying and travel demand. From February 1 to March 19 airline carbon dioxide emissions fell by more than 10 million tons from the same period a year ago. Based on traffic forecasts by the International Air Transport Association (IATA), airline emissions could fall 38 percent in 2020. Although negative for carriers that there are significantly fewer flights, it is positive for the environment in the short-term.

- The Essential Air Service program pays airlines to fly to 160 remote cities in the U.S. that otherwise wouldn’t have air service. Bloomberg reports that with the coronavirus reducing air travel by 95 percent, the Department of Transportation (DOT) will make adjustments to the program through June 30. So long as airlines operate at least one round trip flight a day for six days a week on certain essential routes, the DOT will pay the carrier 50 percent for additional flights that weren’t made. This is positive relief for carriers who are suffering from just a few people on each flight. Alaska has the most airports with subsidized flights and the DOT will continue paying carriers as long as they complete at least half of their normal weekly schedule in the state.

Weaknesses

- The IATA estimates that carriers will lose $314 billion in 2020 due to the coronavirus – a 25 percent jump from its previous forecast. Demand is so low that carriers are asking permission to not fly certain routes and not lose landing slots. Delta Air Lines said it has flown just one passenger per day to and from Worcester, Massachusetts. Bloomberg reports that JetBlue asked to let it suspend flights to 16 airports warning that continuing to fly to certain locations would significantly harm liquidity.

- The biggest three Chinese airlines reported first quarter results and had a combined loss of $2 billion. China South Airlines lost 5.3 billion yuan, China Eastern Airlines lost 3.9 billion yuan and Air China lost 4.8 billion yuan. China was the first nation to be hit hard by the coronavirus in January. According to Cirium, in March and April more than 30 percent of domestic capacity has returned to the country. Singapore Airlines said that it would cancel 96 percent of scheduled flights until the end of June and only fly to 15 cities.

- It is not just airlines feeling the pain. Airplane manufacturers too are suffering. Boeing said that it lost 150 orders for its 737 Max aircraft in March. Airlines are cutting orders or delaying the delivery of jets due to reduced capacity. EasyJet announced the deferred delivery of 24 Airbus aircraft.

Opportunities

- Air France-KLM said that it could see activity recover to nearly 70 percent by the end of this year if passengers feel safe traveling again. CEO Ben Smith said that a best-case scenario would see traffic back at more than 80 percent by the end of 2021. However, Smith added that he doesn’t expect the carrier to have any flights outside of the European Union before the end of August. Although not the brightest travel forecast, it is one of the more positive forecasts released by a carrier and provides some hope that travel demand will recover.

- Airlines are taking drastic measures to attract passengers once again. JetBlue announced that it will require all passengers to cover their mouth and nose when checking in, boarding, flying and exiting aircraft. Carriers such as Emirates are enforcing social distancing by not selling the middle seat on rows to create more space between passengers. Other carriers are reassigning seats just before flights to ensure passengers are spread as far apart as possible when seated. Hopefully these measures make customers feel safe while flying and attract travelers back to the skies.

- Brendan Sobie, an aviation consultant at Sobie Aviation, says that the worst is over for the Chinese airlines. In an interview with Bloomberg TV, Sobie says business travel has resumed slowly domestically, while leisure travel still lags. Sobie added that the combined $2 billion loss in the first quarter for the major Chinese airlines is the worst of it with second quarter losses to not be as sharp.

Threats

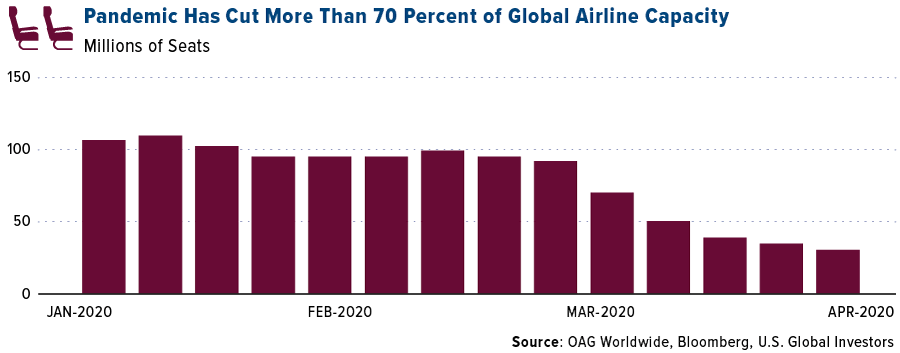

- According to OAG Aviation Worldwide, airlines have cut international capacity to just half a million seats a week from an average of 5.9 million before the coronavirus outbreak curbed travel demand. Senior analyst John Grant says that demand is lacking, but strong domestic capacity has helped stem declines in countries such as the U.S., Japan and Indonesia. The report added that total capacity for international and domestic routes has fallen to just 29.8 million seats, down more than 70 percent from January.

- The biggest threat for the airline industry is that the coronavirus continues to spread and a return to normal travel demand is pushed further away. United Airlines said that travel demand was “essentially zero” with no sign of improvement in the near term, reports Bloomberg. United further cut its flight schedule in May to just 10 percent of what it planned at the start of 2020 with similar cuts in June. The airline said it would fly fewer people during all of May than it did on a single day in May 2019. The carrier fell over 9 percent on April 16 after the comments were released.

- A new challenge has emerged for the aviation industry: what to do with thousands of grounded jets. According to Cirium, more than 16,000 passenger jets – or 62 percent of the world’s planes – are grounded due to the coronavirus. Bloomberg reports that aircraft still need attention while in storage such as maintenance of hydraulics, protection against insects and wildlife and keeping humidity from corroding parts. Anand Bhaskar, CEO of Air Works, says “Parking space is a problem. These are logistics nightmares which we’re trying to work around.”

Strengths

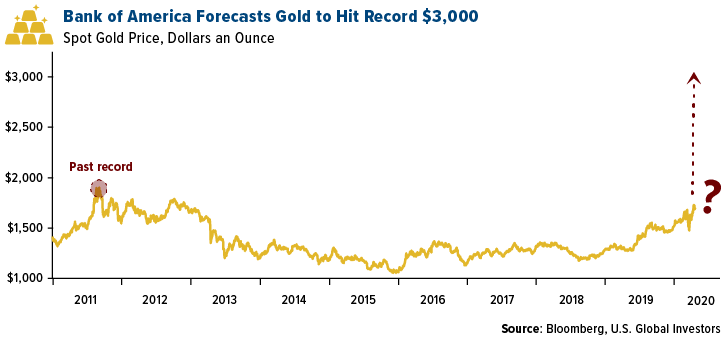

- Gold performed strongly in April overall. The metal traded near its highest since 2012 on April 29 after the Federal Reserve voiced concern that the pandemic could leave permanent scars on the U.S. economy. Additional liquidity thanks to central bank action also benefited gold in the month of April after struggling in March from a selloff.

- The U.K. Mint said sales of gold bullion coins and bars jumped 736 percent in March compared to a year earlier. The mint added that a fifth of new customers were under 35. Gold exports from Switzerland to the U.S. rose to 43.2 tons in March – the most since data going back to 2012, according to data from the Swiss Federal Customs Administration. The U.S. Mint reopened its West Point facility in New York this week after temporarily closing the plant.

- Ghana still plans to move forward with the sale of $750 million of shares in a gold mining fund this year. The top gold miner in Africa will list the fund in London and will pay dividends from the government’s income from mining operations. Finance Minister Ken Ofori-Atta said that the coronavirus makes things difficult, but we will not relent.

Weaknesses

- Capital Economics said in a report that a decline in gold prices is looming in May as economies will come back online and demand for haven assets will fade. The firm predicts gold will fall back to $1,600 an ounce by year-end.

- Gold consumption in China fell 48 percent to 148.63 tons in the first quarter, according to the China Gold Association. Buying in the world’s top consumer was hampered by closed shops and higher metal prices.

- The global silver surplus is expected to more than double in 2020 as falling demand outweighs mine shutdowns, according to CPM Group. Supply is expected to surpass demand by 78.9 million ounces, compared to a surplus of 36.2 million in 2019.

Opportunities

- Bank of America made two very bold precious metal price predictions. The bank said silver could rally to $20 an ounce due to a rebound of economic growth later in the year. Spot silver last traded at $20 in 2016. Secondly, the bank says gold could nearly double to $3,000 an ounce over the next 18 months as central bank stimulus and economic turmoil drive record interest in the metal. The bank released this forecast in a report titled “The Fed can’t print gold.”

- UBS raised its second quarter-end price forecast for palladium to $2,300 an ounce, up from $2,000. The group expects a supply deficit to continue in 2020 of 500,000 ounces, compared with almost 1.2 million ounces in 2019.

- Although gold jewelry buying In India has been down for months, a new love for gold has emerged. The World Gold Council (WGC) wrote in a report that nearly 29 percent of retail investors who had never bought gold, now look forward to buying gold in the future. The report adds that gold is now a preferred investment option in the country.

Threats

- The central bank gold buying spree could slow in 2020 as the coronavirus ripples through global economies and creates a cash crunch, reports Bloomberg. Russia announced in April that it has paused its domestic gold buying. Standard Chartered Plc expects net purchases to drop to 360 tons from last year. The World Gold Council (WGC) doesn’t expect central banks to become net sellers, but that demand will likely decline this year.

- Palladium could be looking at a small surplus in 2020 after years of a deficit that led to skyrocketing prices. Kitco News reports that palladium fell from an all-time high of $2,700 at the end of February to nearly $1,400 in mid-March on demand concerns surrounding coronavirus. The world’s top palladium producer, Norilsk Nickel, said that it expects a small surplus of around 0.1 million ounces. The surplus is projected to be temporary and that a deficit will resume once the world fully reforms after the pandemic subsides.

- First quarter earnings for miners aren’t a sure bet even with gold prices higher. Gold prices were up about 20 percent from the first quarter a year ago, but companies are still dealing with operation shutdowns and supply chain disruptions due to the coronavirus. Bloomberg’s Aoyon Ashraf writes that investors shouldn’t be fooled by gold’s rally. CIBC’s Anita Soni says that operational results will likely be “mixed and messy” and that estimates are less meaningful given the recent disruptions.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business.

The outbreak of the COVID-19 pandemic and the resulting actions to control or slow the spread has had a significant detrimental effect on the global and domestic economies, financial markets and industries, including airlines. U.S. Global Investors continues to monitor the impact of COVID-19, but it is too early to determine the full impact this virus may have on commercial aviation. Should this emerging macro-economic risk continue for an extended period, there could be an adverse material financial impact to the U.S. Global Jets ETF.