The price of gold rose above $2,000 an ounce on August 4! Although it corrected later in the month, it remained in a “Golden Cross” trading pattern. In the airline space, carriers are still cutting jobs, but other optimistic news emerged. Click the buttons below to read our recap of the airline sector and the gold market for August 2020.

Strengths

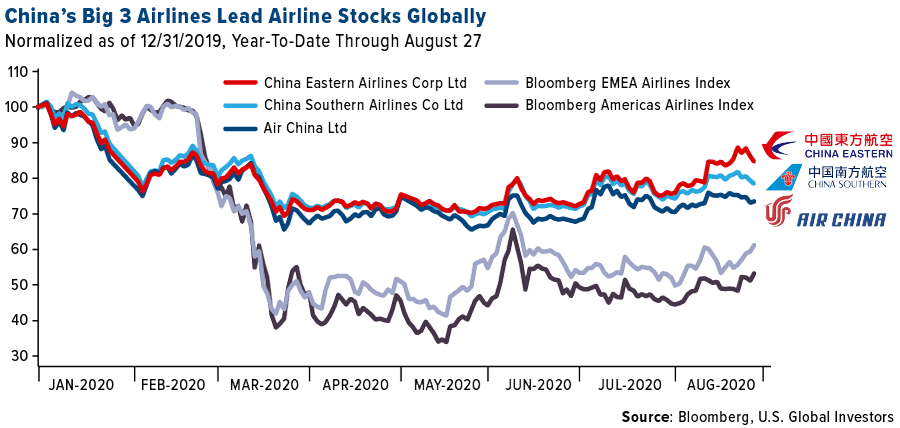

- China’s domestic air travel industry has made a speedy recovery from pandemic-hit demand. Ticket bookings for the last week of August hit 98 percent of last year’s levels, according to travel analytics company ForwardKeys. The firm also predicts that China’s travel demand will fully recover in September. The big three domestic airlines – Air China, China Eastern Airlines and China Southern Airlines – have outperformed airlines globally. China was also the first hit with the virus and the virus to ease restrictions.

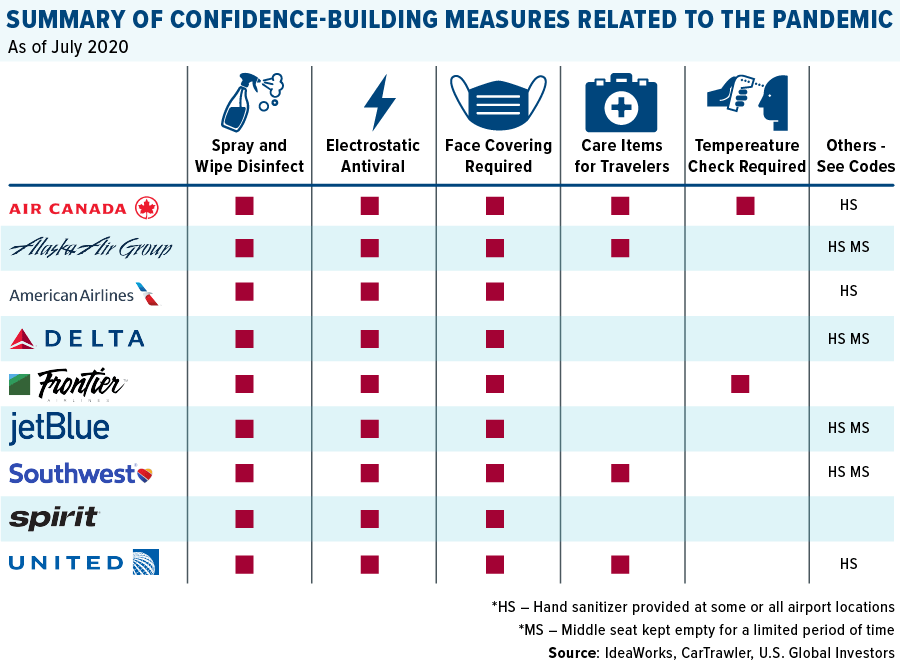

- The Trump administration gave emergency approval for American Airlines to deploy a surface coating that kills coronavirus for up to seven days. The EPA issued the emergency declaration for use in some planes and airport facilities, reports Bloomberg. This is a strong positive step forward for ensuring the safety of travelers. The administration is also looking at executive actions to help airlines avoid employee furloughs if Congress fails to provide financial assistance in a new round of stimulus. Several airlines have warned they will cut significant numbers of employees after restrictions on federal aid ends.

- Wizz Air, Europe’s third-biggest budget airline, said it will continue adding planes to its fleet. European budget carriers have emerged as the winners from weak travel demand for two key reasons: 1) they had significantly higher cash reserves compared to network carriers before the pandemic and 2) they rely on short-haul services that are expected to recover before long-haul travel. Wizz Air plans to expand its presence at London’s Gatwick airport from just one plane to 20 if it can secure takeoff and landing slots, reports Bloomberg.

Weaknesses

- Times are so tough for Qantas Airways that the carrier is selling its in-flight biscuit and tea bags to consumers at home. Bloomberg reports Qantas is selling its in-flight complimentary items online such as its signature biscuits, sleeper suits and smoked almonds. The packs, selling for $18 apiece, sold out within hours. Qantas announced 6,000 job cuts and plans to raise A$1.9 billion to weather the pandemic.

- Aviation industry job cuts continue globally. The latest example is Finnair Oyj, Finland’s national carrier, who plans to eliminate as much as 15 percent of its workforce. The carrier said in a statement that it will lay off practically all its personnel in Finland.

- Jet-engine maker Rolls-Royce reported its biggest-ever loss and shares fell as much as 10 percent August 27 on the news. The company plans to raise $2.6 billion in cash from disposals. Rolls-Royce said it lost 5.4 billion pounds in the first half of 2020 and said cash will flow out for at least another year. The company is one of many manufacturers suffering big losses from reduced aircraft demand.

Opportunities

- Boeing announced its first 737 MAX deal of 2020. Poland’s largest charter carrier Enter Air added an option to take two additional aircraft, which if exercised would bring its MAX fleet to 10, reports Bloomberg. This is a rare positive story for Boeing as the manufacturer copes with both coronavirus-induced demand collapse and mechanical issues with the 737 that has left it grounded for a year.

- Indonesia’s largest airport operator, PT Angkasa Pura II, is moving ahead with the construction of a new goods-handling facility in Jakarta, predicting that cargo will rise to 1 million tons a year within the next three years. The group is betting that cargo traffic at Jakarta’s Soekarno-Hatta airport will rise significantly from current levels around 600,000 tons annually.

- Virgin Atlantic Airways announced its first new routes since the beginning of the pandemic. The recently rescued carrier controlled by Richard Branson will begin serving Pakistan for the first time after bans on the country’s flag carrier created a void in the market, reports Bloomberg. The first commercial flight from Israel to the United Arab Emirates (UEA) took place, after crossing through Saudi Arabian airspace that is normally restricted to Israeli air traffic. The UAE is the third Arab country to recognize Israel and opens new routes for commercial flights.

Threats

- American Airlines said it will cut 19,000 workers when the federal payroll aid expires, capping a 30 percent workforce reduction since the pandemic began. United warned it may have to furlough 2,850 pilots if no extension to its federal aid is granted. Delta warned of 1,941 furloughed pilots. These are just a few examples of carriers warning of the consequences of a lack of more federal aid to stem decimated air travel demand losses.

- Singapore Airlines spent half of the $6.4 billion it raised through sale shares in just two months – a stark warning that airlines are still burning cash rapidly amid weakened travel demand. The company said in a statement that the proceeds have been used for operating expenses, maturing fuel-hedging trades and ticket refunds from canceled flights.

- Aviation Week Network said in a video conference that deliveries of commercial aircraft over the next decade will be 30 percent lower than previously forecast. The group sees around 16,000 jets delivered between 2021 and 2030 as the pandemic shattered air travel demand and a slow recovery is expected. This could be a long-term problem for aircraft and part manufacturers such as Boeing and Airbus.

Strengths

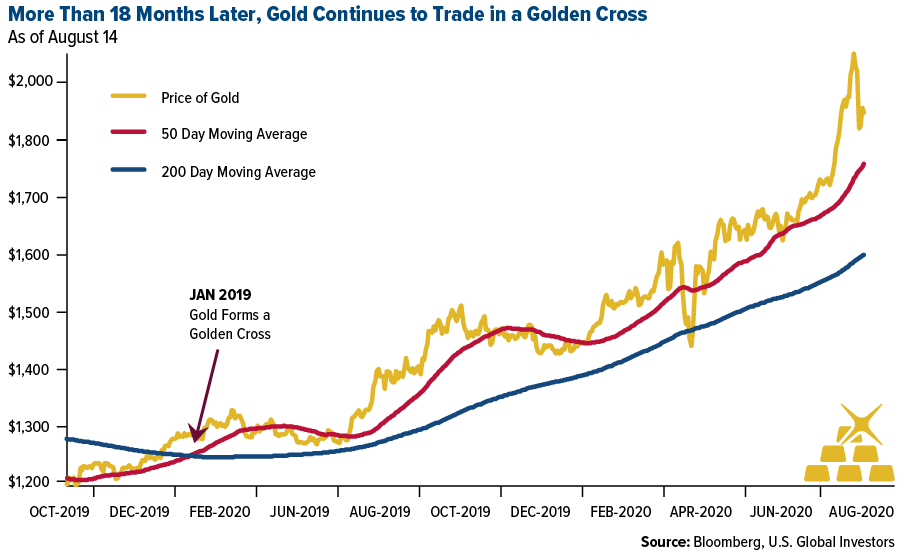

- The price of gold rose above $2,000 an ounce on August 4. It’s new all-time high is $2,075 an ounce. Retail investors appear to be jumping into the gold investing space. According to World Gold Council data, ETFs backed by physical bullion had their eighth straight month of inflows in July, bringing total holdings to 3,785 metric tons. To put that in perspective, that’s more gold than any country has in its official reserves, excluding only the U.S., which currently holds 8,133.5 tons.

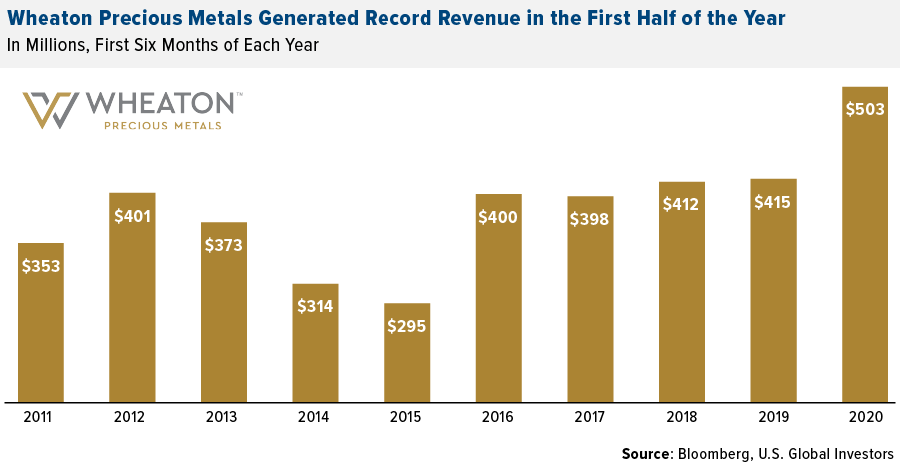

- Royalty and streaming company Wheaton Precious Metals had a blowout quarter. The company reported $105.8 million in net income, substantially beating Wall Street estimates of around $80 million. Revenue also beat for the second quarter, and in fact, Wheaton generated record revenue for the first half of the year. Total revenue was more than $503 million, an increase of 21 percent over the same six-month period in 2019.

- Barrick Gold boosted its quarterly cash dividend by 14 percent to 8 cents per share. The company said in its second quarter earnings statement that “the dividend increase is sustainable and reflects the ongoing robust performance of our operations.” In afterhours trading on Friday August 14, Barrick Gold was up 5 percent as Warren Buffett’s Berkshire Hathaway disclosed in a 13F filing that it had accumulated 20.9 million shares of the world’s second-largest miner.

Weaknesses

- The price of gold had its first down week since early June in the week ended August 14, ending a spectacular nine-week rally, the likes of which we haven’t seen since 2006. The yellow metal briefly fell below $1,900 an ounce as stocks neared their all-time closing high and the 10-year Treasury yield jumped on record supply. Despite the correction, gold continued to trade in a golden cross. That’s when the average price for the past 50 trading days is above the average price for the past 200 trading days, and it’s typically seen as a bullish signal.

- India’s gold jewelry and retail investment demand will slump to just 350 to 400 tons in fiscal year 2021, according to UBS Group. The second-largest gold consuming nation is likely facing its worst ever recession due to the pandemic and consumption is unlikely to record to normal levels anytime soon. The UBS report says India consumed 633 tons in 2020.

- Colombia sold $475 million its gold in June, equivalent to 67 percent of its holdings, according to the central bank’s website. This means the nation missed out on gold’s record price surge just a few weeks later. Gold now accounts for about 0.4 percent of Colombia’s international reserves, compared to much higher percentages of other South American countries, reports Bloomberg.

Opportunities

- Mint Innovation, a New Zealand start-up company, plans to open a refinery in the U.K. for extracting precious metals from electronic waste. Bloomberg reports this would be the world’s first commercial operation to use bacteria rather than cyanide-based processes to recycle precious metals from electronics. A United Nations report found that at least $10 billion of gold, platinum and others were thrown away every year in e-waste.

- SkyBridge Capital, which recently added exposure to gold after exiting in 2011, says that gold will continue its record-setting rally due to massive currency debasement as the world prints money like crazy. Chief investment officer Troy Gayseki said “gold is obviously a natural alternative currency” as the dollar weakens against other paper currencies. Bloomberg notes that Gayseki went on to say that it wouldn’t surprise him to see bullion around the $2,100 to $2,200 an ounce range by the end of 2021.

- Nomad Royalty is buying Coral Gold Resources in a deal valued at $45.8 million. Nomad also announced it is acquiring a cash flowing royalty on the Moss gold mine in Arizona through the acquisition of Valkyrie Royalty Inc for $7.6 million. Brixton Metals Corp is acquiring a 100 percent interest in the Metla mineral claim group from Stuhini Exploration in Canada – expanding its existing Thorn project.

Threats

- The U.S. Mint said it has reduced the volume of gold and silver coins for distribution as the pandemic slows production. A document obtained by Bloomberg says that the Mint’s West Point complex in New York will probably slow coin production for 12 to 18 months as it implements measures to prevent the virus spreading among employees.

- Mark Hulbert of MarketWatch cited research by Duke University professor Campbell Harvey that the gold price is as high as it’s ever been in inflation adjusted terms. Their research suggests that when the inflation adjusted price is high, gold’s subsequent performance tends to be low and vice versa five-years later. They caveat their abstract noting that massive buying of physical bullion by the ETFs may still push prices higher.

- JPMorgan says the gold rally could start to lose steam in the second half of this year. Analysts said in a report that “gold will likely see one last hurrah before prices turn lower into year-end.” Some believe that the gold rally is overdone and will correct soon after rising 29 percent so far this year.

Want to receive this recap straight to your inbox? Sign up for monthly updates by clicking here.

The Bloomberg EMEA Airlines Index is a capitalization-weighted index of the leading airlines stocks in European, Middle Eastern and African region.

The Bloomberg Americas Airlines Index is a capitalization-weighted index of the leading airline stocks in the North, South and Central American region.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.