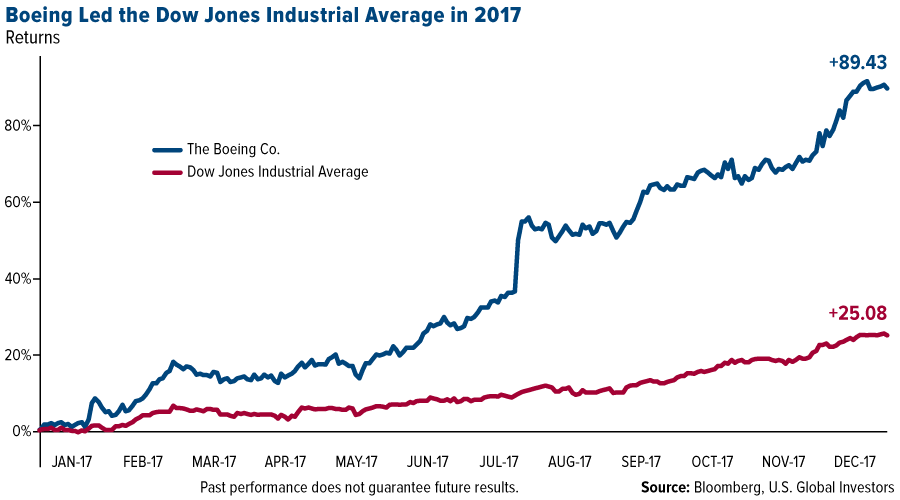

Boeing has a lot to celebrate—and so do its investors. Not only was the jet manufacturer the best performing stock in the Dow Jones Industrial Average in 2017, rising more than 89 percent, but it produced a record number of aircraft in a single year. The Chicago-based company reported building and delivering 763 jets during the year, up 2 percent from its previous record of 762 in 2015. It also reported 912 net new orders in 2017, valued at $134.8 billion, pushing its total backlog up to 5,864 commercial airlines, a new high.

These developments have helped Boeing generate record free cash flow, from an average of $1.83 billion in 2010 to an estimated $10.5 billion last year. Free cash flow allows companies to not only expand operations but also reduce debt and pay dividends. Last month, Boeing raised its quarterly dividend 20 percent and authorized a sweeping $18 billion stock buyback program.

Many analysts predict another stellar year for the world’s largest aerospace manufacturer.

Speaking to Reuters this month, Fort Pitt Capital founder Charles Smith said that “Boeing shares are still moderately undervalued, particularly if the company can sustain free cash flow margins in the 13 to 15 percent range.” This position is echoed by Melius Research’s Carter Copeland, one of the nation’s leading aerospace and defense analysts, according to Institutional Investor’s Alpha magazine. Copeland believes “the market continues to underestimate the multi-faceted and aggressive nature of Boeing’s efforts on costs, cash, profits and growth.” Morgan Stanley analyst Rajeev Lalwani forecasts “another +50 percent year” on disciplined management and benefits stemming from the recently-passed U.S. tax reform law.

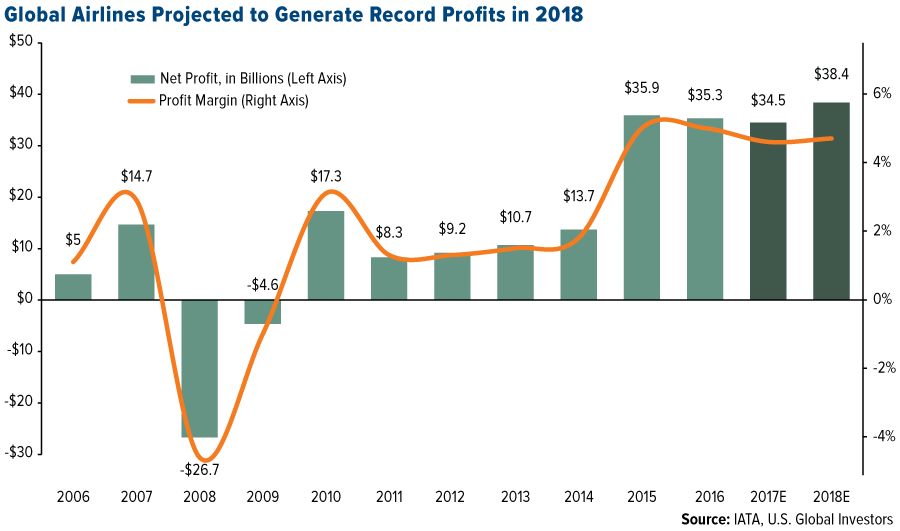

Not uncoincidentally, global airlines as a whole are forecast to log a record year of profits. The International Air Transport Association (IATA) sees the worldwide industry generating $38.4 billion in profits in 2018, up from an estimated $34.5 billion last year.

The IATA expects higher profits to be driven by improved revenue, an increase in passenger and cargo demand and reduced interest payments as carriers pay down debt.

We’re especially pleased by Boeing’s recent performance, as the company is held in our U.S. Global Jets ETF (JETS). The fund focuses on the global airline industry, including airline operators and manufacturers.

High Expectations for Global Air Travel Demand

In our view, Boeing’s success is indicative of the overall health of the airlines industry. That the company delivered so many new aircraft in 2017 and recorded a high number of new orders suggests international carriers are optimistic about long-term air passenger and cargo demand.

In September, American Airlines CEO Doug Parker told CNBC he was very bullish on the industry’s ability to stay profitable, in both good and bad times.

Whether or not you agree with Parker’s prediction, his decision to be compensated in company stock rather than in cash was well made. Since announcing the decision in April 2015, American Airlines stock has risen more than 55 percent as of January 10.

By its own estimate, Boeing sees global passenger traffic growing 4.7 percent annually on average for the next 20 years. China’s air travel growth is estimated at closer to 6.1 percent as its already-massive middle class expands even more. By 2036, Boeing says, the Asian giant should be the largest air travel market, representing almost 40 percent of the world’s jet fleet.

Carriers’ huge orders of new aircraft also show they have the capital to replace aging fleets and invest in newer, more sophisticated planes with better fuel efficiency. The Boeing 777 series, launched near the end of 2013, delivers attractive fuel economy through reduced weight, more aerodynamic wingtips and improved fuel-burn rates. The 777X, scheduled to be released next year, is expected to make even further strides in fuel economy, with Boeing billing it as “the largest and most efficient twin-engine jet in the world.”

For the sixth year in a row, Alaska Airlines ranked as the most fuel-efficient carrier in North America in 2016, according to the International Council on Clean Transportation (ICCT). Alaska is one of the top holdings in JETS, as is Spirit Airlines, ranked number three in the ICCT’s December 2017 report.

Oil an Overstated Risk?

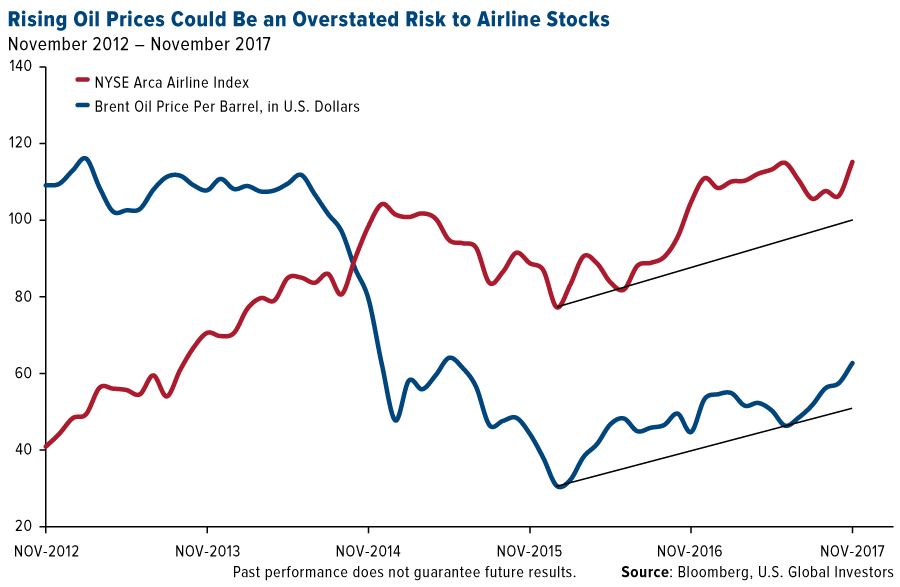

Fuel efficiency should become more of a concern this year as oil prices continue to creep up. Brent crude, the international benchmark, has been trading above $60 a barrel since the end of October and is currently within striking distance of $70 a barrel.

Unlike many, however, we don’t believe rising oil prices pose such a threat to airline profits. As you can see below, the NYSE Arca Airline Index began to rise while oil was still trading above $100 a barrel. The index of U.S. carriers has also continued to climb even as Brent has appreciated more than 147 percent since January 2016.

We’re confident that higher fuel costs can be offset by new revenue streams, reduced interest payments, stronger travel demand as the economy improves and better management since the industry consolidated in the past decade. Again, the IATA forecasts more than $38 billion in profits by the end of this year, and the broad interest in new aircraft may suggest overwhelming optimism in the future.

See which holdings round out the U.S. Global Jets ETF (JETS)!

Airline companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Index performance is not indicative of fund performance. To obtain fund performance, click here.

The Boeing Co. accounted for 3.14% of the U.S. Global Jets Index (JETS) as a percentage of net assets as of 12/31/2017.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The DJIA was invented by Charles Dow in 1896. The NYSE Arca Airline Index (XAL) is an equal dollar weighted index designed to measure the performance of highly capitalized companies in the airline industry. The XAL Index tracks the price performance of major U.S. and overseas airlines.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Free cash flow (FCF) is a measure of a company’s financial performance, calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after spending the money required to maintain or expand its asset base.

Doug Parker is not affiliated with the U.S. Global Jets ETF (JETS).

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.