As investors in the airline industry, we closely track the changes and goings-on within this important sector. The recent development concerning Southwest Airlines—one of the top holdings in our U.S. Global Jets ETF (NYSE: JETS)—is particularly noteworthy.

See the top holdings in JETS by clicking here

On Monday, June 10, Elliott Investment Management announced a substantial $1.9 billion stake in Southwest, signaling a significant activist play aimed at rejuvenating the Dallas-based carrier’s operations and long-term strategy.

Elliott’s Push for New Management

Elliott, led by billionaire investor Paul Singer, has a reputation for implementing meaningful changes in companies. The firm has called for replacing Southwest CEO Bob Jordan with an external candidate and overhauling the board to drive a “comprehensive business review.” This review aims to cut costs, improve customer choice and upgrade technology, with an ambitious target to boost Southwest’s stock performance over the next year.

Southwest has expressed confidence in its existing strategy and leadership, writing in a press release that the company has “the right plan and the right team in place to drive long-term value for our Shareholders.” Bob Jordan has been CEO since February 2022, succeeding Gary Kelly, who had a 17-year tenure and continues as executive chairman.

Addressing Operational Hurdles

It’s essential to recognize the operational challenges that have impacted the low-cost airline. A significant flight disruption in late 2022, caused by a winter storm, led to the cancellation of over 16,000 flights and a $1.2 billion loss. This event highlighted the need for greater investment in technology and scheduling software.

The company’s reliance on the Boeing 737 has also exposed it to delays and production issues. The airline was forced to freeze pilot hiring due to only receiving 20 out of the 79 promised Boeing jets this year.

Southwest’s Dominance in U.S. Business Travel

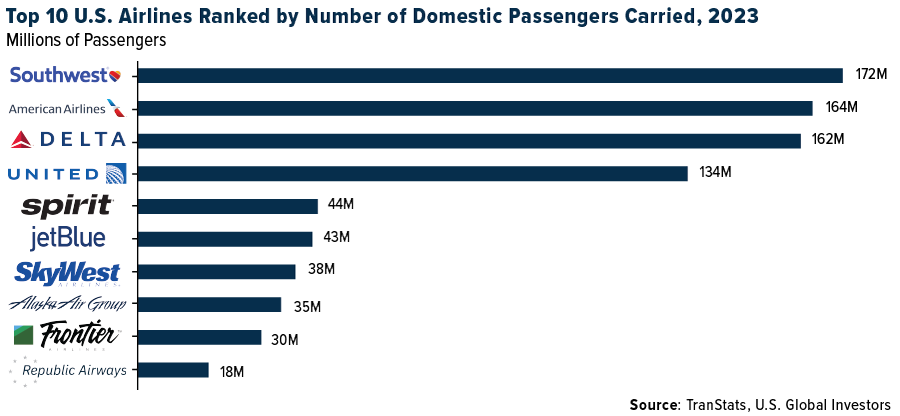

The good news is that corporate bookings are on the rise, and Southwest claims it is the number one business airline in the U.S. with a 10% market share. This trend is likely to continue, reinforcing Southwest’s position in the business travel segment.

Financially, the airline stands out as the only investment grade-rated U.S. airline. They’ve recently restarted their quarterly dividend and currently possess $10.5 billion in unrestricted cash, equivalent to $16-$17 per share. This financial strength provides ample room for increased share repurchases and dividends, which we expect to ramp up.

Investing in Technology

Southwest’s technology infrastructure has been a point of contention, especially after the operational meltdown in late 2022. The airline has since invested hundreds of million to address these issues, including the lack of crew scheduling software and bag tracking capabilities. The Department of Transportation (DoT) and Congress have criticized the company for these shortcomings. However, Southwest is making progress in narrowing the technological gap, which should enhance its operational efficiency.

Unlike many of its competitors, Southwest does not sell tickets through booking sites like Expedia, opting instead to sell exclusively through its website. This approach could represent a significant opportunity to expand its customer base and increase revenue by tapping into broader distribution channels.

Ancillary Revenue Opportunities

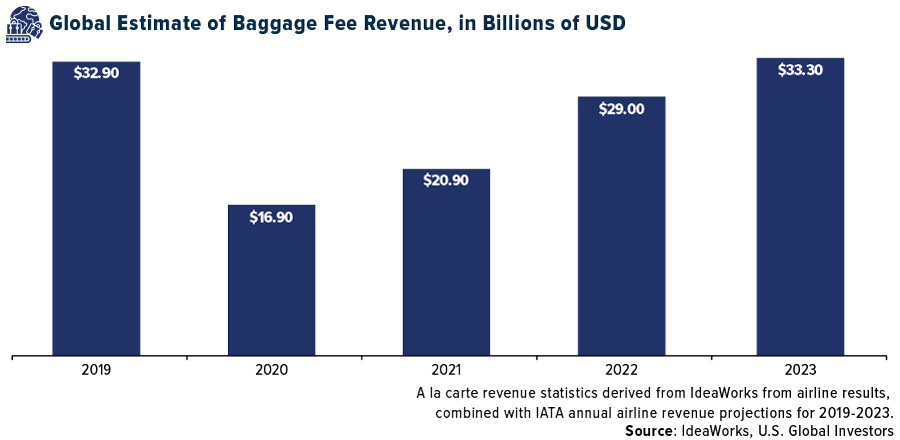

Southwest has traditionally resisted implementing fees for seat assignments and checked bags, which sets it apart from other carriers. However, introducing these fees could generate significant ancillary revenue, similar to what other airlines use to offset higher pilot salaries. Additionally, instituting change and cancellation fees could further enhance Southwest’s financial performance.

The airline industry has seen a shift towards ancillary revenues, including baggage fees, seat assignment fees, and commissions from hotel bookings. Global baggage fees alone were estimated at $33.3 billion in 2023. Introducing such fees at Southwest could align the airline with industry practices and potentially enhance its financial performance.

Why Now May Be the Time to Consider JETS

We believe that Elliott’s involvement could serve as a catalyst for positive change at Southwest Airlines. We acknowledge that the airline has some outdated operational procedures, which contributed to massive cancellations in late 2022.

However, with the right strategic adjustments, Southwest has the potential to significantly improve its operational efficiency and financial performance.

For investors considering exposure to the airline industry, now might be an opportune time to participate in the industry. Southwest’s anticipated strong revenue for the summer, coupled with potential strategic reforms by Elliott, could lead to a substantial upside. We believe our U.S. Global Jets ETF (NYSE: JETS) remains well-positioned to capture these developments, offering diversified exposure to the airline sector.

Elliott’s nearly $2 billion stake in Southwest represents a significant vote of confidence in the airline’s potential. While Southwest faces challenges, Elliott’s involvement could drive the necessary changes to unlock shareholder value. As always, we remain vigilant and optimistic about the opportunities within the airline industry, ready to adapt and capitalize on emerging trends.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.