Over the past 12 months, global container shipping rates have steadily declined to their long-term averages as supply chain snarls have receded and backups at ports have disappeared.

Now, another segment of the cargo shipping industry is seeing day rates explode to record highs.

So-called dirty tankers, those that carry crude oil, are charging over $100,000 a day for their services as international sanctions against Russia force ships to take longer, more circuitous routes. Carriers that once made deliveries to the North Sea port of Rotterdam via the Baltic Sea are now having to sail to China, India and Turkey, which are twice or three times the distance. All three Asian countries have said they will continue to buy Russian oil.

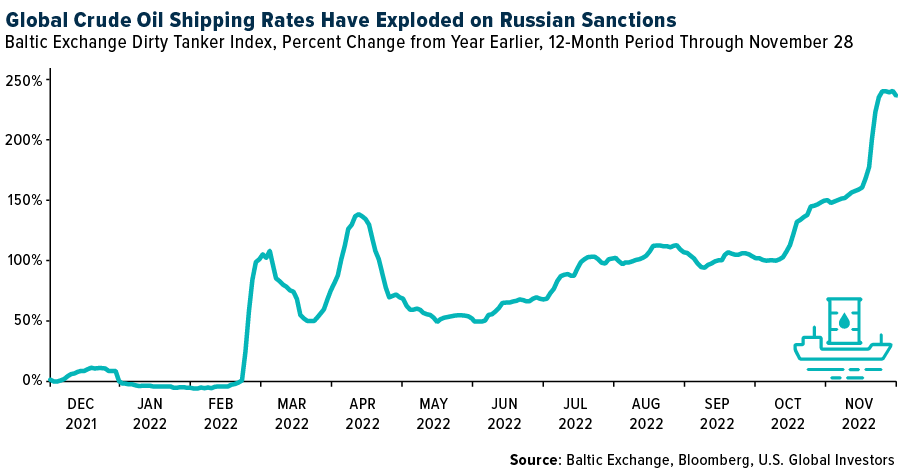

The Baltic Exchange Dirty Tanker Index, which measures shipping rates on 12 international routes, rose as much as 243% for the 12-month period through the end of November.

So how high could rates go? According to Omar Nokta, a shipping analyst at Jefferies, they could potentially climb to between $150,000 and $200,000 a day.

We’re almost there now. The day rate to ship oil from the Black Sea to the Mediterranean hit an astronomical $145,000 a day during the week ended November 18, according to Compass Maritime.

Russia Oil Turmoil to Drive Tanker Market Higher

This week, the 27 countries of the European Union (EU) officially banned crude imports from Russia, the world’s number two producer, and on February 5, 2023, all Russian oil products will be banned. This will have the effect of disrupting global trade routes further, driving up rates even more.

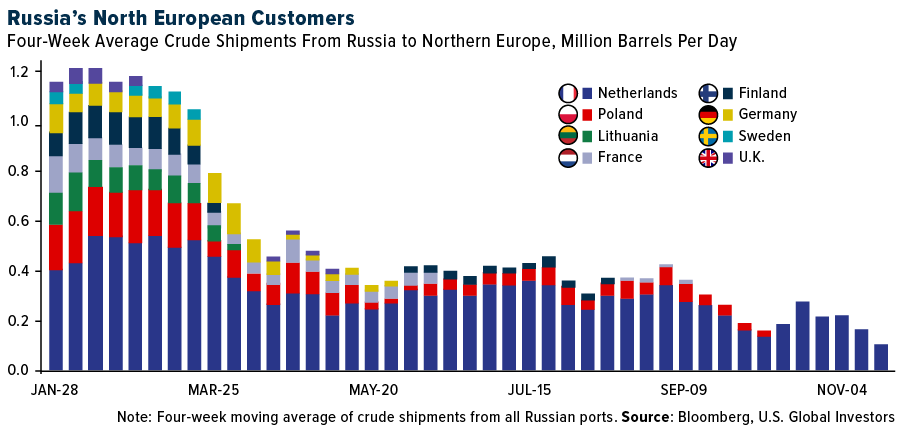

As you can see below, Europe’s imports of Russian oil were already down dramatically from the beginning of 2022, when the country invaded Ukraine. Before the ban, the Netherlands was the only remaining European destination for deliveries outside of the Mediterranean and Black Sea basin. To help offset the loss of Russian supply, Norway will ship a record volume of North Sea oil in January, Bloomberg reports.

Due to changes in shipping routes, demand for oil tankers is expected to surge to levels not seen in three decades, according to Clarkson Research. The U.K.-based group is forecasting that the number of ton-miles, defined as one ton of freight shipped one mile, could increase 9.5% next year. That would mark the largest annual increase since 1993.

Oil Tankers Generating Record Revenues, Stocks Hitting New Highs

Also supporting rates is the fact that oil carriers are replacing vessels at a historically low pace.

In July, Clarksons reported that new shipbuilding orders for container vessels had surpassed those for tankers for the first time ever. Whereas the global orderbook for containerships stood at 72.5 million deadweight tonnage (dwt)—a measure for how much weight a ship can carry—the orderbook for crude oil and oil product tankers was 34 million dwt, a new record low.

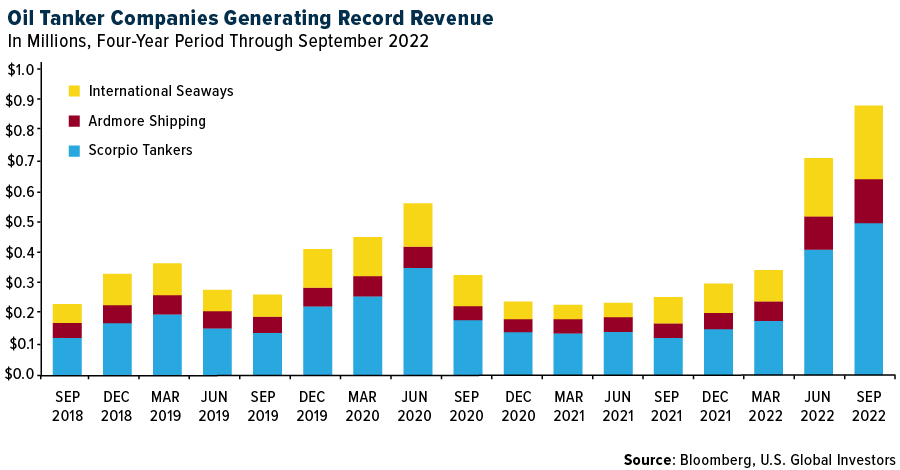

This has contributed to massive revenues and net income, which should keep carriers in a strong position even as container rates have dried up. Last week, Mitsui O.S.K. Lines president Takeshi Hashimoto told JPMorgan analysts that he believes profits will remain strong due to the company’s liquified natural gas (LNG) business as well as dry bulkers and tankers.

Frontline, the fourth largest oil tanker company, just reported net income of $154.4 million in the third quarter, compared to $108.5 million estimated.

Below you can see how revenues have surged for companies such as International Seaways, Ardmore Shipping and Scorpio Tankers.

With the S&P 500 still down more than 14% for the year, shares of a number of oil tankers have hit new all-time highs in recent days. Among those are Ardmore, International Seaways and Euronav. Teekay Tankers was up 226% year-to-date, while Scorpio was up 323% over the same period.

Will these returns continue? We can’t say, of course, but the structural support doesn’t appear to be going away anytime soon.

Looking to get exposure? Our U.S. Global Sea to Sky Cargo ETF (NYSE: SEA) gives investors access to global companies involved in the air freight and seaborne shipping industries, of which oil tankers are a member.

To see the full list of holdings in SEA, click here.

Explore and discover the Sea to Sky Cargo ETF (SEA) today by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for SEA by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns, and share price may be more volatile than those of a less concentrated portfolio. Cargo Companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

The Baltic Dirty Tanker Index is made up from 12 routes taken from the Baltic International Tanker Routes. The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to SEA.