The Suez Canal has long been a critical artery, facilitating the movement of goods between the East and the West. However, recent Houthi rebel attacks on vessels trying to cross the channel have forced shipping companies to reroute their journeys, opting for the longer, more costly path around Africa’s Cape of Good Hope.

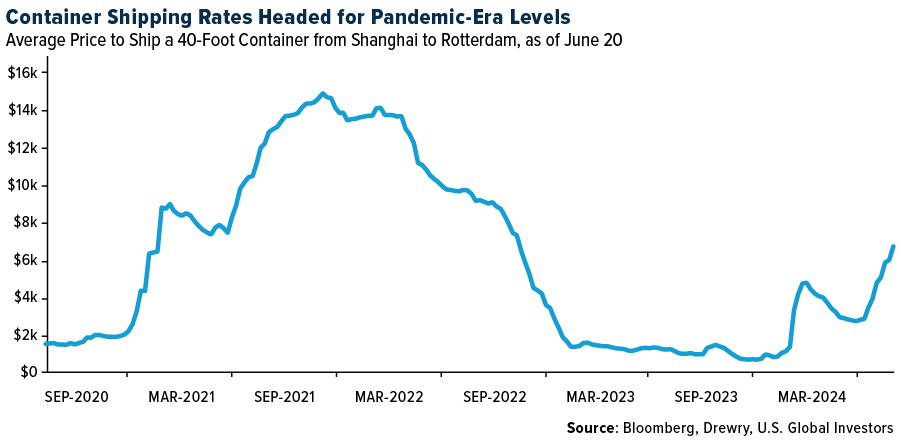

Since October, we’ve witnessed a dramatic increase in the cost of shipping. Moving a 40-foot container from China to Europe now costs approximately $7,000, a steep rise from the pre-crisis average of $1,200. Similar spikes are seen in trans-Pacific routes.

These increases might seem worrisome, but they also signify a potentially profitable environment for shipping companies that must navigate these troubled waters.

How Port Congestion and High Demand Are Shipping the Market

The extended route around the Cape of Good Hope is becoming a new norm. This diversion, coupled with port congestion and strong demand for goods—particularly in the U.S.—has tightened the supply chain, creating a more favorable pricing environment for shipping companies.

Constrained supply has naturally driven up shipping rates. Companies like Maersk have responded by raising their earnings forecasts, potentially indicating a more profitable year ahead.

We believe there’s an opportunity for investors to capitalize on these higher earnings. Shipping companies are benefiting from higher freight rates and increased demand, translating into potentially higher returns.

Investing in SEA

For those seeking to act on this opportunity, we’re proud to offer a practical solution through our U.S. Global Sea to Sky Cargo ETF (NYSE: SEA), which provides diversified access to the global sea shipping and air freight industries, tracking the performance of the U.S. Global Sea to Sky Index (SEAX).

The SEA ETF employs a smart beta 2.0 strategy, helping it capture the most efficient and profitable marine shipping, air freight, courier and port and harbor companies worldwide. These companies have shown a favorable ability to increase prices—a key driver of revenue growth in today’s market.

The tools in place within the shipping industry, such as fleet idling, ship scrapping and reducing ship speeds, prevent large increases in capacity. As demand continues to outpace supply, shipping companies are in a strong position to maintain or even raise their prices, benefiting from the constrained market.

How SEA Provides Market Exposure

In times of geopolitical instability, the shipping industry has historically proven resilient, adapting to new routes and challenges while maintaining its critical role in global trade. By investing in SEA, you gain exposure to a fundamental aspect of the global economy that we believe is poised for growth amid the current uncertainties.

While the situation in the Suez Canal presents significant challenges, it also offers substantial opportunities for those who understand the market dynamics and are prepared to act. The SEA ETF is a strategic investment that can provide you with the exposure needed to benefit from the current shipping industry trends.

Stay informed, and stay invested!

Please click here to see the SEA prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Cargo companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, regional ETFs’ returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS, GOAU and SEA.

Smart-beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization-based indices. The U.S. Global Sea to Sky Cargo Index is a 29-stock index that seeks to provide diversified access to the global sea shipping and air freight industries. The index uses various fundamental screens to determine the most efficient sea shipping, air freight and port companies in the world. The index consists of common stocks listed on developed and emerging market exchanges across the globe.

The World Container Index assessed by Drewry reports actual spot container freight rates for major East-West trade routes, consisting of 8 route-specific indices representing individual shipping routes and a composite index.