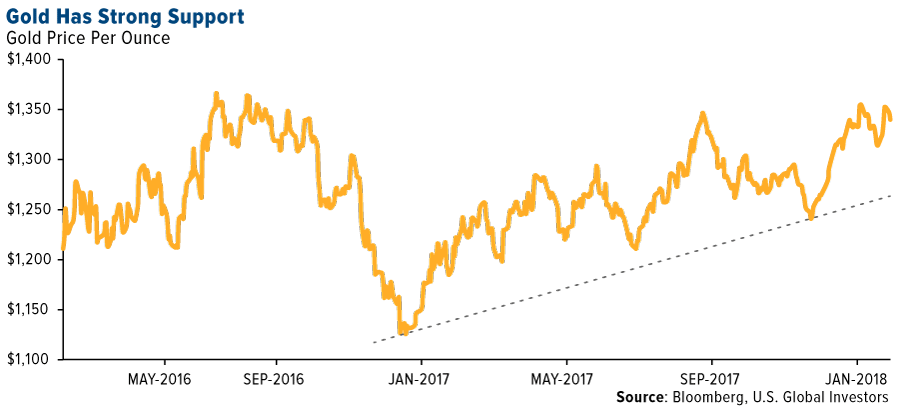

Since its recent high of $1,370 an ounce at the end of January, the price of gold has shaved off about $40 as Treasury yields continue to head north. The yield on the benchmark 10-year T-note is looking to cross above 3 percent, which would be the first time since early January 2014. This is a short-term headwind for the yellow metal that could reverse if inflation continues to rise more than expected, as it did in January. The consumer price index (CPI) increased 0.5 percent from the previous month, against forecasts of 0.3 percent.

Looking more long-term, there are mounting risks involving debt that make gold appear very attractive right now as a perceived safe haven and portfolio diversifier.

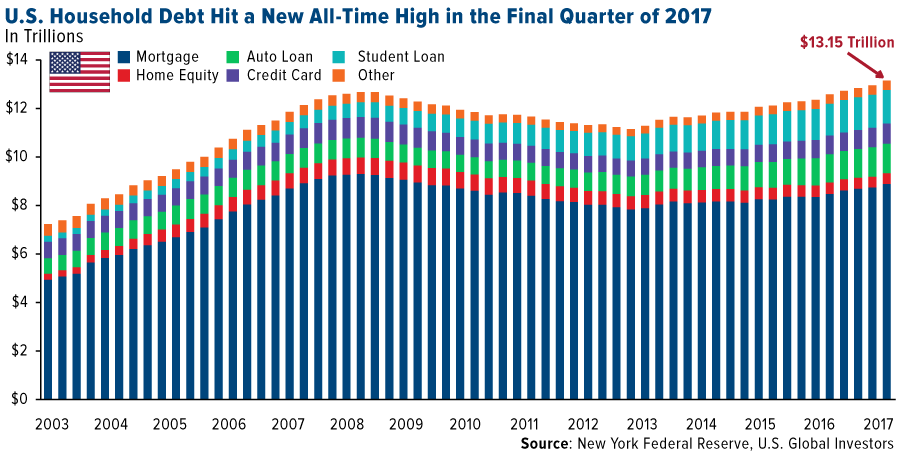

A new report from the Federal Reserve Bank of New York indicates that U.S. household debt rose to a fresh all-time high in the last quarter of 2017. American families now owe a jaw-dropping $13.15 trillion, or roughly $40,000 per man, woman, and child. That’s up 1.5 percent, or $193 billion, from the previous quarter, and up 8.5 percent from the high during the financial crisis.

Thirteen trillion is a head-spinning sum, but we can’t place all the blame on borrowers. For nearly a decade now, the Fed has kept interest rates at historically low levels, flooding the economy with cheap money.

The good news is the rate of delinquency for all debt has fallen to pre-recession levels.

But there’s one area that’s worsened since then—student debt, which now stands at nearly $1.4 trillion, the largest type of lending second only to mortgages. At the start of this year, about 11 percent of student debt was considered delinquent, or more than 90 days past due.

A Global Credit Binge

Americans aren’t the only ones loading up on debt, though.

Last month, the Institute of International Finance (IIF) reported that global debt rose to a record $233 trillion in the third quarter, up $16 trillion in only nine months. As much as $44 trillion is owed by households alone. And in some countries—most notably Switzerland, Australia, Norway, and Canada—the amount of debt families have on their balance sheets is now greater than what Americans owed soon before the housing bubble.

All of this news follows an October 2017 report from the International Monetary Fund (IMF) warning that leveraging in G-20 nonfinancial sectors—governments, nonfinancial companies, and households—had exceeded pre-crisis levels, presenting “rising financial vulnerabilities.”

Combined with overstretched asset valuations, these debt loads “could undermine market confidence in the future, with repercussions that could put global growth at risk,” the IMF writes.

Time to Add to Your Gold Exposure?

We view this growing debt bomb as just the latest sign that investors might want to consider adding to their gold exposure. The yellow metal has been sought as a perceived safe haven during times of economic and systemic market risk, and we frequently recommend a 10 percent weighting, with 5 percent in gold bullion or jewelry and the other 5 percent in high-quality gold stocks, mutual funds, and ETFs.

Since the Fed raised rates in December, the price of gold has been trending up, as it did in the previous two years following December rate hikes. A declining U.S. dollar continues to support the metal, which has consistently been hitting higher highs and higher lows for the past 12 months.

The greenback is expected to remain lower for longer, with CLSA, a brokerage and investment group, writing in a note to investors last Tuesday that it “is a casualty of strong risk appetite that has characterized financial markets since the start of the year.”

As for the monumental debt load, we can’t say when or whether it might burst. All we can say with certainty is that the bigger it gets, the greater the risk it presents. This, in turn, underscores the need for an asset that may not be as strongly affected by rising debt, such as gold.

Curious to learn more about why now might be a good time to consider investing in gold? Check out these 10 Charts That Show Why We Believe Gold is Undervalued Right Now.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.