Gold prices surged to an all-time high of $2,950 per ounce on Monday, February 24, pushing its market cap above $20 trillion, as tensions between the U.S. and its trading partners have stoked fears of a global economic slowdown. And while safe-haven demand is certainly a driver, there’s another potential catalyst that could send prices soaring even higher: the revaluation of America’s gold reserves.

As many readers are aware, the U.S. holds the most gold of any country on earth by far, with reserves totaling 8,133 metric tons. But what’s less well-known is that the stockpile’s value has remained at just $42 per ounce since 1973, putting its total value at around $11 billion.

Let’s say we were to revalue those reserves at today’s price of around $2,900, which some people are in favor of. The total value, then, would jump to a staggering $760 billion, creating a windfall of $749 billion. This could provide the government with options to sell a portion of its gold or enhance its balance sheet by reducing debt.

Verifying the Gold at Fort Knox

Before any revaluation can occur, though, it’s probably best to verify that the gold reserves actually exist—a concern that’s lingered for decades.

The U.S. Bullion Depository at Fort Knox, which houses the bulk of the nation’s gold, has only opened its doors to non-authorized personnel three times in history: 1) in 1943 for President Franklin D. Roosevelt, 2) in 1974 for a small group of Congress members and 3) in 2017 for a delegation including Senator Mitch McConnell and then-Treasury Secretary Steven Mnuchin.

Elon Musk has announced plans to conduct an in-person audit of Fort Knox’s gold reserves on behalf of his cost-cutting operation, the Department of Government Efficiency, or DOGE. If the audit confirms the reserves, it could boost confidence in the U.S. government’s finances. Conversely, if discrepancies are found, it could send shockwaves through global markets, adding further momentum to gold prices.

Central Bank Buying and Global Market Trends

Central banks have been on a gold buying spree, having snapped up over 1,000 tons of the metal for the third consecutive year in 2024, according to the World Gold Council (WGC). The National Bank of Poland (NBP) led the pack, adding 90 tons to its reserves, while the People’s Bank of China (PBoC) announced a fresh purchase of 5 tons to start 2025, bringing its total holdings to 2,285 tons.

Central banks are widely recognized as influential players in the gold market, and their sustained accumulation of gold reflects a broader strategy to diversify reserves and hedge against their very own policies. What’s more, this buying activity supports prices, creating a favorable backdrop for gold as an investment.

Positioned for Growth

The high gold price environment has allowed gold mining companies to expand operations, prioritize sustainability initiatives and attract investor interest. Bank of America estimates that companies under its coverage could generate around $3 billion in free cash flow (FCF) in the fourth quarter of 2024, with even more expected this year.

However, rising costs present a challenge. The average All-In Sustaining Cost (AISC) for gold miners hit a record $1,456 per ounce in the third quarter of 2024, driven by higher labor costs and maintenance expenses.

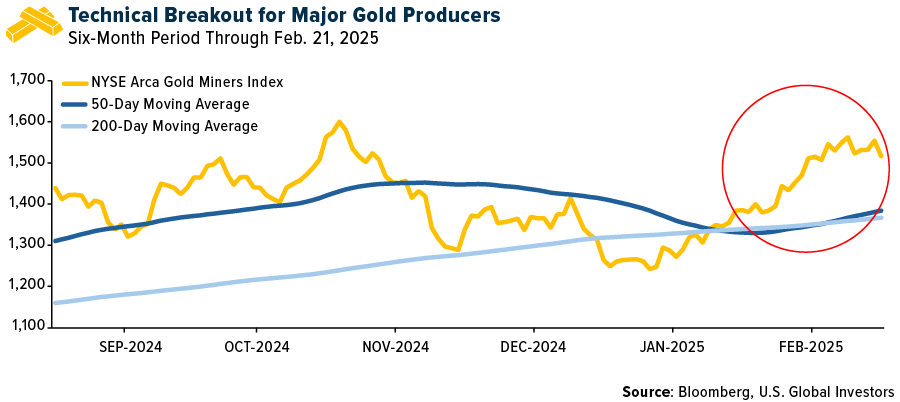

Despite these pressures, many miners remain highly undervalued, making them attractive to value investors, we believe. The NYSE Arca Gold Miners Index, which tracks major gold producers, recently made a technical breakout, with the 50-day moving average crossing above the 200-day moving average.

Getting Exposure with GOAU

For investors looking to participate in the upside potential of gold and gold miners, we believe the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) provides an attractive option. Unlike traditional gold mining ETFs that focus solely on producers, GOAU employs a smart beta 2.0 strategy, dynamically selecting companies engaged in both active mining and passive royalty or streaming agreements.

Royalty and streaming companies, which receive a percentage of mine production in exchange for upfront capital, have historically demonstrated higher margins, lower risk and stronger cash flow generation than traditional miners. This puts GOAU in a position to capture both the profitability of gold production and the financial discipline of royalty firms.

GOAU is rebalanced and reconstituted quarterly to ensure holdings reflect the most fundamentally sound companies in the sector. With its focus on high-quality, well-managed firms with strong balance sheets, GOAU provides investors with targeted exposure to gold while lowering some of the volatility associated with traditional mining stocks.

As gold prices remain elevated and central banks continue their historic accumulation of the metal, we believe the current environment is highly favorable for gold-focused investments. Learn more about GOAU and how it fits into a diversified investment strategy by visiting www.usglobaletfs.com.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus by visiting www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Because the fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The fund is non-diversified, meaning it may concentrate more of its assets in a smaller number of issuers than a diversified fund.

The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The fund may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the fund may diverge from that of the index. Because the fund may employ a representative sampling strategy and may also invest in securities that are not included in the index, the fund may experience tracking error to a greater extent than a fund that seeks to replicate an index.

The fund is not actively managed and may be affected by a general decline in market segments related to the index. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Past performance does not guarantee future results.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.

Smart beta 2.0 combines the benefits of passive investing and the advantages of active investing strategies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver.