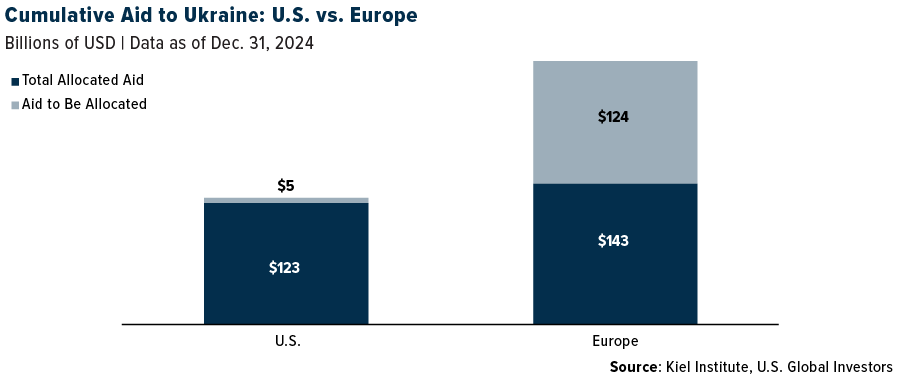

The U.S. has poured more than $120 billion into Ukraine since its war with Russia began three years ago, but with a new administration in Washington, that support is grinding to a halt.

The White House announced recently that further military aid will be paused until President Donald Trump can determine that Ukrainian President Volodymyr Zelenskyy is making a “good faith” effort toward peace negotiations with Russia.

This decision has left Ukraine in a precarious position. Without additional U.S. support, Western officials estimate that the Eastern European country has enough weaponry to sustain its current pace of fighting until mid-2025.

In response, European leaders are taking decisive action, launching an unprecedented military spending spree that is already reshaping global markets.

Germany Takes the Lead in Ramping Up Military Spending

Germany, Europe’s largest economy, is leading the charge, with Chancellor-in-waiting Friedrich Merz vowing that his government will do “whatever it takes” to support Ukraine. He’s even pledged to amend the German constitution to exempt defense spending from the country’s strict fiscal constraints.

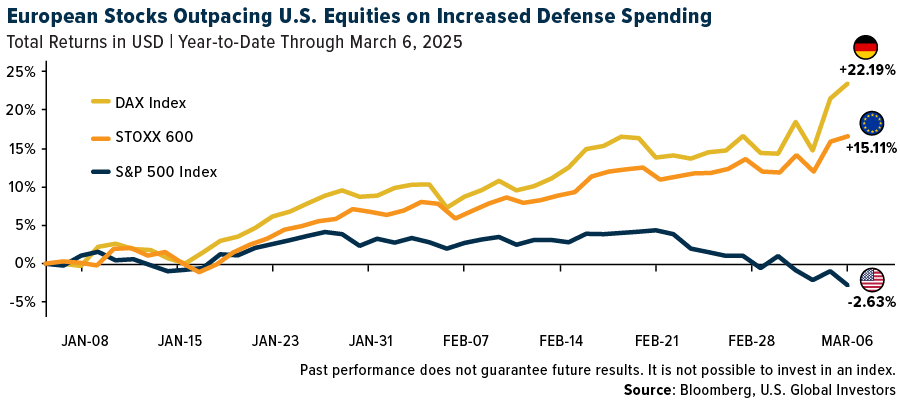

The markets have responded positively, with German equities rallying. The DAX Index was up more than 22% year-to-date through March 6, compared to a loss of over 2% for the S&P 500.

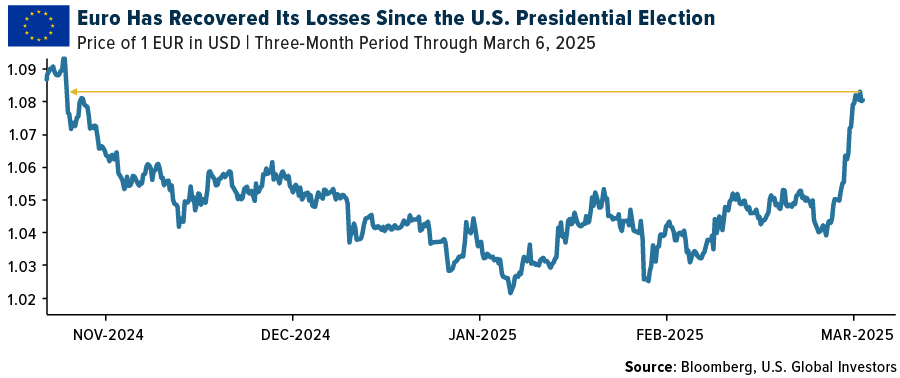

The euro has also rebounded from recent lows, erasing its losses since November’s U.S. presidential election.

EU Unveils $840 Billion Plan to Strengthen Defense

Other European nations are making similar moves. France’s President Emmanuel Macron delivered a stark warning in a televised address, declaring that Europe must be prepared to defend Ukraine without U.S. support. He made it clear that abandoning Ukraine now would only embolden Moscow, stating, “Russia has become, and will remain, a threat to France and Europe.”

The Czech government, meanwhile, has announced plans to raise its defense budget to 3% of its gross domestic product (GDP) by 2030, up from its current 2%. Brussels has responded with an unprecedented $840 billion plan to boost military readiness across the continent.

The bulk of this money will reportedly come from direct national spending, as European Union (EU) leaders have agreed to temporarily lift fiscal rules that limit government deficits. Additional funds will be made available in the form of loans to governments looking to modernize their defense industries.

An analysis by European research firms Bruegel and Kiel estimates that for Europe to establish a truly independent military deterrent against Russia, it will require at least 250 billion euros ($272 billion) in annual defense spending. That means deploying tens of thousands of additional soldiers, acquiring thousands of new tanks and infantry fighting vehicles and ramping up production of long-range drones and other advanced military technologies.

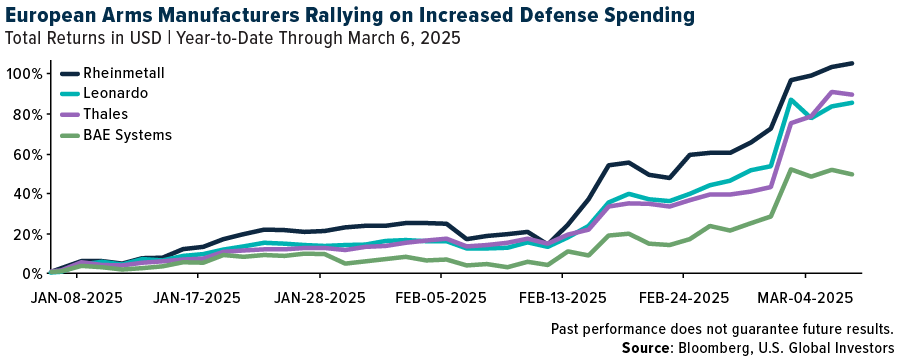

European Arms Manufacturers See Record Gains

This wave of spending has fueled a blistering rally in European defense stocks as investors bet on long-term demand for military hardware.

Defense companies have been among the best-performing stocks in global markets this year. As of March 6, Italy’s Leonardo and France’s Thales have seen their shares jump 85%, while Britain’s BAE Systems has climbed close to 50%. Germany’s Rheinmetall, a leading supplier of armored vehicles and artillery systems, has more than doubled in value.

To see the top 10 holdings in the U.S. Global Technology and Aerospace & Defense ETF (WAR), click here.

China Expands Defense Budget as Pacific Tensions Rise

The arms race is not confined to the West. China has announced a 7.2% increase in military spending this year as it continues its efforts to expand its influence in the Pacific.

Taiwan is under increasing pressure to boost its defense budget to deter a potential invasion from Beijing. Japan, too, has been urged to increase its military spending, though its leaders insist they will not allow foreign governments to dictate their defense budget.

Investing in the Future of Defense and Technology

With global defense spending surging in response to heightened geopolitical risks, investors are looking for ways to gain exposure.

We believe the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR) offers an attractive opportunity to invest in the companies driving innovation in military technology, cybersecurity, semiconductors and aerospace defense.

WAR provides diversified exposure to key industries shaping modern defense strategies, from advanced fighter jets and missile systems to AI-powered cybersecurity and high-performance data centers. The ETF takes a smart beta 2.0 approach, combining quantitative metrics with fundamental research to identify companies positioned to benefit from rising defense budgets and increasing global security demands.

Key Features of the WAR ETF:

- Global Diversification: Invests in leading companies across the U.S., Europe and Asia, reflecting the interconnected nature of modern defense and technology supply chains.

- Sector Rotation Strategy: Adjusts allocations based on geopolitical developments and emerging industry trends, ensuring exposure to the most relevant opportunities.

- Smart Beta 2.0 Methodology: Uses profitability, volatility and liquidity metrics to identify companies with strong growth potential in the defense and technology sectors.

- Exposure to Critical Industries: Focuses on aerospace & defense (30%), cybersecurity (28%), semiconductors (27%), and data centers (12%)—industries experiencing record demand amid rising global tensions.

As European nations ramp up military spending and the arms race extends into the Pacific, the need for advanced military technology and cybersecurity has never been greater. For investors seeking exposure to this growth, we believe WAR offers a strategic entry point into the industries shaping the future of defense and global security.

To learn more about the WAR ETF, click here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus at www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk including the possible loss of principal.

The Fund is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

The Fund’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. The STOXX Europe 600 is a broad measure of the European equity market. The S&P 500 is a market-capitalization-weighted stock market index that tracks the stock performance of about 500 of some of the largest U.S. public companies.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment advisor to WAR.