Shares of global airline stocks advanced more than 12% during the week ended January 13 indicating that investors were unfazed by the service outage that temporarily grounded planes in the U.S. United Airlines was the best performer for the week, up 22%, followed by American Airlines (20%) and Frontier Airlines (17%).

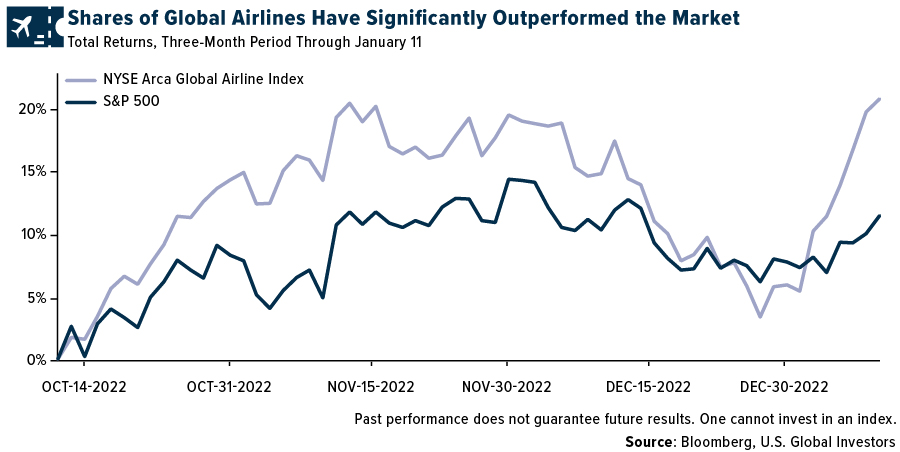

For the one-month, three-month and six-month periods, a basket of global airline stocks has significantly outperformed the market. Since the middle of October, the NYSE Arca Global Airline Index has soared over 22% compared to the S&P 500, which has gained 11%.

Much of the recent increase has been driven by China’s decision to lift quarantining requirements for incoming travelers for the first time since the start of the pandemic. Airline bookings in China have exploded as a result.

But regional air travel demand was expanding even before China’s announcement. The Association of Asia Pacific Airlines (AAPA) reported that 13.4 million international passengers were carried by Asian airlines in November 2022, a phenomenal 663% increase from the same month a year earlier. Based on revenue passenger kilometers (RPKs), demand rose nearly 500% in the 12-month period through the end of November.

There are other drivers to the stock rally, though.

Optimism for Airline Earnings

It’s earnings season, and so far, only Delta Air Lines has reported fourth-quarter and full-year profits. Although profits were dented somewhat from higher expenses and debt-servicing, the Atlanta-based carrier made great progress toward reaching and surpassing 2019 levels. In the fourth quarter, net income was $828 million, still 25% away from the $1.1 billion that was generated three years earlier. However, operating cash flow came in at $1.2 billion for the quarter, $220 million more than was reported for the period in 2019.

It was American’s recent statement that really excited investors. The carrier said that its fourth-quarter profit will be double analyst expectations, and revenue will also beat, thanks to a strong holiday travel season. Preliminary filings show that fourth-quarter revenues were as much as 17% over those generated during the year-ago period, against expectation of a 12% increase.

U.S. Airlines Investing Record Amounts

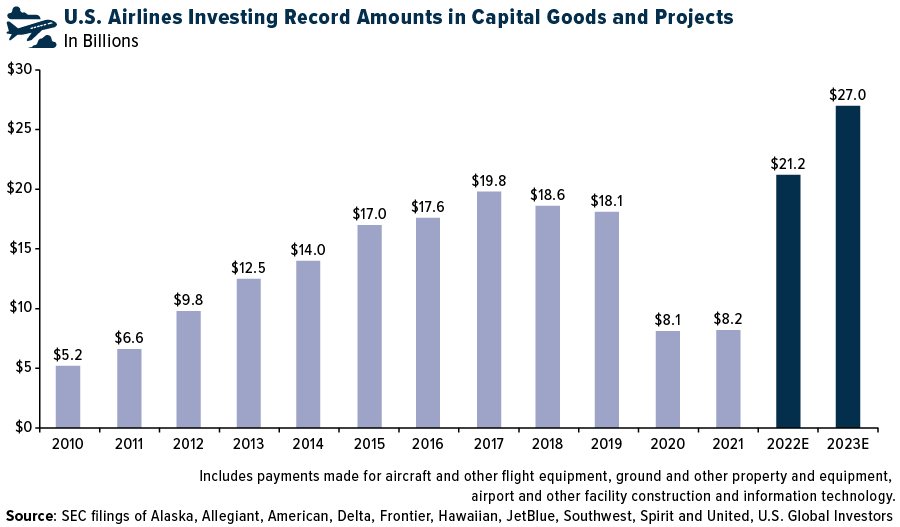

We like to see when a company invests in itself, whether that means building a new facility or putting in new orders. It tells me executives are optimistic about the future and are positioning the company for growth.

We’re seeing airlines do just that right now. According to Airlines for America (A4A), U.S. carriers are investing a record amount on things such as aircraft, equipment, airport construction, information technology and more. In 2022, capital expenditures were estimated at $21.2 billion; this year, they’re forecast to hit $27.0 billion, which would be a record.

Both Airbus and Boeing reported strong delivery and new orders numbers for 2022. Since the tragic events involving Boeing’s 737 MAX in 2019, the Arlington-based company has been playing catchup to its main rival, and for the fourth straight year, Airbus topped its U.S. competitor. Airbus delivered 661 jets and won a net 820 new orders last year, against Boeing’s 480 jets delivered and 774 net new orders.

United Airlines was responsible for putting in one of the largest orders I’ve ever seen. In the “largest widebody order by a U.S. carrier in commercial aviation history,” the company announced in December that it ordered 100 Boeing 787 Dreamliners with an option to purchase 100 more. What’s more, United says it continues to its “unprecedented effort to upgrade the interiors of its existing fleet.”

Will Business Travel Recover in 2023? Morgan Stanley Believes So

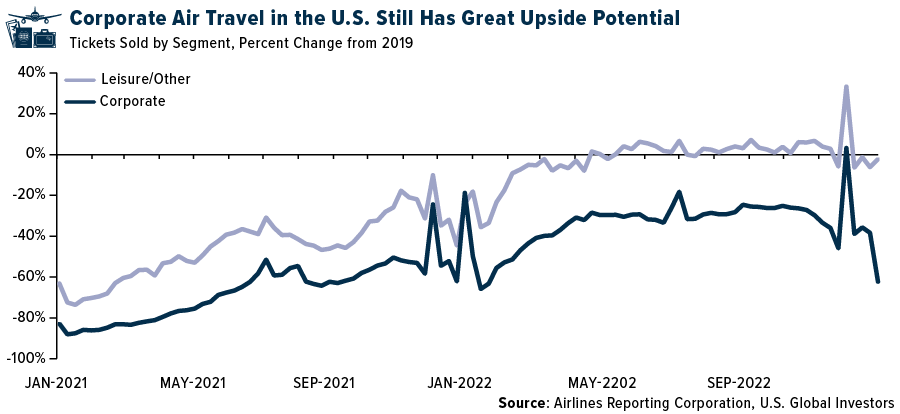

What a lot of investors are waiting for, we believe, is a sign that business travel has fully bounced back. According to data from ticket transactions settlement firm Airlines Reporting Corporation (ARC), leisure travel has safely returned to 2019 levels, whereas business travel continues to trail. Of course, that may just means there’s great upside potential.

A recent report from Morgan Stanley suggests businesses are ready to start spending on corporate travel again. Based on a survey of 100 global corporate travel managers, travel budgets are expected to be 98% of 2019 levels on average. Smaller companies are leading demand, Morgan Stanley says, with nearly two-thirds of them saying they believe travel budgets will increase this year compared to 2022.

To see the full list of holdings in the U.S. Global Jets ETF (JETS), click here.

To download a copy of the JETS prospectus, fact sheet and investment case, click here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

The NYSE Arca Global Airlines Index is a modified equal-dollar weighted Index designed to measure the performance of highly capitalized and liquid U.S. and international passenger airline companies identified as being in the airline industry and listed on developed and emerging global market exchanges. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.