On November 18, Spirit Airlines filed for bankruptcy protection. Two days later, the company was removed from the U.S. Global Jets Index (JETSX), and its weighting was distributed proportionally among the index’s remaining constituents.

Filing for Chapter 11 is occasionally a necessary step for a company to position itself for long-term success. But make no mistake—this situation could have been avoided if not for what we believe were misguided policies from the Biden administration’s Department of Justice (DOJ).

Let’s unpack what happened and why we still consider the airline industry a healthy and profitable investment.

Spirit Airlines’ Bankruptcy in Context

For consumers, the low-cost carrier (LCC) will continue to operate as usual. Flights will not be affected, and tickets will be honored.

This isn’t the first time an airline has used Chapter 11 to reset its financial footing. Major carriers such as American and Delta have emerged from similar processes stronger than ever. At this moment, there’s no reason to believe that things will be any different for Spirit, which maintains a nationally recognized brand and a loyal customer base.

The DOJ’s Role in Spirit’s Struggles

It’s clear to us that Spirit’s troubles are closely tied to actions taken by the Biden administration’s DOJ, which blocked the carrier’s proposed $3.8 billion merger with low-cost rival JetBlue earlier this year.

The merger, announced in 2022, could have provided Spirit with the capital and scale it needed to thrive in today’s complex marketplace. Many critics of the DOJ’s antitrust action have argued that blocking the deal ultimately hurt, rather than protected, travelers by stifling Spirit’s ability to offer low-cost options to consumers.

In short, this incident highlights the unintended consequences of government intervention. Blocking the Spirit-JetBlue merger may have scored political points, but it deprived the market of competition.

Airline Industry Resilience

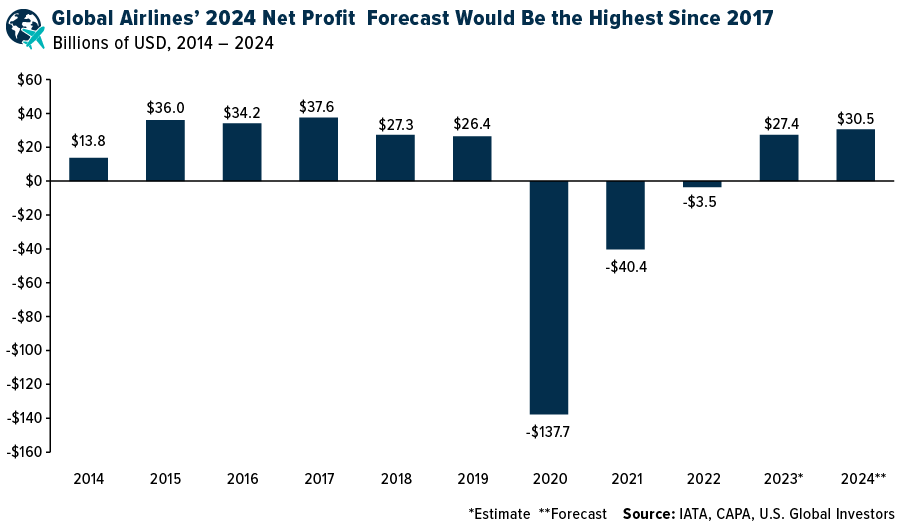

Despite Spirit’s filing, the airline industry as a whole remains on a strong growth trajectory. The International Air Transport Association (IATA) projects the global industry’s net profits to reach $30.5 billion this year, which would be the highest since 2017.

If you’ve been to the airport lately, you know that flight demand continues to soar. Airlines for America (A4A), the chief aviation trade group, projects that over 31 million travelers will take to the skies this Thanksgiving season, a potential 5% increase from last year.

Spirit’s bankruptcy, then, doesn’t appear to signal systemic economic or commercial aviation weaknesses. Instead, it reflects one carrier’s need to reset and adapt, and history has shown that airlines can emerge from restructuring stronger and more competitive than they were before.

How the U.S. Global Jets ETF (JETS) Can Help Mitigate Risk

For investors, it’s important to look beyond the headlines and focus on the broader industry outlook. The U.S. Global Jets ETF (NYSE: JETS) is designed to help investors simplify the complexities of the airline industry.

JETS tracks a wide range of companies, including not just airlines but also aircraft manufacturers, airport service providers and online travel booking companies. This reduces exposure to any single carrier like Spirit. The ETF employs a smart-beta 2.0 approach, emphasizing the most efficient and profitable carriers to adapt to industry changes.

At U.S. Global Investors, we believe in the long-term growth story of airlines. With rising passenger volumes, expanding global connectivity and a diversified approach through JETS, investors are invited to explore how this vital and dynamic industry can fit in their portfolios.

Learn more about JETS by clicking here.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.

Smart beta is a rules-based approach to investing that seeks to capture specific factors, like value or quality, while preserving the benefits of traditional indexed investments.

The U.S. Global Jets Index seeks to provide access to the global airline industry. The index uses various fundamental screens to determine the most efficient airline companies in the world, and also provides diversification through exposure to global aircraft manufacturers and airport companies. The index consists of common stocks listed on well-developed exchanges across the globe. It is not possible to invest directly in an index.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.