Thousands of dockworkers, represented by the International Longshoremen’s Association (ILA), went on strike this week, bringing a halt to around half of all U.S. ocean freight. U.S. Oxford Economics estimates the damage could cost the U.S. economy between $4.5 billion and $7.5 billion each week the strike lasts.

You may be asking: How could this be a good thing for investors? In short, disruption creates volatility, and volatility can create opportunity. Just as we saw during the pandemic and, more recently, with the Houthi attacks on container ships in the Red Sea, supply chain disruptions lead to higher freight rates. And for the well-positioned investor, this could spell potential gains.

Rising Freight Prices Could Boost Shipping Revenues

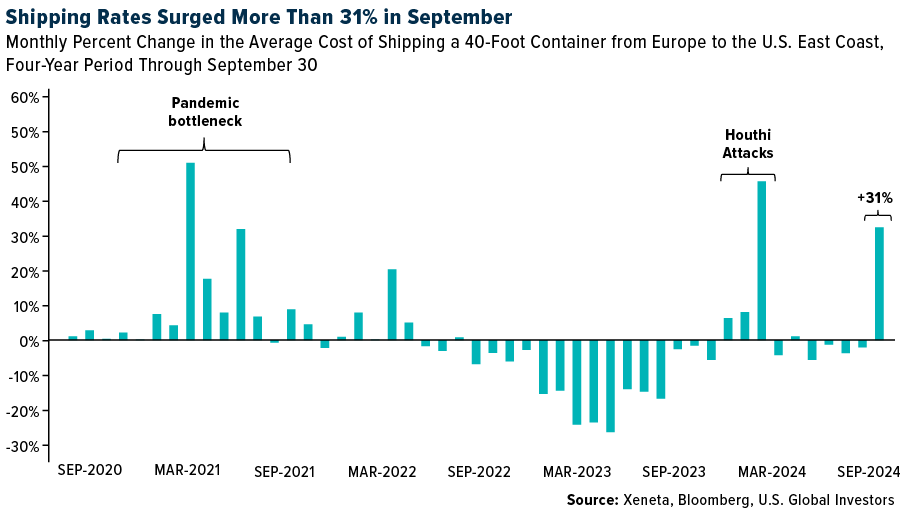

The key is the surge in freight rates. In September alone, the average cost of shipping a 40-foot container from Europe to the U.S. East Coast jumped over 31%, according to data provider Xeneta. And that’s before any strike even started.

Ship operators were prepared for the announcement, with companies like Maersk announcing a $1,500 surcharge per 20-foot container and double that per 40-foot container. In the past, when freight rates have risen, companies involved in the shipping industry have often seen a boost in revenue.

Is the Strike a Buy Event?

The port worker strike, at 36 hubs across the East Coast, is expected to further tighten an already stressed supply chain. The last time we saw significant labor disruptions in U.S. ports was about a decade ago on the West Coast, and we know the toll it took on businesses, from manufacturing to retail. The ILA, which represents East Coast workers, last hit the picket line almost 50 years ago, in 1977.

But here’s the rub: Just like during the pandemic when shipping costs soared, the companies that provide the backbone for global trade—shipping and air freight companies—stand to benefit from the volatility. This is why we believe the strike could actually be a buy event for investors looking to get ahead of the curve.

“Shippers have diverted freight to the U.S. West Coast ahead of a potential strike by port workers,” Bloomberg Intelligence analyst Lee Klaskow wrote in a note dated October 1. “This could provide support for container rates, which have been falling from July peaks.”

Shipping Companies See Revenue Growth Amid Supply Chain Strain

Let’s take a step back and look at what happened during the pandemic. When the global supply chain was disrupted, freight rates skyrocketed. Many investors who had exposure to the shipping industry reaped the benefits as shipping companies raised prices to compensate for delays and backlogs.

Similarly, the ongoing Houthi attacks in the Red Sea have forced between 90% and 95% of container ships to reroute around the Cape of Good Hope, adding roughly 10% to the distance they have to travel. This disruption is forecast to boost demand three times faster than cargo volumes in 2024, according to BIMCO, the Baltic and International Maritime Council.

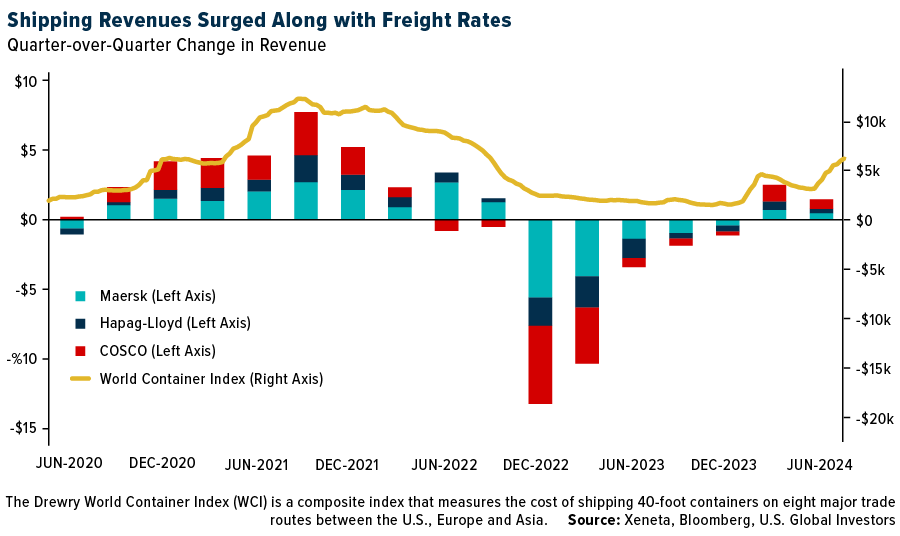

What did we see as a result? A tighter supply-demand balance in global shipping and higher freight costs, leading to revenue growth for shipping companies. Below, you can see the quarter-over-quarter change in revenue for the top three industry leaders that are publicly traded (Denmark’s Moller-Maersk, Germany’s Hapag-Lloyd and China’s COSCO), charted against the average global cost of shipping a 40-foot container.

How to Invest with the SEA ETF

We’re proud to offer the U.S. Global Sea to Sky Cargo ETF (NYSE: SEA), which provides diversified access to the global sea shipping and air freight industries. Using a smart beta 2.0 strategy, SEA is designed to track the performance of some of the most efficient marine shipping and port companies in the world, including those that have the ability to raise prices—a key driver of revenue growth in times of disruption.

With mechanisms in place to prevent large increases in shipping capacity—like fleet idling, ship scrapping and reduced ship speeds—supply remains tight, even as demand continues to grow. This is the kind of environment that has benefited shipping companies and their investors.

In times of uncertainty, it’s critical to stay focused on the long-term trends driving the global economy. Shipping is a fundamental part of that, and we believe we’re at the start of another wave of opportunities for investors. The port worker strike will likely cause short-term pain for the broader economy, but for those who are prepared, it could also present a powerful buying event.

Stay smart, and stay invested!

Learn more about SEA by clicking here!

Please click here to see the SEA prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Cargo companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, regional ETFs’ returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to SEA.

Smart-beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization-based indices.

The World Container Index assessed by Drewry reports actual spot container freight rates for major East West trade routes, consisting of 8 route-specific indices representing individual shipping routes and a composite index.