The airline sector may be experiencing some turbulence now with COVID-19, but the industry has flown through storms before. As one of the most exposed industries to global travel disruptions, airlines have seen a deeper selloff than the market and now look like an attractive bargain. After all, airlines stocks managed recoveries after the 9/11 attacks, the SARS outbreak in 2003 and the global financial crisis in 2008.

U.S. Global Investors is proud to offer the only dedicated airline ETF on the market today – the U.S. Global Jets ETF (JETS). The fund has seen a massive increase in inflows since the coronavirus pandemic began, jumping from $52 million at the end of 2019 to $302 million as of March 31. As of May 21 the fund had over $705 million in assets under management.

On May 19, U.S. Global Investors hosted a webcast in partnership with ETF Trends to answer advisors’ questions about investing in airlines and the impact of COVID-19. The advisors on the webcast were extremely engaged and asked numerous questions. Below are the most frequently asked questions and responses from CEO and chief investment officer Frank Holmes.

You can also watch a replay of the entire webcast by visiting this page.

How long could it take for travel demand to return to pre-virus levels? Will the increase in remote work hurt business travel?

It’s hard to predict when travel demand will fully recover. However, we’ve already seen an increase in commercial air passengers as lockdown restrictions are eased. The number of people the Transportation Security Administration (TSA) screened bottomed at 87,500 on April 14 and since then it’s risen steadily. As of May 20, the TSA screened more than 230,000 people, a gain of about 163 percent from the low.

Remote work has always been a threat to business travel demand. More companies will likely transition to fully remote working post-lockdown, but I believe some travel will still be necessary for businesses. You can’t replace the human connection of meeting face-to-face with video chat.

Warren Buffett sold his stake in airlines. Do you think this will discourage other investors?

In early May, the “Oracle of Omaha” revealed that he recently dumped his entire stake in the big four U.S. airlines—Delta, American, United, and Southwest. As of the end of December, the position collectively stood at around $10 billion. Buffett’s decision to exit airlines seems to have stemmed directly from the coronavirus lockdown and its impact on the travel industry. In other words, it had nothing to do with how the carriers were being managed.

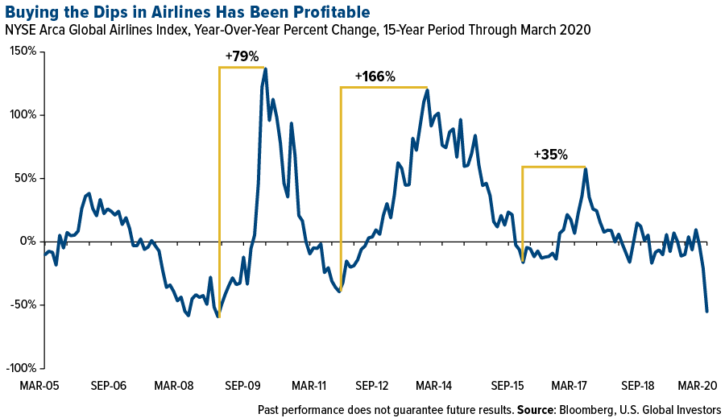

While I agree with Buffett that the COVID-19 pandemic has been a challenge for airlines, I disagree with his decision to dump airline stocks for that reason. Few industries have escaped unscathed from the virus’s impact, after all. I don’t think Buffett’s exit will deter other investors from the space. As evidenced by strong inflows into the JETS ETF, investors are still piling into airlines while share prices are battered. Buying the dips in airlines has been profitable, as seen in this chart below.

How can airlines stay profitable with greatly reduced passenger loads?

It’s true. Airlines are burning through cash as they continue operating flights with fewer passengers. Airlines 4 America reported that planes averaged just 17 passengers per domestic flight as of May 10.

In 2019, the average passenger load factor, or the percentage of seats on a plane occupied by passengers, in the U.S. was 84.62 percent. In April, American Airlines reported a load factor of just 15 percent and Southwest said they had a measly 8 percent. But in the month of May carriers are already seeing huge improvements. American is expecting an increase to 35 percent and Southwest between 30 and 35 percent load factor. Once we see second-quarter reporting there will be a better idea of how airlines have stayed or not stayed profitable during the pandemic.

With planes flying at limited capacity to enforce social distancing could there be an increase in ticket prices?

Yes, airlines will likely continue to take revenue hits due to social distancing measures. For carriers not allowing passengers to book middle seats, they’re looking at a 33 percent revenue drop per flight. I do not expect ticket prices to rise because of this. Airlines are trying to incentivize travelers to fly with lower prices and flexibility with rescheduling. For example, United is allowing passengers to reschedule their trip if a flight is booked over 70 percent full.

Do you see airline stocks as a proxy for the COVID-19 vaccine?

Yes, I believe airlines can be seen as a proxy for sentiment surrounding a vaccine. After all, once a vaccine for COVID-19 is developed and distributed, travelers globally will likely feel more comfortable leaving home and interacting with others. Legendary value investor Bill Miller recently appeared on CNBC and said that if you don’t own airlines, “you’re making a bet against the vaccine.” I agree with Miller’s optimistic view.

Will the recent decline in fuel costs benefit airlines?

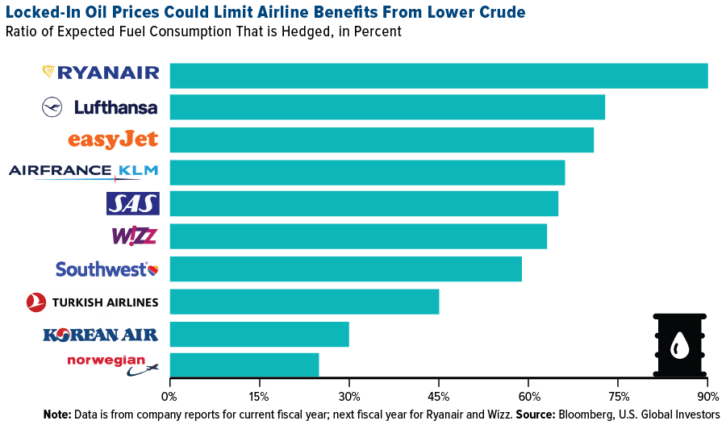

Fuel is one of airlines’ biggest expenses. However, many carriers now hedge oil prices and secure locked-in prices. For example, Ryanair hedges almost 90 percent of its oil consumption, while Southwest is less than 60 percent hedged. Airlines learned from the oil surge in 2013 that locking in lower prices can be beneficial when prices rise, but a weakness when prices fall. Even with higher oil prices, airline stocks can still perform strongly looking at data from 2010 to 2018.

Do you think airlines could become nationalized in the U.S.?

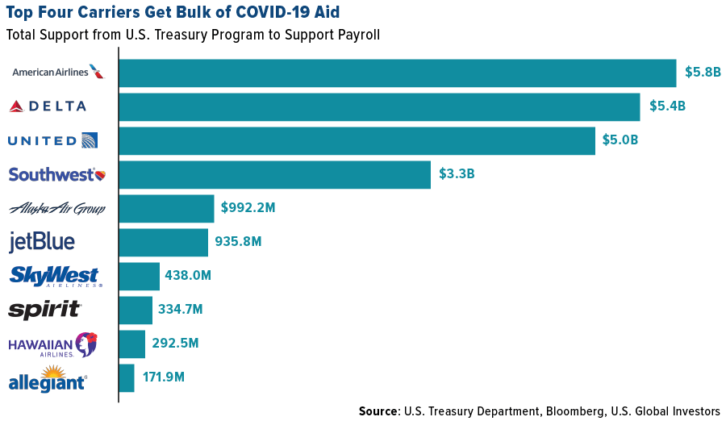

Airlines in the U.S. were deregulated in 1978, incentivizing carriers to compete on fares, routes, and services. I don’t think too many people would be in favor of returning to government-controlled airlines. There is a strong competition domestically between the top four carriers – United, Delta, American, and Southwest – in addition to many other major players. The government has already issued financial assistance for passenger carriers of $25 billion that was fairly evenly distributed between the top three players. Southwest is far less dependent on international travel than American, Delta, and United, which is part of why it received less aid.

There could be continued nationalization of airlines in countries that have a clear flag carrier and were already struggling before the onset of COVID-19. For example, in France, Air France is the clear national airline and in Germany there is Lufthansa. In Italy, the nation’s largest carrier Alitalia is back in government ownership for survival.

Regarding the JETS ETF – what happens to a holding if it files for bankruptcy?

If a company files for bankruptcy and JETS holds it, the security would be removed from the index.

Why did Boeing leave the JETS model and Airbus enter? Could this reverse?

Boeing left the JETS model as of the most recent rebalance on March 13, 2020, and was replaced with Airbus. The fund is rebalanced quarterly and there is always the possibility that Boeing will again fit the investment model or Airbus could no longer meet the model. Factors that are used to determine constituents include cash flow, sales growth, gross margin, and sales yield.

Does the JETS ETF hold more than just carriers? What about manufacturers or airports?

The fund is composed of not only passenger carriers but also airline operators, manufacturers, and airport operators from all over the world. You can view the JETS methodology here and all current holdings here.

We remain optimistic about the airline industry and economic recovery after the COVID-19 pandemic. Learn more about the JETS ETF and how you can gain exposure to the global airline space by visiting the fund page.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business. Passenger load factor measures capacity utilization and is used to assess how efficiently airlines fill seats and generates fare revenue. Sales yield refers to the earnings generated and realized on an investment over a particular period of time. It is expressed as a percentage based on the invested amount, current market value or face value of the security.

The NYSE Arca Global Airline Index (“AXGAL” or “Index”) is a modified equal- dollar weighted index designed to measure the performance of highly capitalized and liquid international airline companies. The Index tracks the price performance of selected local market stocks or ADRs of major U.S. and overseas airlines.

The outbreak of the COVID-19 pandemic and the resulting actions to control or slow the spread has had a significant detrimental effect on the global and domestic economies, financial markets and industries, including airlines. U.S. Global Investors continues to monitor the impact of COVID-19, but it is too early to determine the full impact this virus may have on commercial aviation. Should this emerging macro-economic risk continue for an extended period, there could be an adverse material financial impact to the U.S. Global Jets ETF.