Growing tensions in the Red Sea, a crucial artery for international trade, have sparked a significant shift in the shipping industry. This shift, we believe, offers a compelling case for global shipping stocks.

As many readers are already aware, Iran-backed Houthis have recently attacked tankers and cargo vessels sailing through the Red Sea, a passage used by about 12% of global trade. These disruptions, which are related to the Israel-Hamas War, have prompted shippers to seek alternative, though costlier, routes, including around Africa’s Cape of Good Hope.

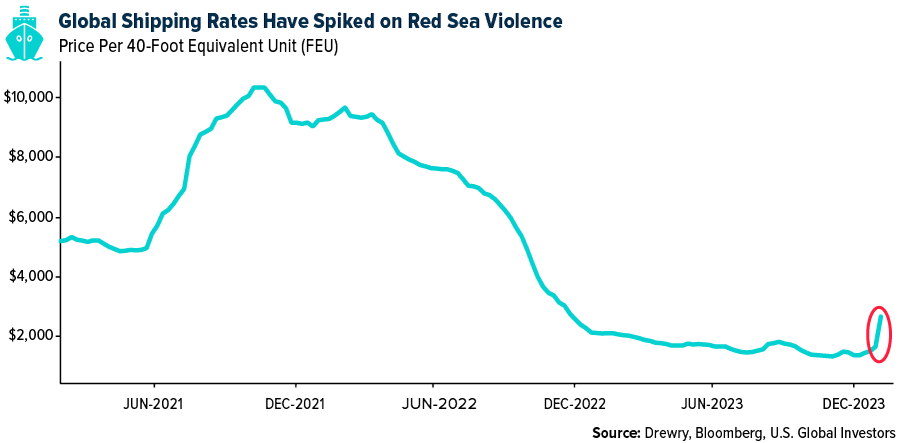

The detour has had an immediate impact: soaring container freight rates. Since tensions escalated last month, global rates have nearly doubled, a clear indicator of the increased costs incurred by carriers and passed on to exporters. According to Drewry data, a company that paid about $1,400 to ship a 40-foot container at the end of November 2023 can now expect to pay more than $2,600 to ship the very same container.

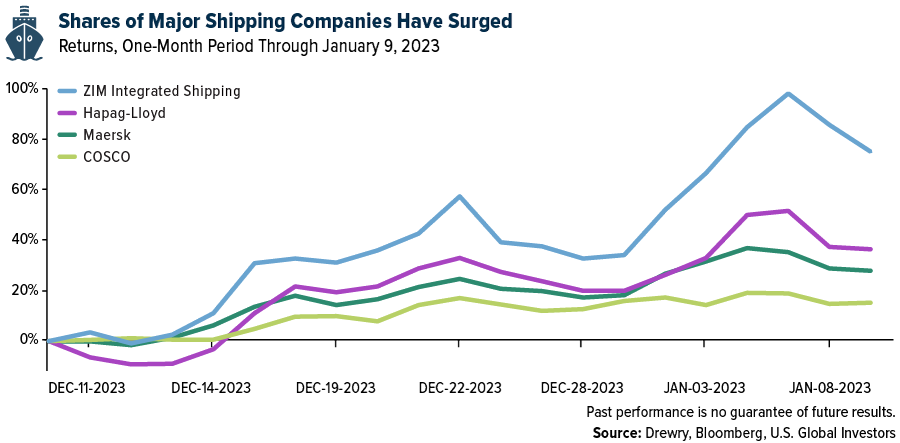

Shares of shipping companies have jumped as a result. For the one-month period through January 9, Israel’s ZIM Integrated Shipping surged over 73%, the highest of any company in the Solactive Global Shipping Index. Other top performers were Hapag-Lloyd, up 37% over the same period; AP Moller-Maersk, up 28%; and China’s Cosco Shipping, with a 14% return.

The Economic Ripple Effects of Shipping Detours

The financial implications of the detours are substantial. An extended round trip between Asia and northern Europe is believed to cost an additional $1 million in fuel per vessel, and given the strategic importance of the Suez Canal, the rerouting of ships adds significant delays to cargo shipments, further inflating costs.

Remember the March 2021 incident where the Ever Given container ship ran aground in the Suez Canal? The six-day episode cost the global economy an estimated $9.6 billion a day. The current standoff in the Red Sea could have a similarly profound economic impact, albeit spread out over a longer period.

The timing is also particularly sensitive, as China’s Lunar New Year approaches—a period traditionally marked by an increase in shipping demand. Even before the Houthi attacks, Maersk warned customers of “exorbitant” rates, “additional peak season surcharges” and a “shortage of empty containers” related to the Chinese holiday.

Set Sail with SEA

We believe the current standoff in the Red Sea presents a unique opportunity for investors to consider global shipping stocks. The hostilities are reshaping the logistics of international trade, leading to higher costs and extended transit times. The situation is likely to persist, offering a potentially lucrative method for investors seeking to capitalize on these developments.

The U.S. Global Sea to Sky Cargo ETF (NYSE: SEA) provides investors diversified access to the global sea shipping and air freight industries. SEA seeks to track the performance, before fees and expenses, of the U.S. Global Sea to Sky Cargo Index (SEAX). The Index uses a smart beta 2.0 strategy to help determine the most efficient marine shipping, air freight and courier, and port and harbor companies in the world.

Think it’s time to set sail? Explore SEA by clicking here!

Please click here to see the SEA prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Cargo companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, regional ETFs’ returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS, GOAU and SEA.

Smart-beta refers to investment strategies that emphasize the use of alternative weighting schemes to traditional market capitalization-based indices. The U.S. Global Sea to Sky Cargo Index is a 29-stock index that seeks to provide diversified access to the global sea shipping and air freight industries. The index uses various fundamental screens to determine the most efficient sea shipping, air freight and port companies in the world. The index consists of common stocks listed on developed and emerging market exchanges across the globe.

The Solactive Global Shipping Index consists of global shipping companies engaged in the maritime transportation of goods and raw materials, including consumer and industrial products, vehicles, dry bulk, crude oil and liquefied natural gas.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.