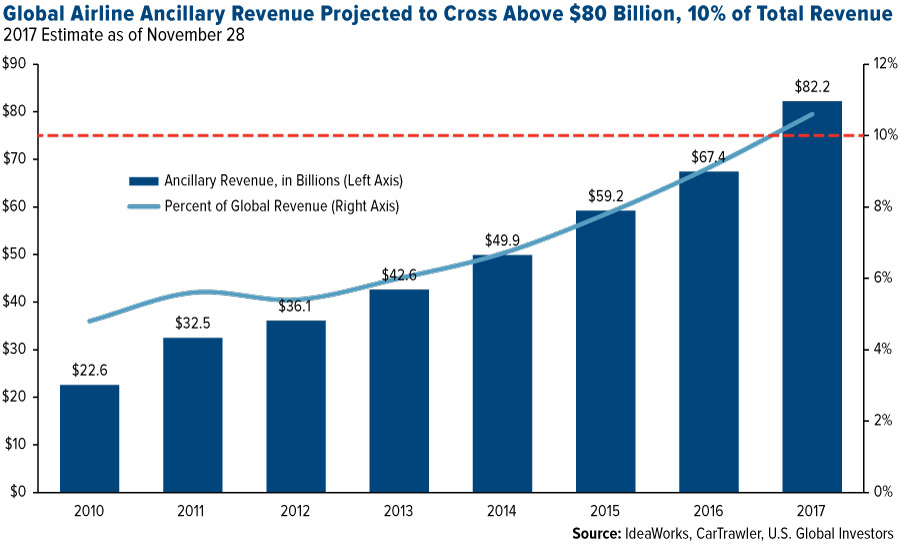

Global airlines’ ancillary revenue, or non-ticket fees, is projected to exceed $80 billion for the first time in 2017, according to IdeaWorks, a worldwide consultancy firm on airline finance. If accurate, this amount will represent more than 10.5 percent of total global airline revenue. IdeaWorks estimates the figure to come in at $82.2 billion, up 22 percent from last year and up an incredible 264 percent from 2010.

As a reminder, ancillary revenue includes most fees not directly associated with airfare, such as baggage, onboard services (food, seating), sales of frequent flyer programs, travel retail (hotel, car rentals, insurance) and other à la carte services.

Like many air passengers, you’ve probably balked at having to pay separately for services you once got for free, baggage handling being a notable example. But such fees have increasingly played a huge role in helping carriers expand their profit margins since the industry consolidated a decade ago. Between 2006 and 2016, world industry profit margins widened from 1.1 percent to 5 percent, according to the International Air Transport Association (IATA)—thanks largely to non-ticket sales.

“The economic boon of ancillary revenue has proven to be a highly useful tool to fix airline finances,” IdeaWorks writes.

____________________________________

“The economic boon of ancillary revenue has proven to be

a highly useful tool to fix airline finances.”

____________________________________

According to the group’s estimates, non-ticket fees accounted for 14.2 percent of North American carriers’ total operating revenue this year, up from 12.3 percent in 2016.

What’s more, an analysis of ancillary revenue’s exponential growth leads IdeaWorks to conclude that such fees could even eventually help cover airlines’ total fuel costs. Using the IATA’s calculation that the industry will spend $129 billion on fuel this year, the consultancy group writes that it’s “reasonable to suggest ancillary revenue will someday exceed the airline industry’s annual fuel bill.”

Record Profits in 2018?

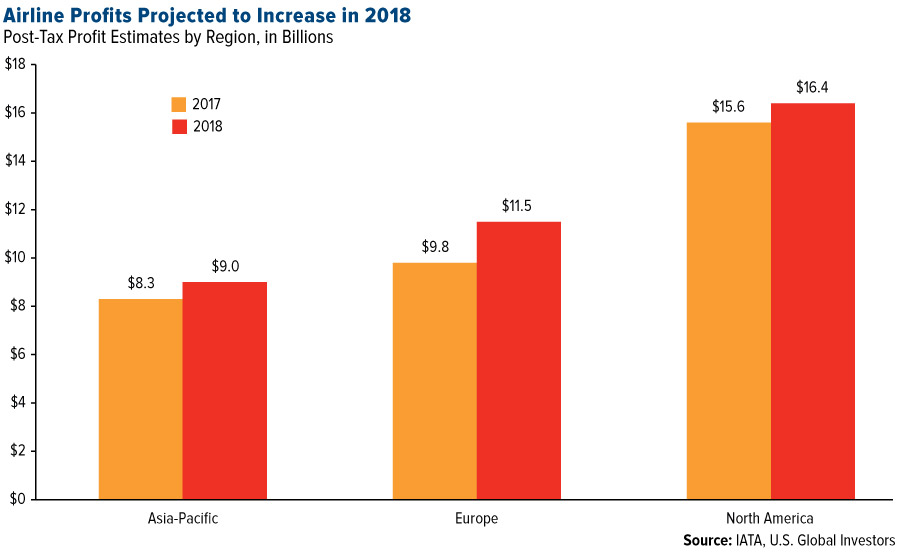

Combined with rising ancillary revenue, moderate changes in fuel costs and stronger economic growth—especially in developing economies—the IATA sees airline profits surging to new all-time highs in 2018. Globally, net profits could hit $38.4 billion on revenues of $824 billion, up from $34.5 billion and $743 billion this year.

The strongest financial performance is projected to be delivered by North American carriers, which could see profits grow more than 5 percent, from $15.6 billion in 2017 to $16.4 billion next year.

It’s unclear, however, if IATA’s estimates include the potential effects of U.S. tax reform, which are set to cut the top U.S. corporate tax rate nearly in half, from 39.6 percent to 21 percent, effective January 1.

According to Delta Air Lines, the tax restructuring could help the carrier’s 2018 earnings increase as much as $1.25 per share. In addition, investment bank and research firm Atlantic Equities says corporate tax reform could contribute to Southwest Airlines’ stock skyrocketing more than 30 percent in 2018, after it rose approximately as much so far in 2017, as of December 18.

Now Could Be an Attractive Entry Point for Investors

With airline profits potentially on the rise, along with higher ancillary revenue and a recovering global economy, now might be an ideal time for investors to consider gaining exposure to the broader aviation space. Our U.S. Global Jets ETF (JETS) is the only airline-focused exchange-traded fund available today, making it a convenient “one-click” way to invest in the global airline market, which includes not just commercial carriers but also airline operators and manufacturers.

All opinions expressed and data provided are subject to change without notice. Opinions are not guaranteed and should not be considered investment advice.