Readers of a certain age will recall President Ronald Reagan launching one of the most ambitious military buildups in American history.

In a bid to overwhelm the Soviet Union, Reagan doubled the U.S. military’s budget from under $150 billion in 1980 to over $300 billion by 1985. The government invested heavily in B-1 bombers, MX missiles and an expanded Navy fleet.

The 40th president believed that peace could only be achieved through strength, and history proved him right. The Americans outspent and out-innovated the Soviets… and ultimately outlasted them.

NATO Agrees to Increase Defense Spending

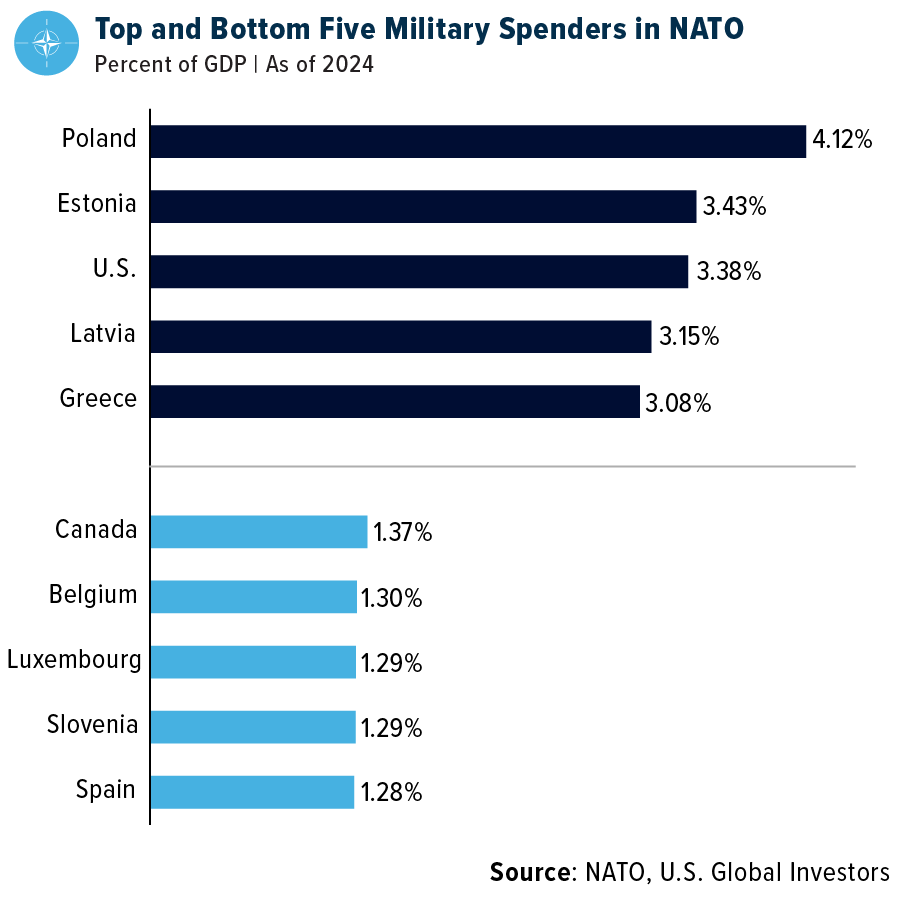

Today, we’re seeing Regan’s strategy play out on the international stage. At the NATO summit in The Hague last week, the 32-member alliance agreed to boost defense spending to 5% of GDP by 2035, with a floor of 3.5% earmarked for “core military needs.” That’s more than double the previous 2% target set back in 2014.

President Donald Trump echoed Reagan’s “peace through strength” energy in his own remarks: “It’s vital that this additional money be spent on very serious military hardware… and hopefully that hardware is going to be made in America because we have the best hardware in the world.”

Growing Number of Conflicts Across the Globe

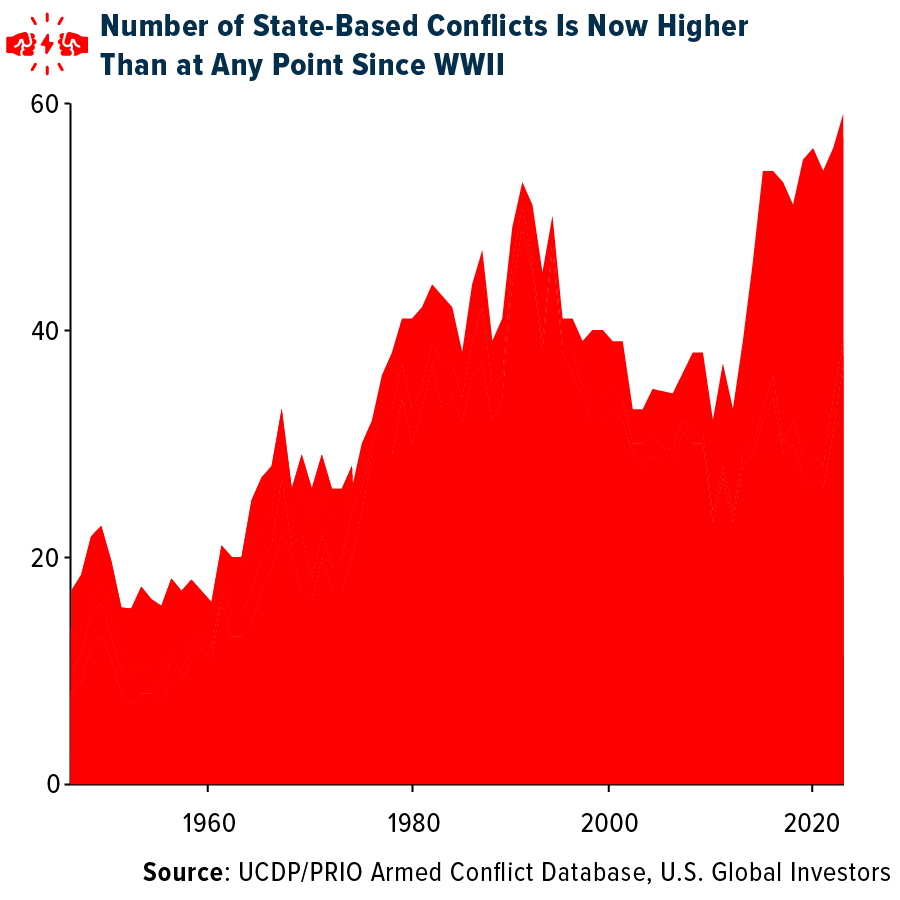

It’s not difficult to see why this spending spree is happening now. The world is getting more dangerous. According to the 2025 Global Peace Index, there are 59 active state-based conflicts globally, the highest number since World War II.

Ranked as this year’s least peaceful country, Russia remains an active military threat, with its war in Ukraine extending into a third year and showing few signs of resolution.

China is executing a “massive” military expansion, according to NATO, including advanced missile systems and naval expansion in the South China Sea.

NATO Allies Moving Fast

Some NATO countries aren’t waiting until 2035 to act. Poland is already spending over 4% of its GDP on defense, the highest rate among all other members.

Germany has pledged to reach 3.5% by 2029, even changing its constitutional debt rules to make it possible.

The UK just ordered a dozen nuclear-capable F-35A fighter jets, marking its biggest nuclear deterrent upgrade since the Cold War.

Here in the U.S., President Trump has proposed an $893 billion defense budget for 2026 that favors drones and smart missiles, while reducing some legacy investments such as warships and fighter jets. He appears to be focused on high-tech, cost-effective equipment, modeled in part after Ukraine’s recent successes with drones on the battlefield.

Consider Exposure Through the WAR ETF

For investors seeking to gain exposure to the global buildup in defense spending, the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR) offers a targeted approach.

WAR is U.S. Global Investors’ first actively managed ETF, seeking to provide capital appreciation by investing in companies across the aerospace, defense, semiconductor, cybersecurity and data center industries. These sectors are increasingly vital to national security and economic resilience, especially as governments prioritize advanced military capabilities and digital infrastructure.

What sets WAR apart is its Smart Beta 2.0 strategy. This means the fund blends quantitative metrics—such as profitability, volatility and liquidity—with fundamental analysis to identify and weight holdings. This quantamental approach enables WAR to respond to changing geopolitical and economic conditions while relying on data-driven decision-making.

Rather than simply tracking an index, the fund’s active management allows it to adjust allocations based on macroeconomic trends and regulatory developments. WAR includes companies from across the globe, reflecting the interconnectedness of modern defense supply chains and technology.

Request more information on the WAR ETF by clicking here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus at www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk including the possible loss of principal.

The Fund is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

The Fund’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment advisor to WAR.

Smart Beta 2.0 is an investment strategy that improves upon traditional smart beta by dynamically weighting multiple factors such as value, momentum and quality using rules-based, often algorithmic, approaches to enhance risk-adjusted returns.

The Global Peace Index (GPI) is a report published by the Institute for Economics and Peace (IEP) that measures the peacefulness of nations and regions. It’s a comprehensive data-driven analysis that explores trends in peace, its economic value, and how to build more peaceful societies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.