Air travel continues to rebound in China but remains subdued globally due to a growing number of coronavirus infections and the reintroduction of lockdown measures. Although bullion was down for the month, gold coin buying surged to a record high.

Click the buttons below to read our recap of the airline sector and gold market for October 2020.

AIRLINES

GOLD

Strengths

- The best performing airline for the month of October was Jet2, up 21.07%.

- The air travel recovery continues to strengthen in China. According to the International Civil Aviation Organization (ICAO), domestic passenger traffic in China, having already bottomed in mid-February, is now above 2019 levels in terms of capacity. Some areas of Chinese tourism are not just surviving but “booming,” according to McKinsey & Company. By the end of August, occupancy rates at luxury and high-end hotels were back to around 90 percent capacityfrom a year earlier.

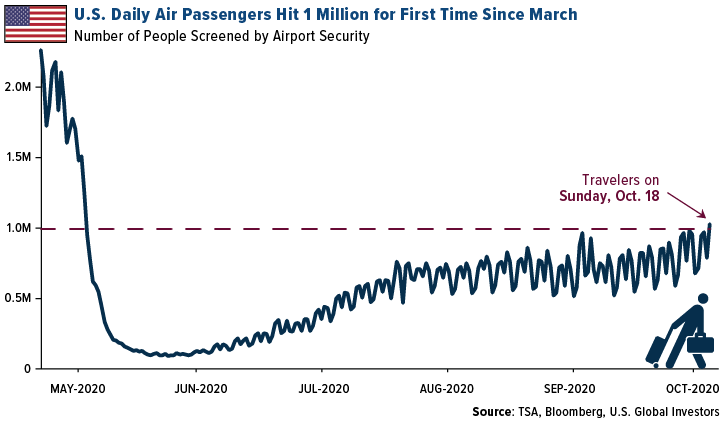

- Transportation Security Administration (TSA) data flashed a resounding positive signal on October 18. On that day, the number of passengers screened in the U.S. exceeded 1 million for the first time since March. Exactly 1,031,505 people passed through TSA, around 40 percent of the traffic compared to the same day a year ago.

Weaknesses

- The worst performing airline for the month of October was Hainan Meilan International, down 24.02%.

- Although U.S. lawmakers have been discussing another round of fiscal stimulus, particularly for the hard-hit airline industry, there was still no package confirmed. On October 12, Speaker Nancy Pelosi said she would not agree to stand-alone air for airlines unless the Trump administration committed to a broader pandemic relief plan. Lawmakers appear to be at a standstill until after the U.S. presidential election.

- British Airways retired its last two Boeing 747 airliners, reports Bloomberg. BA had one of the largest fleets of the iconic jumbo jet. Airlines have been phasing out the older, larger aircraft models to cut costs amid the pandemic, but were also phasing them out well before the crisis.

Opportunities

- Singapore and Hong Kong will open their borders to one another for the first time in seven months, reports Bloomberg, exempting travelers from both cities from quarantine. In place of a mandatory quarantine, there will be coronavirus testing, hopefully in place within “weeks”. Cathay Pacific Airways jumped as much as 7.8 percent on October 15 after the news.

- Southwest Airlines CEO Gary Kelly said the carrier will add new destinations to boost revenue. “It’s exciting to take the fight to the competition and put idle aircraft and overstaffed employees to work,” Kelly said in a video message to employees. “Fortunately, our route map still has dozens of airports for growth with 737s. We’ll pursue these opportunities aggressively but not recklessly, and in every case they must meet our cash-flow threshold and contribute to our recovery.” The domestic-focused carrier added a new seasonal service to Montrose, Colorado near ski resorts in Telluride.

- Singapore Airlines said all seats on its Airbus A380 jetliner pop-up restaurants were reserved within 30 minutes of bookings opening, reports Bloomberg. The carrier is using two of its superjumbo jets parked at Changi Airport as temporary restaurants to generate revenue. A meal in a suite costs $474, while an economy seat meal costs closer to $40.

Threats

- Coronavirus cases continue to surge globally, sparking fears that the short-lived travel recovery will reverse. The U.S. reported 69,000 cases on October 16 – the most since July. Europe is also seeing cases rise to record highs and countries are re-implementing travel restrictions and lockdowns.

- American Airlines and Southwest Airlines announced on October 22 they will defer the delivery of more Boeing 737 Max jets. American deferred delivery of 18 Max jets and will now take them over 2023 and 2024, pushed back from 2021 and 2022. Southwest, the largest customer for the Max, said it may restructure its order, reports Bloomberg. Competitor Airbus is also seeing carriers delay delivery. Delta Air said it had pushed out the handoff of $5 billion worth of Airbus jets until after 2022.

- More women are becoming pilots, but the coronavirus could threaten progress. According to the International Society of Women Airline Pilots in Las Vegas, the share of female pilots rose to 5.3 percent worldwide this year, up from 3 percent in 2016. Bloomberg Businessweek notes that more than 15,000 pilot jobs have been cut in Europe so far this year due to the pandemic halting travel. According to Five Aero, job losses among all airlines globally could hit 340,000 by yearend.

Strengths

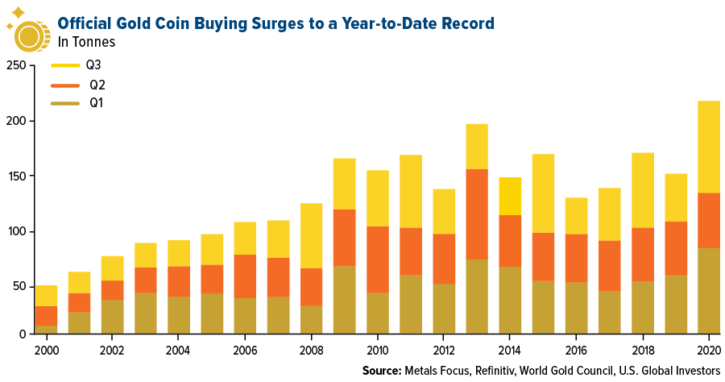

- The World Gold Council’s (WGC) summary of the third quarter shows that total holdings in gold-backed ETFs hit a record high of 3,880 tonnes, having added 272.5 tonnes in the three months ended September 30. Physical gold investment also hit a new all-time high. Gold bar and coin purchases increased an incredible 49 percent year-over-year through the end of the third quarter, reaching 222.1 tonnes. Largest volume increases were seen in Western markets, China and Turkey, the WGC says.

- In the first nine months of 2020, inflows into silver-backed ETFs nearly tripled the amount from the same period a year ago. Silver holdings rose by 297 million ounces, up from 103 million ounces in the first three quarters of 2019. Silver bullion coin demand is also strong – up 65 percent from the same period last year.

- Russia’s largest gold producer, Polyus PJSC, announced its Skuhoi Log deposit in Siberia holds the world’s biggest gold reserves, according to a new audit. Data shows the deposit has 40 million ounces of proven reserves with an average gold content of 2.3 grams per ton.

Weaknesses

- Central banks were net sellers of gold for the first time since 2010 in the third quarter. Net sales totaled 12.1 tons, compared with purchases of 141.9 tons a year earlier, according to WGC data. Countries are taking advantage of record-high gold prices to soften the blow from the economic impact of the coronavirus.

- India, which polishes nearly 90 percent of the world’s rough diamonds, says exports will fall by as much as a quarter in 2020. The Gem & Jewellery Export Promotion Council says supply disruptions and lower demand from the coronavirus could push exports down as much as 25 percent and that the current slump is worse than that in 2008-2009.

- The Perth Mint is being investigated for links to global organized crime syndicates and for failing to conduct identity checks required to prevent money laundering, reports The Financial Review. The refinery’s failure to conduct background checks on Euro-Pacific customers raises the possibility that it sold and is storing precious metal holdings of tax cheats and foreign criminals.

Opportunities

- Demand for gold in China, the world’s top consumer, could continue to rebound as the country recovers economically from the coronavirus. WGC data shows China’s jewelry demand fell 25 percent year-over-year in the third quarter but was up 31 percent from the prior quarter. Gold bar and coin demand rose 35 percent year-over-year in the quarter to 57.8 tons.

- Union Bancaire Privee (IBP) says gold could reach $2,200 an ounce by December 2021 due to deeply negative inflation-adjusted U.S. interest rates. According to a report by authors including Michael Lok, gold miners position investors to benefit from the resumption of the long cycle bull market expected in early 2021 and the near-term earnings catalyst of increased output and the long-term driver of rising dividends.

- Goldman Sachs Group said silver stands out as an “obvious beneficiary” from government stimulus programs that lean toward renewable energy, which boosts demand for the metal used in solar panels. Analysts said in a note that global solar installations will increase by 50 percent between 2019 and 2023. Goldman’s forecast is for silver to rise to $30 an ounce – about 26 percent higher than current prices.

Threats

- The fate of oil drilling in the Arctic and the Pebble gold mine in Alaska hang in the balance of the presidential election, writes Bloomberg Green. Trump is pushing for development of the region while Biden has pledged to protect the natural resources. For the Pebble gold mine project in particular, the Trump administration has scrapped Obama administration pollution restrictions blocking the mine and Biden has promised to block the project if he wins, calling the area no place for a mine.

- Barrick Gold ended its battle with Papua New Guinea and will give the nation a “major share” of its Progera mine. In exchange, Barrick can re-open and continue operating the facility that had been suspended since April after the government failed to extend the mining lease. Barrick suffered another blow after agreeing to pay Tanzania $40 million to settle a tax dispute. The miner paid the first installment of $100 million in May. Lastly, Barrick reported an 11 percent drop in gold production in the third quarter from a year ago.

- Centamin Plc, an Egyptian-focused miner, fell as much as 19 percent in London trading after announcing it will produce less gold than expected in 2021. Centamin operates the Sukari gold mine in Egypt, seen as one of the best gold deposits in the world not owned by a major producer, but the company has long faced operational and political challenges. The company said 2021 output will be between 400,000 and 430,000 ounces, which is below analyst consensus of around 500,000 ounces, reports Bloomberg.

Want to receive this recap straight to your inbox? Sign up for monthly updates by clicking here.