A little over a hundred years ago, the United States emerged from the double whammy of a world war and deadly pandemic. Eager to get back to “normal” life, Americans went on a decade-long spending splurge, buying cars and radios and stocks, most for the first time ever. Although we all know how it ended, the Roaring Twenties was largely a product of pent-up demand.

This summer, we could see the start of a similar demand-driven economic boom as millions of Americans, newly vaccinated and $1,400 richer, make up for lost time by booking flights and vacations.

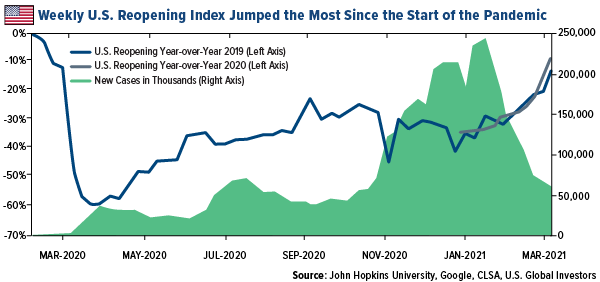

According to CLSA’s proprietary reopening index, the U.S. saw the biggest weekly gain since the start of the pandemic, up 8%, as the number of new daily infections dropped further. Here in Texas, all COVID-19 restrictions were lifted 100%, just in time for Spring Break.

Airlines Hoping for Strong Rebound in Summer Bookings

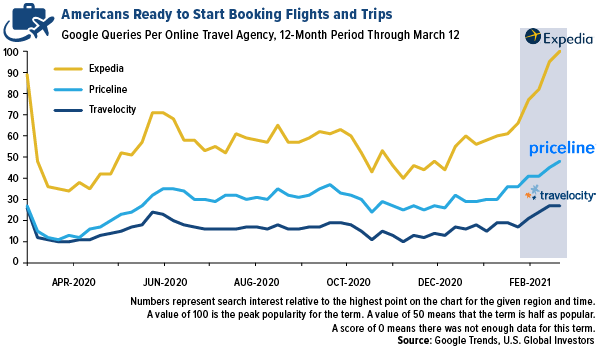

March 12 marked the one-year anniversary of the start of the pandemic, and if Google Trends data is any indication, Americans are ready to travel again. The number of Google queries for online travel agencies Expedia, Priceline and Travelocity hit pandemic highs last week as airlines announced new deals and routes.

Low-cost carriers Allegiant and Southwest recently expanded their networks to include 36 new non-stop routes in the former’s case, 17 in the latter’s. According to Bloomberg, this is the second-largest network expansion in Allegiant’s history and the largest for Southwest since 2013.

Across the Atlantic, Lufthansa is also adding to its slate of summer destinations in anticipation of a strong rebound in bookings. Europe’s largest carrier will add around 20 new routes from Frankfurt and 13 from Munich to vacation spots such as the Caribbean, Canary Islands and Greece.

Meanwhile, credit card data from the end of February shows an uptick in airline booking among older Americans—those most likely to have been fully vaccinated. At a Raymond James conference, the CEOs of Delta and Spirit told investors that bookings took a positive turn in mid-February.

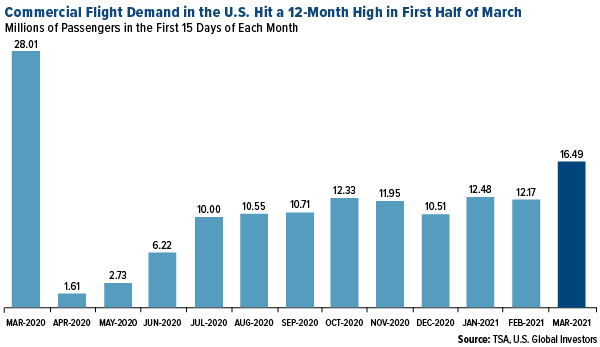

Passenger volume in the U.S. is still down about 60% compared to pre-pandemic levels, but this could improve the closer we get to vacation season and as more people get their vaccinations. As of March 14, the number of passengers screened by TSA exceeded 1 million people for the fourth day straight.

American Airlines is so optimistic of a recovery in summer leisure travel that it increased the size of its debt financing, from $7.5 billion to $10 billion. The debt, according to MarketWatch, is underpinned by the carrier’s $20 billion AAdvantage loyalty program.

Another sign that airlines are sensing a shift in Americans’ appetite for air travel? Budget carrier Frontier filed to IPO, saying that it was “well positioned to take advantage of the anticipated demand recovery as vaccine distribution continues.” Rival carrier Sun Country also provided new details for its own upcoming IPO, telling investors it seeks to raise some $200 million to help pay off pandemic crisis loans from the federal government.

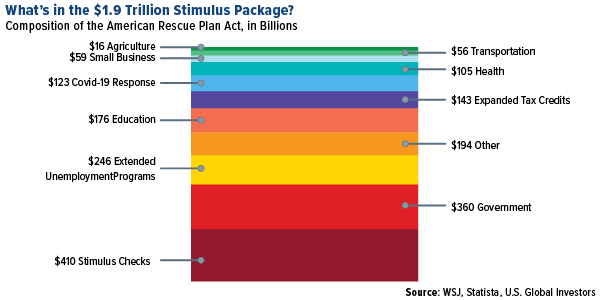

$1.9 Trillion Stimulus Package Includes Relief for Aviation Industry

The U.S. aviation industry is set to receive another round of fresh stimulus now that President Joe Biden has signed the $1.9 trillion rescue package. Included in the bill is approximately $15 billion for airlines and airline contractors, $8 billion for airports and concessionaires.

American and United immediately dropped plans to lay off or furlough a combined 27,000 workers.

As expected, U.S. airline and airport trade groups were quick to praise the rescue package.

Commercial aviation still has some challenging times ahead of it, but we believe the worst is behind us, meaning now may be an opportune time to get exposure. Read our 5 reasons to buy airline stocks.