More than half of all Americans see leisure travel as an important budget priority right now, even as an economic recession looms, according to the results from a new survey.

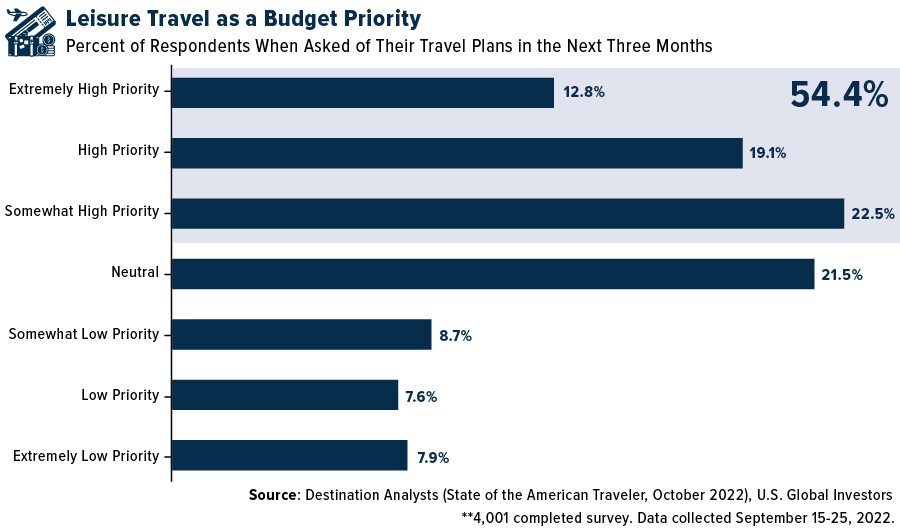

Responding to a September questionnaire conducted by San Francisco-based market research firm Destination Analysts, 54.4% of Americans said that travel was either an “extremely high,” “high” or “somewhat high” budget priority in the remainder of 2022. By comparison, nearly a quarter of participants said that travel was not a priority at this time.

Further, a huge majority of American travelers don’t seem too dismayed by the likelihood of a recession. In response to another survey question, approximately three out of four participants (74.8%) said they believed travel was a “worthwhile” investment, even if the economy were to contract.

Late fall and early winter are popular times for many Americans to hit the road or take to the skies, and this holiday travel season may be no exception. Over a quarter of survey respondents said they had plans to take a trip in October (26.6%), November (24.8%) and/or December (28.4%).

Traveling in Luxury

Destination Analysts also makes note of so-called “luxury travelers,” who represent some 27% of the U.S. traveling population. Over the next 12 months, the average luxury traveler is expected to spend $6,260 on their trip, or $2,000 more than the typical American traveler.

Compared to other Americans, luxury travelers are more likely to prefer flying commercial over driving, and they’re also more likely to take cruises.

An Economic Powerhouse

We believe this is all very positive news for the travel and tourism industry, which is estimated to account for a not-insignificant 7.6% of the U.S. economy this year. From a loss of almost $766 billion in 2020 due to the pandemic, the industry appears set to contribute $1.8 billion by the end of 2022, according to the World Travel & Tourism Council (WTTC).

Millions of Americans depend on travel and tourism for their livelihood and careers. In 2019—the most recent year of data—the industry supported one out of every 20 jobs in the U.S., either directly or indirectly, according to Commerce Department data. The airline industry alone employed approximately 770,000 Americans as of June 2022.

JETS, the Pure-Play Airlines ETF

We believe the survey results are also constructive for the U.S. Global Jets ETF (JETS),which provides investors access to not only commercial airliners but also aircraft manufacturers, airport services companies and travel technology companies.

Like the broader market, airline stocks have fallen this year as investors weigh the impact of rising interest rates, higher fuel costs and a potential global recession. From its pandemic high of $28.71, set in mid-March 2021, JETS has cooled to trade around $15.50, which we see as an attractive buying opportunity.

Already there are signs that airlines are committed to remain resilient in a slowing economy. American Airlines, one of the top four holdings in JETS, said this week that it expects third-quarter sales to outperform prior guidance as both leisure and business travel has surprised to the upside following Labor Day.

Meanwhile, Boeing, also held in JETS, just announced that deliveries rose in September to 51 airplanes, compared to 35 in August, while new orders increased by 90. We see this as a positive sign that commercial carriers are anticipating stronger travel demand in the coming months.

To see the full list of holdings in JETS, click here.

Explore and discover the U.S. Global Jets ETF (JETS) today by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.