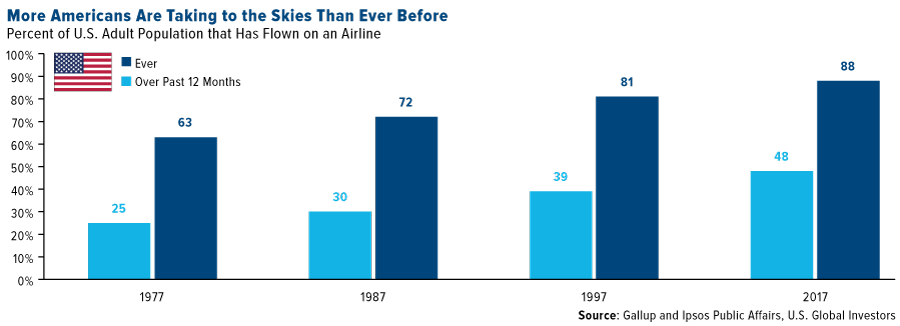

More Americans are flying on airlines than ever before, according to a new survey. In 2017, nearly half of the U.S. adult population flew on an airline in the past 12 months, compared to only a quarter of adults 40 years ago. Close to 90 percent said they have flown at least once in their lifetimes, up from 63 percent in 1977.

Conducted in January 2018 by Ipsos Public Affairs, the survey of more than 5,000 Americans shows that flight demand has steadily climbed in the past 40 years as median household income has risen and competition among major carriers has spurred them to improve the passenger experience. We believe this news underscores the long-term investment case for the U.S. Global Jets ETF (JETS), which provides investors access to not only airlines but also airline operators and manufacturers.

The average number of airline trips for the 12-month period rose in every age group, with the total number climbing from 2.2 in 2016 to 2.5 in 2017. The same was true for every household income bracket except for those making over $150,000 a year, which fell from 5.6 trips in 2016 to 5.4 last year. The biggest improvement was seen in the $75,000-to-$99,000 income bracket. That group took 5.1 trips on average in 2017, compared to 3.4 the previous year.

The survey, commissioned by Airlines for America (A4A), also shows that a vast majority of Americans were satisfied with their flight experiences in 2017. Of those polled, 43 percent said all of their flights were satisfactory, while 42 percent claimed that “most” were satisfactory.

A Better Flight Experience Keeps Passengers Coming Back

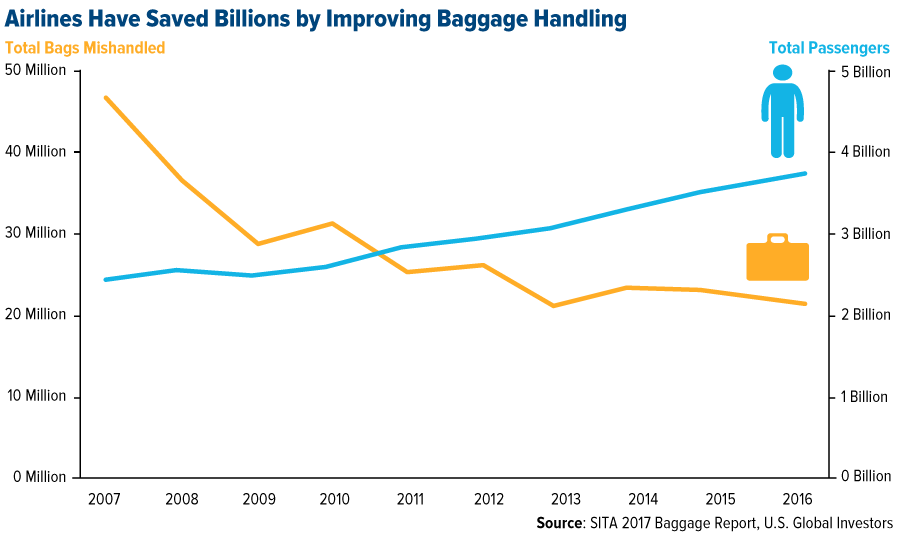

Ipsos and A4A’s findings are in line with the J.D. Power 2017 North America Airline Satisfaction Study, released in May 2017, which reported passenger satisfaction at its highest level ever recorded on lower fares, better on-time performance and fewer lost and mishandled bags. Overall satisfaction rose a significant 30 points in 2017 to 756, on a 1,000-point scale.

Carriers continue to make strides in preventing mishandled bags. This is good news not just for passengers but also the industry as a whole, which lost $27 billion between 2007 and 2016 because of lost and mishandled baggage, according to Geneva-based Société Internationale de Télécommunications Aéronautiques (SITA). But according to the group’s baggage report of 2016, the number of mishandled bags per thousand passengers fell to an all-time low of 5.73. This is thanks in large part to radio frequency identification devices (RFID), which can cost as little as $0.10 per bag. SITA projects that RFID technology can help the industry save $3 billion between now and 2024.

Some carriers are also responding to investor concerns that airlines are growing capacity too quickly. American Airlines, for instance, is decreasing the number of seats in some of their planes after replacing as many as 40 economy seats with 24 “premium economy” seats, which are wider and cost around $20 more, the Dallas Business Journal reports. This will expand the number of seat class options to four and help boost American’s revenue.

Airlines Are on Sale

With household incomes on the rise, passenger satisfaction looking strong and the busy summer travel season right around the corner now might be a good time for investors to consider the airline industry.

One investor who still has a large position is billionaire Warren Buffett’s holding company, Berkshire Hathaway. According to fourth-quarter filings, Berkshire owns a little over $10 billion in stock in the top four carriers—American, Delta Air Lines, United Continental and Southwest Airlines—with the largest position, by number of shares held, being Delta. That means the company now owns between 6 percent and 10 percent of each of the four carriers.

What’s more, speaking to CNBC recently, Buffett commented that he “wouldn’t rule out owning an entire airline.”

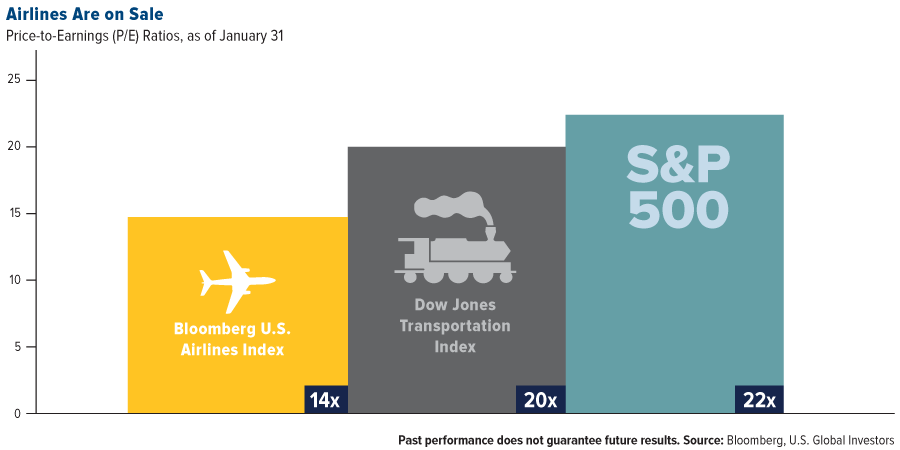

Berkshire sits on $116 billion in cash, and according to his annual shareholder letter, Buffett seeks to deploy some of these funds into “more productive assets.” The problem, he notes, is that it’s difficult to find a deal today with a “sensible purchase price,” as stocks are currently overvalued. As of January 31, the S&P 500 Index was trading at 22 times earnings.

Buffett doesn’t mention airlines directly in his shareholder letter, but it’s worth pointing out that airline stocks were trading at 14 times earnings, as measured by the Bloomberg U.S. Airlines Index. This is a more “sensible” price than transportation stocks and the broader market.

We believe our U.S. Global Jets ETF (JETS) is an attractive “one-click,” broad-based solution to investing in the airline industry. Nearly 80 percent of the fund is invested in the domestic market, including 47 percent in American, Delta, United, and Southwest, as of December 31.

The only pure-play airline ETF on the market today, JETS is diversified across the globe and value chain. Besides airlines, the fund holds jet manufacturers such as Boeing—the best-performing stock in the Dow Jones Industrial Average last year—and airport services firms.

See which holdings round out the U.S. Global Jets ETF (JETS) by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The price-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. The price-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

The J.D. Power 2017 North America Airline Satisfaction Study measured passenger satisfaction among both business and leisure travelers. It was based on responses from 11,015 passengers who flew on a major North American airline between March 2016 and March 2017. The study was fielded between April 2016 and March 2017.

The Bloomberg U.S. Airlines Index is a capitalization-weighted index of the leading airlines’ stocks in the U.S. The Dow Jones Transportation Average is a price-weighted average of 20 U.S. transportation stocks. The Standard & Poor’s 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices. The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

Neither Warren Buffett nor Berkshire Hathaway is affiliated with U.S. Global Investors.