The latest wholesale inflation numbers in the U.S. took some of the wind out of Wall Street’s sails last week, but they haven’t dulled investor enthusiasm for gold. Even with a hotter-than-expected producer price index (PPI) reading in July, the yellow metal continues to trade near historic highs, and gold stocks, particularly royalty and streaming companies, are delivering record results.

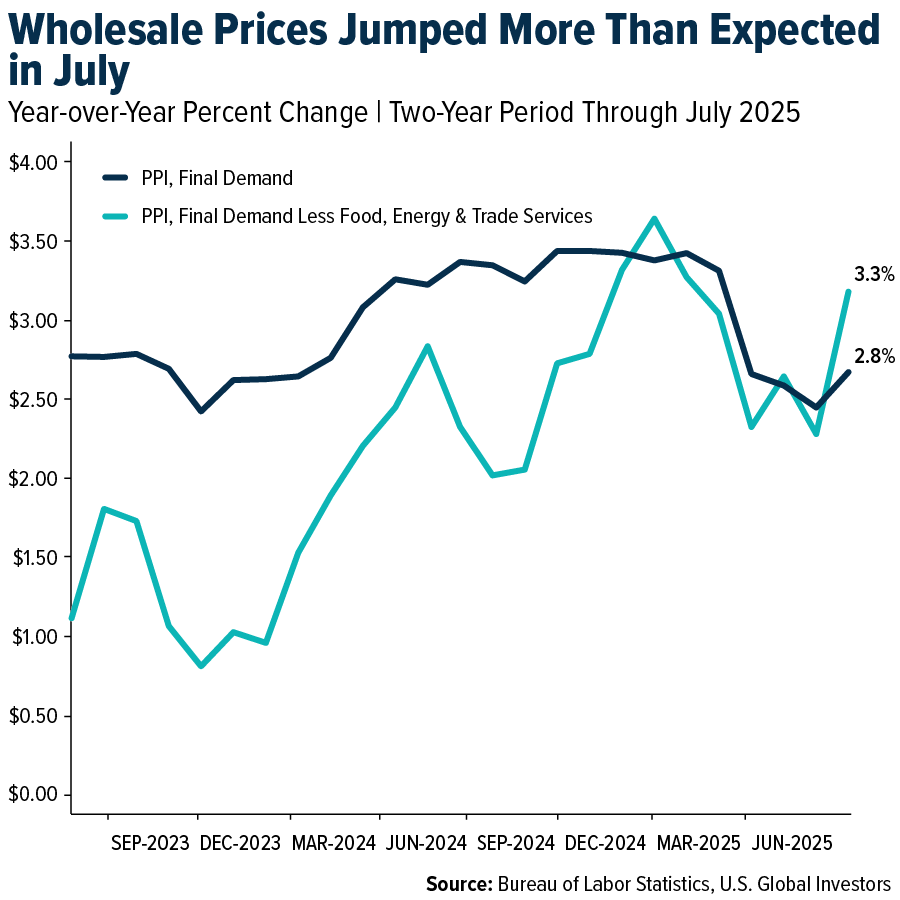

As we often say, government policy is a precursor to change. The PPI, which measures prices producers receive for goods and services, jumped 0.9% in July from the previous month and 3.3% from a year earlier, the largest monthly increase in three years. The core PPI, which strips out volatile food, energy and trade services, advanced 2.8% compared to the same months last year.

The biggest driver was services, which rose a full 1.1% last month. This could suggest that companies are passing along higher import costs related to tariffs, something Goldman Sachs recently projected could hit consumers’ wallets in a big way by the fall.

The PPI report rattled rate-cut expectations. For the record, traders still seem to anticipate the Federal Reserve will lower borrowing costs in September, but the odds of a “jumbo” half-point cut have diminished.

While the White House has been vocal in urging the Fed to “go big,” central bankers may prefer to stick with smaller, sequential moves, especially with inflation proving sticky in some areas.

Gold’s Resilience in the Face of Mixed Data

If there’s been one constant in 2025, it’s gold’s ability to attract buyers in an uncertain environment. Spot prices have been consolidating in the mid-$3,300s after hitting an all-time high of $3,500 an ounce in April and reaching $3,439 as recently as July 22. The metal’s steady performance this summer has been fueled by a number of factors, including inflation concerns, a softer U.S. dollar, central bank demand and the expectation of lower interest rates.

Gold has also tended to shine brightest during periods of uncertainty, whether economic, political or geopolitical. This year, that list has been long: renewed tariff skirmishes, questions about the Fed’s independence and elevated levels of global debt have all driven investors toward hard assets.

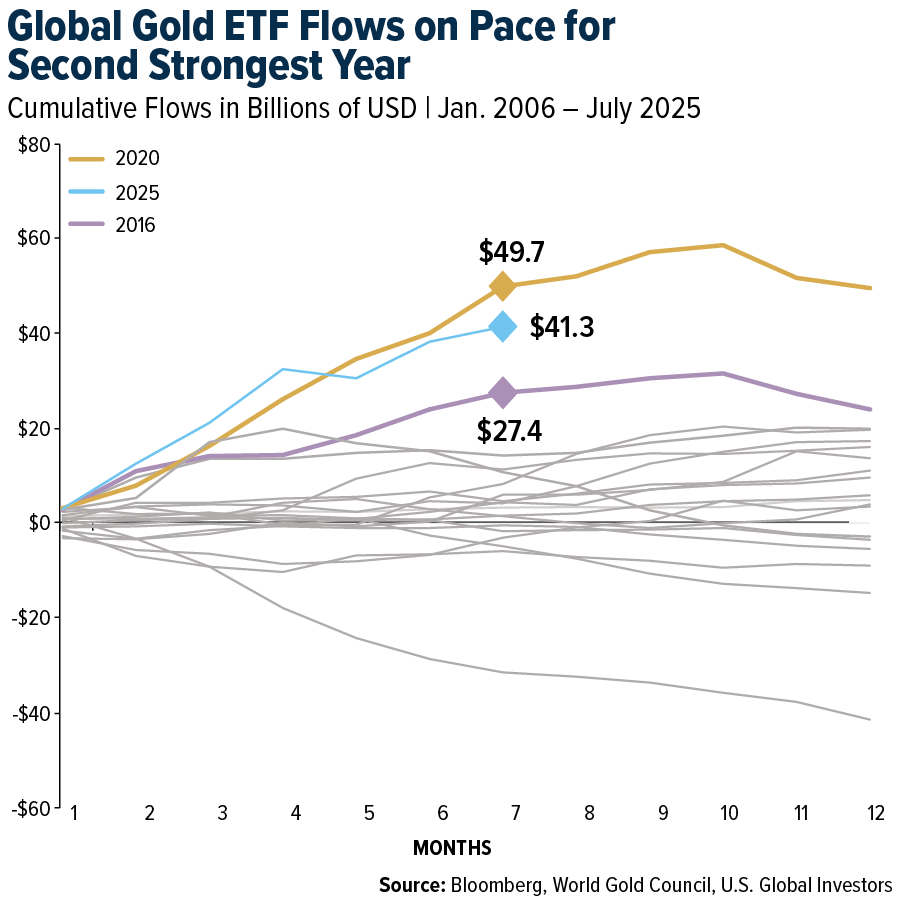

According to the World Gold Council (WGC), gold-backed exchange-traded funds (ETFs) added $3.2 billion in July alone, raising total assets under management (AUM) to $386 billion, a month-end high. Global flows are now on pace for the second-strongest year on record, following 2020.

Why We Favor Royalty and Streaming Companies

As many of you know, we have long favored royalty and streaming companies, and their latest quarterly results only reinforce that view. These firms don’t own or operate mines themselves. Instead, they provide upfront financing to miners in exchange for the right to purchase a portion of future production—either through royalties or streams—at a fixed, often heavily discounted, price.

This model has several compelling advantages, including lower risk exposure. Royalty and streaming firms have no direct operating costs, meaning they’re insulated from rising labor and fuel prices. Their portfolios often span multiple mines and jurisdictions, and they’ve also demonstrated strong cash flow.

In short, we believe royalty and streaming companies offer a “happy medium” between owning bullion and owning traditional mining equities. They capture much of the upside in a rising gold price environment while providing downside protection during pullbacks.

Record-Breaking Quarters

The June quarter and first half of 2025 were nothing short of spectacular for the big names in the royalty and streaming space.

Franco-Nevada reported record revenue of $369.4 million for the quarter, up 42% year-over-year. Operating cash flow surged 121% to a record $430.3 million, while net income more than doubled to $247.1 million. The company also posted record adjusted EBITDA margins.

Wheaton Precious Metals likewise delivered all-time highs in the second quarter, generating $503 million in revenue and $415 million in operating cash flow. Net earnings came in at $292 million, and the company ended the quarter with $1 billion in cash, no debt and an undrawn $2 billion revolving credit facility.

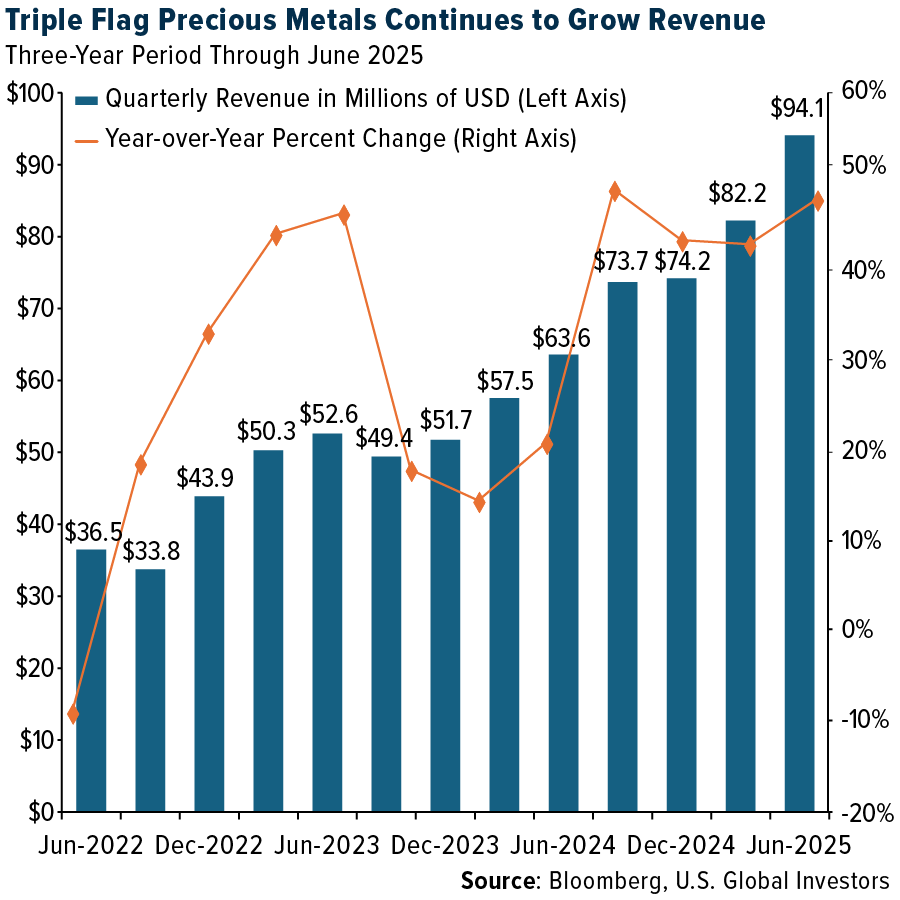

Triple Flag Precious Metals, a relative newcomer compared to its larger peers, posted record operating cash flow per share and announced its fourth consecutive annual 5% dividend increase since its IPO in 2021. Revenues have been growing steadily for the past seven quarters, hitting a new all-time high of $94 million in the June quarter, representing an increase of almost 50% compared to the same quarter in 2024.

Click here to see the top 10 holdings in GOAU.

We believe these results demonstrate why royalty and streaming companies have been gaining market share in investors’ portfolios. They combine the potential for capital appreciation with consistent income, an attractive mix in a yield-starved world.

Getting Access to Royalty and Streaming Leaders Through GOAU

For investors who want exposure to the strength of royalty and streaming companies without having to pick individual stocks, one option is the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU).

Unlike many traditional mining funds, GOAU—or the GoGold ETF, as we sometimes call it—emphasizes high-quality, well-managed producers and places special focus on North American royalty and streaming firms. These companies help manage risk by avoiding the high operating costs of running mines while still benefiting from production upside.

GOAU is built on a Smart Beta 2.0 strategy, which combines the advantages of passive indexing with active management insights. The index uses a rules-based, quantitative model to identify companies with strong fundamentals, profitability and capital discipline, ensuring that only those meeting rigorous criteria are included. The fund’s construction gives meaningful weight to industry leaders like Franco-Nevada, Wheaton Precious Metals and OR Royalties, while also including a diversified mix of other precious metals companies across North America, Africa and Australia.

With gold trading near historic highs, royalty and streaming companies delivering record results and central banks continuing to accumulate the metal, we believe GOAU offers an attractive way to participate in this environment. By blending exposure to both producers and financiers, the ETF seeks to provide investors with a balance of growth potential, income opportunities, and risk management in the gold space.

Click here to learn more about GOAU!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU by clicking here. Read it carefully before investing.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Gold, precious metals and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

The Producer Price Index (PPI) measures changes in the average prices received by domestic producers for their output. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver.

Smart Beta 2.0 is an investment approach that combines the broad diversification and low cost of passive indexing with the factor-based insights and selectivity of active management strategies.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

GOAU is distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.