U.S. Global Investors CEO and Chief Investment Officer Frank Holmes recently had the chance to interview Jonathan Roth, founder of ResourceWars.com and a veteran of capital markets, who highlighted an increasingly urgent issue: the Arctic.

As polar ice caps melt, new opportunities—and risks—are emerging in this increasingly contested region that we believe investors should be aware of. Nations like the U.S., Russia and China are jockeying for influence, not only to access the Arctic’s vast natural resources but also to secure strategic military and trading advantages.

Greenland, in particular, is shaping up to be a geopolitical hotspot, and it’s no wonder that President Donald Trump has repeated his interest in acquiring the island.

A Treasure Trove Beneath the Ice

During the conversation, Jonathan emphasized the Arctic’s immense resource wealth. The region is home to some of the world’s largest untapped reserves of natural resources. A 2008 study by the U.S. Geological Survey says that the Arctic holds 1,670 trillion cubic feet of natural gas and other fuels—equivalent to Russia’s entire oil reserves and three times those of the U.S.

Greenland, the world’s largest island that isn’t a continent, is rich in critical minerals essential for modern technologies, including rare earth metals, graphite, niobium and titanium. These materials are vital for everything from smartphones to electric vehicles (EVs) to military hardware.

Ice loss in the Danish territory has also exposed significant deposits of lithium, hafnium, uranium and gold. A 2023 survey by the Geological Survey of Denmark and Greenland evaluated 38 raw materials on the island, most of which have high or moderate potential.

Russia’s Arctic Ambitions

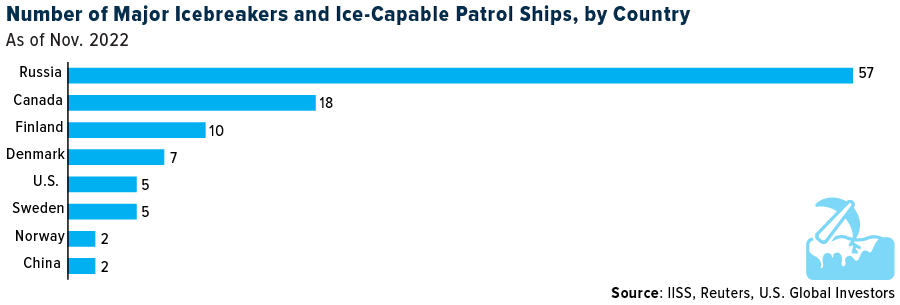

Jonathan also pointed out that Russia has been quietly building its Arctic presence for over a decade. It now has the most significant military presence in the region, with refurbished Soviet-era bases and a fleet of nuclear-powered icebreakers.

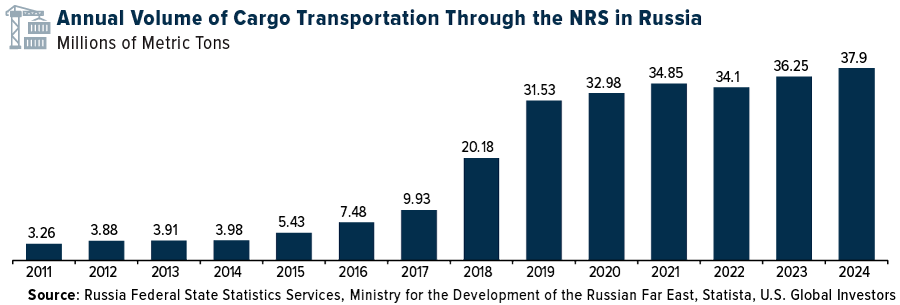

In 2024, some 38 million metric tons of cargo were shipped through Russia’s Northern Sea Route (NSR), a record amount for a single year and a nearly tenfold increase from a decade earlier. The NSR is central to President Vladimir Putin’s vision of a shipping lane that rivals the Suez and Panama Canals, but challenges like shallow, ice-filled waters and foggy conditions mean the route has a long way to go before becoming a global sea lane.

The country’s Arctic ambitions are about more than just trade. The region is a cornerstone of its strategy to secure military and economic power. This poses a significant concern for the U.S. and its allies, especially as climate change accelerates ice melt and opens up new access routes. Russia’s dominance in the Arctic could disrupt global trade, heighten geopolitical tensions and undermine U.S. strategic interests.

The U.S. Lags in Icebreaker Capabilities

While Russia boasts dozens of icebreakers, including nuclear-powered vessels, the U.S. is woefully behind. Jonathan highlighted that the last heavy polar icebreaker built by the U.S., the Polar Star, was commissioned nearly 50 years ago, in 1976. Meanwhile, the newer Polar Security Cutter (PSC) class of icebreakers, intended to bolster U.S. capabilities, has faced years of delays and budget overruns.

Recognizing this, the U.S. has partnered with Canada and Finland under the ICE Pact to develop a new generation of icebreakers. Finland, which designs 80% of the world’s icebreakers, brings valuable expertise to the table.

Greenland: A Strategic Prize

Greenland’s importance extends beyond its resource wealth. Jonathan noted the island occupies a key position along two potential Arctic shipping routes—the Northwest Passage and the Transpolar Sea Route. As sea ice continues to melt, these routes could significantly reduce shipping times and bypass traditional chokepoints like the Suez and Panama Canals.

Greenland is also home to Pituffik Space Base (formerly Thule Air Base), a critical U.S. military installation for missile early warning and space surveillance. The base’s strategic value is compounded by Greenland’s role in the so-called GIUK Gap (Greenland-Iceland-United Kingdom)—a naval chokepoint in the North Atlantic.

Investment in Pituffik has been inconsistent, however, and its importance has waned since the Cold War. Renewed attention to Greenland could help the U.S. counter Russia’s growing Arctic dominance and China’s ambitions as a “near-Arctic” power.

Explore the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR)

The geopolitical and technological competition surrounding the Arctic highlights the critical importance of advanced aerospace, defense and technology sectors. Our U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR), launched in December 2024, offers diversified exposure to industries directly tied to this narrative.

With holdings in companies specializing in semiconductors, cybersecurity, data centers and defense manufacturing—including technologies essential for modern warfare and Arctic operations—the WAR ETF captures the intersection of innovation and security. As nations like Russia ramp up Arctic militarization and Greenland’s critical minerals gain strategic prominence, we believe industries tied to aerospace and defense are poised for significant growth.

The ETF uses a Smart Beta 2.0 strategy, blending quantitative and fundamental analysis to target companies benefiting from rising defense budgets and technological advancements. Allocations are adjusted based on macroeconomic and geopolitical trends, ensuring responsiveness to evolving opportunities.

To learn more about the WAR ETF and its potential role in a diversified portfolio, and to request additional information, visit usglobaletfs.com/WAR.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus at www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk including the possible loss of principal.

The Fund is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

The Fund’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment advisor to WAR.